Xerox 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Management’s Discussion

Xerox 2010 Annual Report

In October 2010, Xerox’s Board of Directors authorized the company

•

to issue Commercial Paper, a liquidity vehicle that the Company has

not used for several years. Aggregate CP and Credit Facility borrowings

may not exceed $2 billion outstanding at any time. Under the

company’s private placement CP program as of December 31, 2010,

we could issue CP up to a maximum amount of $1 billion. In February

2011 this amount was increased to $2 billion to be consistent with the

Board authorization.

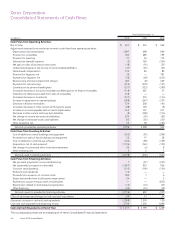

Over the past three years we have consistently delivered strong cash

•

flow from operations, driven by the strength of our annuity-based

revenue model. Cash flows from operations were $2,726 million,

$2,208 million and $939 million for the years ended December 31,

2010, 2009 and 2008, respectively. Cash flows from operations in

2008 included $615 million in net payments for securities litigation.

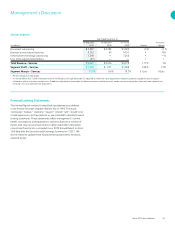

Our principal debt maturities are in line with historical and projected

•

cash flows and are spread over the next 10 years as follows and

includes $300 million of Commercial Paper in 2011 (in millions):

Year Amount

2011 $ 1,370

2012 1,126

2013 412

2014 771

2015 1,251

2016 950

2017 501

2018 1,001

2019 650

2020 and thereafter 348

Total Debt $ 8,380

LoanCovenantsandCompliance

At December 31, 2010, we were in full compliance with the covenants

and other provisions of our Credit Facility and Senior Notes. We have

the right to prepay outstanding loans or to terminate the Credit Facility

without penalty. Failure to comply with material provisions or covenants

of the Credit Facility and Senior Notes could have a material adverse

effect on our liquidity and operations and our ability to continue to fund

our customers’ purchase of Xerox equipment.

Refer to Note 11 – Debt in the Consolidated Financial Statements for

additional information regarding debt arrangements.

Dividends

The Board of Directors declared aggregate dividends of $243 million

and $152 million on common stock in 2010 and 2009, respectively.

The increase in 2010 is primarily due to the common stock issued in

connection with the ACS acquisition.

The Board of Directors declared aggregate dividends of $21 million on

the Series A Convertible Preferred Stock in 2010. The preferred shares

were issued in connection with the acquisition of ACS.

Refer to Note 3 – Acquisitions in the Consolidated Financial Statements

for additional information regarding the ACS acquisition.

CapitalMarketActivity

In 2010, we redeemed our $550 million 7.625% Senior Notes due in

2013. We incurred a loss on extinguishment of approximately $15

million, representing the call premium of approximately $7 million, as

well as the write-off of unamortized debt costs of $8 million.

Refer to Note 11 – Debt in the Consolidated Financial Statements for

additional information regarding 2010 Debt activity.

Liquidity and Financial Flexibility

We manage our worldwide liquidity using internal cash management

practices, which are subject to (1) the statutes, regulations and

practices of each of the local jurisdictions in which we operate, (2) the

legal requirements of the agreements to which we are a party and (3)

the policies and cooperation of the financial institutions we utilize to

maintain and provide cash management services.

Our liquidity is a function of our ability to successfully generate cash

flows from a combination of efficient operations and access to capital

markets. Our ability to maintain positive liquidity going forward depends

on our ability to continue to generate cash from operations and access

to financial markets, both of which are subject to general economic,

financial, competitive, legislative, regulatory and other market factors

that are beyond our control.

The following is a discussion of our liquidity position as of

December 31, 2010:

Total cash and cash equivalents was $1.2 billion and there were

•

no outstanding borrowings or letters of credit under our $2 billion

Credit Facility. The Credit Facility provides backup for our Commercial

Paper (“CP”) borrowings which amounted to $300 million at

December 31, 2010.