Xerox 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

68 Xerox 2010 Annual Report

average exercise price of $6.79 per option. The estimated fair value

associated with the Xerox options issued in exchange for the ACS options

was approximately $222 based on a Black-Scholes valuation model

(refer to Note 19 – Shareholders’ Equity for assumptions). Approximately

$168 of the estimated fair value is associated with options issued prior

to August 2009, which became fully vested and exercisable upon the

acquisition in accordance with pre-existing change-in-control provisions,

was recorded as part of the acquisition fair value. The remaining $54 is

associated with options issued in August 2009 which continue to vest

according to their original terms and therefore is being expensed as

compensation cost over the remaining vesting period which is estimated

to be approximately 3.9 years.

All ACS stock options outstanding at closing were assumed by Xerox

and converted into Xerox stock options. ACS stock options issued prior

to August 2009, whether or not then vested and exercisable, became

fully vested and exercisable in accordance with preexisting change-in-

control provisions. ACS stock options issued in August 2009 will continue

to vest and become exercisable for Xerox common stock in accordance

with their original terms. For the August 2009 options, the portion of

the estimated fair value associated with service prior to the close was

recorded as part of the acquisition fair value with the remainder to be

recorded as future compensation cost over the remaining vesting period.

Each assumed ACS option became exercisable for 7.085289 Xerox

common shares for a total of 96,662 thousand shares at a weighted

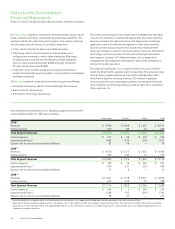

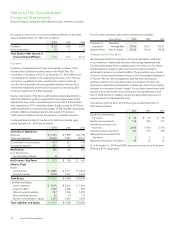

Fair value of consideration transferred: The table below details the

consideration transferred to acquire ACS (certain amounts reflect

rounding adjustments):

(shares in millions) Conversion Calculation Estimated Fair Value Form of Consideration

ACS Class A shares outstanding as of the acquisition date 92.7

ACS Class B shares outstanding as of the acquisition date 6.6

Total ACS Shares Outstanding 99.3

Xerox stock price as of the acquisition date $ 8.47

Multiplied by the exchange ratio 4.935

Equity Consideration per Common Share Outstanding $ 41.80 $ 4,149 Xerox common stock

Cash Consideration per Common Share Outstanding $ 18.60 $ 1,846 Cash

ACS stock options exchanged for a Xerox equivalent stock option 13.6

Multiplied by the option exchange ratio 7.085289

Total Xerox Equivalent Stock Options 96.7 $ 168 Xerox stock options

Xerox Preferred Stock Issued to ACS Class B Shareholder $ 349 Xerox preferred stock

Total Fair Value of Consideration Transferred $ 6,512

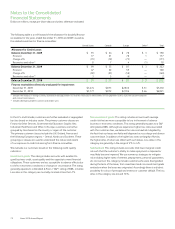

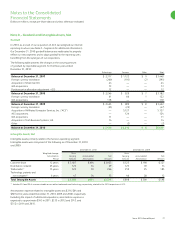

Recording of assets acquired and liabilities assumed: The transaction

has been accounted for using the acquisition method of accounting

which requires, among other things, that most assets acquired and

liabilities assumed be recognized at their fair values as of the acquisition

date. The following table summarizes the assets acquired and liabilities

assumed as of the acquisition date:

February 5, 2010

Assets

Cash and cash equivalents $ 351

Accounts receivable 1,344

Other current assets 389

Land, buildings and equipment 416

Intangible assets 3,035

Goodwill 5,127

Other long-term assets 258

Liabilities

Other current liabilities 645

Deferred revenue 161

Deferred tax liability 990

Debt 2,310

Pension liabilities 39

Other long-term liabilities 263

Net Assets Acquired $ 6,512