Xerox 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Management’s Discussion

Xerox 2010 Annual Report

RD&E2010

The decrease in RD&E spending for 2010 primarily reflects the savings

from restructuring and productivity improvements.

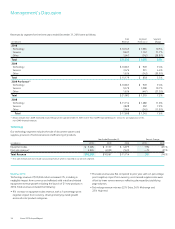

SAG2010

SAG as a percent of revenue decreased 6.1-percentage points on an

actual basis, primarily due to the ACS acquisition. ACS, as a typical

services-based company, had lower SAG as a percent of revenue as

compared to a technology-based company, which typified Xerox before

the acquisition. Since actual comparisons are not meaningful, SAG is

primarily discussed on a pro-forma basis, with ACS’s 2009 estimated

results from February 6 through December 31 included in our historical

2009 results (see “Non-GAAP Financial Measures” section for additional

discussion of this non-GAAP measure).

RD&E2009

The decrease in RD&E spending for 2009 reflects our restructuring and

cost actions which consolidated the development and engineering

infrastructures within our Technology segment.

SAG of $4,594 million was $445 million higher than 2009, or $57

million lower on a pro-forma(1) basis, including a negligible impact from

currency. The pro-forma(1) SAG decrease reflects the following:

$137 million increase in selling expenses, reflecting increased demand

•

generation and brand advertising and higher commissions, partially

offset by restructuring savings and productivity improvements

$86 million decrease in general and administrative expenses, reflecting

•

benefits from restructuring and operational improvements

$108 million decrease in bad debt expense, reflecting an improving

•

write-off trend

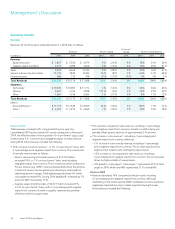

Research, Development and Engineering Expenses (“RD&E”)

We invest in technological research and development, particularly in

color, software and services. We believe our R&D spending is sufficient to

remain technologically competitive. Our R&D is strategically coordinated

with that of Fuji Xerox.

Pro-forma(1)

Year Ended December 31, Change Change

(in millions) 2010 2009 2008 2010 2009 2010

R&D $ 653 $ 713 $ 750 $ (60) $ (37) $ (60)

Sustaining Engineering 128 127 134 1 (7) 1

Total RD&E Expenses $ 781 $ 840 $ 884 $ (59) $ (44) $ (59)

RD&E % Revenue 3.6% 5.5% 5.0% (1.9) pts 0.5 pts (0.4) pts

R&D Investment by Fuji Xerox(2) $ 821 $ 796 $ 788 $ 25 $ 8 n/a

(1) Refer to the “Non-GAAP Financial Measures” section for an explanation of the Pro-forma non-GAAP financial measure.

(2) Increase in Fuji Xerox R&D was primarily due to changes in foreign exchange rates.

Selling, Administrative and General Expenses (“SAG”)

Pro-forma(1)

Year Ended December 31, Change Change

(in millions) 2010 2009 2008 2010 2009 2010

Total SAG $ 4,594 $ 4,149 $ 4,534 $ 445 $ (385) $ (57)

SAG as a % of revenue 21.2% 27.3% 25.7% (6.1) pts 1.6 pts (0.9) pts

Bad Debt Expense $ 188 $ 291 $ 188 $ (103) $ 103 $ (108)

Bad Debt as a % of revenue 0.9% 1.9% 1.1% (1.0) pts 0.8 pts (0.5) pts

(1) Refer to the “Non-GAAP Financial Measures” section for an explanation of the Pro-forma non-GAAP financial measure.