Xerox 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

79Xerox 2010 Annual Report

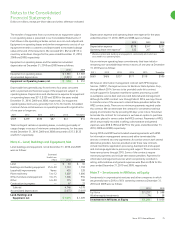

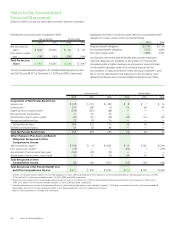

In addition, related to these activities, we also recorded lease cancellation

and other costs of $19 and asset impairment charges of $53. The lease

termination and asset impairment charges primarily related to: (i) the

relocation of certain manufacturing operations including the closing of our

toner plant in Oklahoma City and the consolidation of our manufacturing

operations in Ireland; and (ii) the exit from certain leased and owned

facilities as a result of the actions noted above.

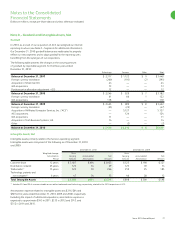

Note 10 – Supplementary Financial Information

The components of other current assets and other current liabilities at

December 31, 2010 and 2009 were as follows:

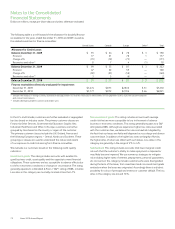

2010 2009

Other Current Assets

Deferred taxes and income taxes receivable $ 345 $ 328

Royalties, license fees and software

maintenance 155 23

Restricted cash 91 31

Prepaid expenses 133 86

Derivative instruments 45 16

Deferred purchase price from sale

of receivables 90 —

Advances and deposits 23 19

Other 244 205

Total Other Current Assets $ 1,126 $ 708

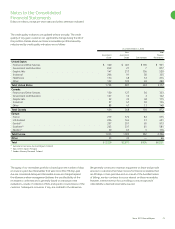

Other Current Liabilities

Deferred taxes and income taxes payable $ 59 $ 68

Other taxes payable 177 161

Interest payable 122 114

Restructuring reserves 309 64

Derivative instruments 19 15

Product warranties 17 19

Dividends payable 74 41

Distributor and reseller rebates/commissions 105 127

Other 925 517

Total Other Current Liabilities $ 1,807 $ 1,126

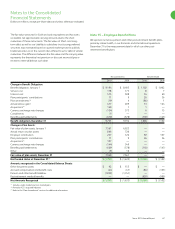

2010 Activity

During 2010, we recorded $483 of net restructuring and asset

impairment charges, which included the following:

$470 of severance costs related to headcount reductions of

•

approximately 9,000 employees. The costs associated with these

actions applied about equally to North America and Europe, with

approximately 20% related to our developing market countries.

Approximately 50% of the costs were focused on gross margin

improvements, 40% on SAG and 10% on the optimization of RD&E

investments and impacted the following functional areas:

– Services

– Supply chain and manufacturing

– Back-office administration

– Development and engineering costs.

$28 for lease termination costs primarily reflecting the continued

•

rationalization and optimization of our worldwide operating locations,

particularly in light of our recent acquisition of ACS.

$19 loss associated with the sale of our Venezuelan subsidiary. The

•

loss primarily reflects the write-off of our Venezuelan net assets

including working capital and long-lived assets. We will continue to

sell equipment, parts and supplies to the acquiring company through

a distribution arrangement but will no longer have any direct or local

operations in Venezuela. The sale of our operations and change in

business model follows a decision by management in the fourth

quarter of 2010 to reduce the Company’s future exposure and risk

associated with operating in this unpredictable economy.

The above charges were partially offset by $41 of net reversals for

changes in estimated reserves from prior period initiatives.

The restructuring reserve balance as of December 31, 2010 for all

programs was $323, of which approximately $309 is expected to be

spent over the next 12 months.

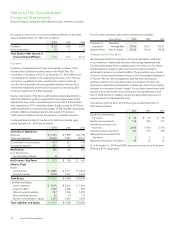

2009 Activity

Restructuring activity was minimal in 2009 and the related charges

primarily reflected changes in estimates in severance costs from

previously recorded actions.

2008 Activity

During 2008, we recorded $357 of net restructuring charges

predominantly consisting of severance and costs related to the

elimination of approximately 4,900 positions primarily in both North

America and Europe. Focus areas for the actions include the following:

Improving efficiency and effectiveness of infrastructure including:

•

marketing, finance, human resources and training

Capturing efficiencies in technical services, managed services, and

•

supply chain and manufacturing infrastructure

Optimizing product development and engineering resources.

•