Xerox 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47Xerox 2010 Annual Report

Management’s Discussion

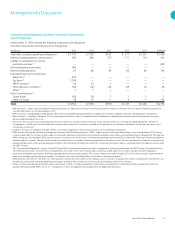

Contractual Cash Obligations and Other Commercial Commitments

and Contingencies

At December 31, 2010, we had the following contractual cash obligations

and other commercial commitments and contingencies:

(in millions) 2011 2012 2013 2014 2015 Thereafter

Total debt, including capital lease obligations (1) $ 1,370 $ 1,126 $ 412 $ 771 $ 1,251 $ 3,450

Minimum operating lease commitments(2) 669 486 337 171 118 106

Liability to subsidiary trust issuing

preferred securities(3) — — — — — 650

Defined benefit pension plans 500 — — — — —

Retiree health payments 87 86 85 85 84 396

Estimated Purchase Commitments:

Flextronics(4) 670 — — — — —

Fuji Xerox(5) 2,100 — — — — —

HPES Contracts(6) 69 23 6 — — —

Other IM service contracts(7) 150 140 122 89 12 36

Other(8) 7 7 1 — — —

Other Commitments(9):

Surety Bonds 636 20 7 1 1 1

Letters of Credit 96 15 — 4 — 155

Total $ 6,354 $ 1,903 $ 970 $ 1,121 $ 1,466 $ 4,794

(1) Refer to Note 11 – Debt in the Consolidated Financial Statements for additional information and interest payments related to total debt. Amounts above include principal portion

only and $300 million of Commercial Paper in 2011.

(2) Refer to Note 6 – Land, Buildings and Equipment, Net in the Consolidated Financial Statements for additional information related to minimum operating lease commitments.

(3) Refer to Note 12 – Liability to Subsidiary Trust Issuing Preferred Securities in the Consolidated Financial Statements for additional information and interest payments (amounts

above include principal portion only).

(4) Flextronics: We outsource certain manufacturing activities to Flextronics and are currently in the first of two one-year extensions of the Master Supply Agreement. The term of

this agreement is three years, with two additional one-year extension periods. The amount included in the table reflects our estimate of purchases over the next year and is not a

contractual commitment.

(5) Fuji Xerox: The amount included in the table reflects our estimate of purchases over the next year and is not a contractual commitment.

(6) HPES contract: We have an information management contract with HP Enterprise Services (“HPES”), legal successor to Electronic Data Systems Corp., through March 2014. Services

to be provided under this contract include support for European mainframe system processing, as well as workplace, service desk, voice and data network management. Although the

HPES contract runs through March 2014, we may choose to transfer some of the services to internal Xerox providers before the HPES contract ends. There are no minimum payments

required under this contract. The amounts disclosed in the table reflect our estimate of minimum payments for the periods shown. We can terminate the contract for convenience by

providing 60 day’s prior notice without paying a termination fee. Should we terminate the contract for convenience, we have an option to purchase the assets placed in service under

the HPES contract.

(7) IM (“Information Management”) services: During 2010 and 2009, we terminated certain information management services provided under the HPES contract. Terminated services

were either discontinued or we entered into new agreements for similar services with other providers. Services provided under these contracts include mainframe application

processing, development and support; and mid-range applications processing and support. The contracts have various terms through 2015. Some of the contracts require minimum

payments and require early termination penalties. The amounts disclosed in the table reflect our estimate of minimum payments.

(8) Other purchase commitments: We enter into other purchase commitments with vendors in the ordinary course of business. Our policy with respect to all purchase commitments is to

record losses, if any, when they are probable and reasonably estimable. We currently do not have, nor do we anticipate, material loss contracts.

(9) Certain contracts, primarily governmental, require surety bonds or letters of credit as guarantee of performance. Generally these commitments have one-year terms which are

typically renewed annually. Refer to Note 17 – Contingencies in the Consolidated Financial Statements for additional information.