Xerox 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

70 Xerox 2010 Annual Report

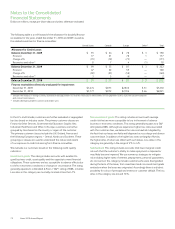

TMS Health: In October 2010, ACS acquired TMS Health (“TMS”), a

U.S.-based teleservices company that provides customer care services to

the pharmaceutical, biotech and healthcare industries, for approximately

$48 in cash. Through TMS, ACS improves communication between

pharmaceutical companies, physicians, consumers and pharmacists.

By providing customer education, product sales and marketing and

clinical trial solutions, ACS builds on the IT and BPO services it already

delivers to the healthcare and pharmaceutical industries.

ExcellerateHRO, LLP: In July 2010, ACS acquired ExcellerateHRO, LLP

(“EHRO”), a global benefits administration and relocation services provider,

for $125 net of cash acquired. This acquisition establishes ACS as one of

the world’s largest pension plan administrators and as a leading provider

of outsourced health and welfare and relocation services. The purchase

price was primarily allocated to intangible assets (consisting of customer

relationships of $32 and software of $8) and goodwill of $77 based on

third-party valuations and management’s estimates.

GIS Acquisitions

Georgia Duplicating Products: In September 2010, GIS acquired

Georgia Duplicating Products, an office equipment supplier, for

approximately $21 net of cash acquired.

ComDoc, Inc.: In February 2009, GIS acquired ComDoc, Inc. (“ComDoc”)

for approximately $145 in cash. ComDoc is one of the larger independent

office technology dealers in the U.S. and expands GIS’s coverage in Ohio,

Pennsylvania, New York and West Virginia. GIS also acquired another

business in 2009 for $18 in cash.

Saxon Business Systems: In 2008, GIS acquired Saxon Business

Systems, an office equipment supplier in Florida, for approximately $69

in cash, including transaction costs. GIS acquired three other similar

businesses in 2008 for a total of $17 in cash.

These acquisitions continue the development of GIS’s national network

of office technology suppliers to serve its expanding base of small and

mid-size businesses.

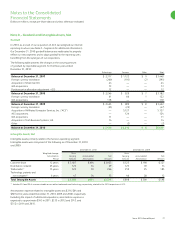

Summary – Other Acquisitions

The operating results of the acquisitions described above are not

material to our financial statements and are included within our results

from the respective acquisition dates. Excluding ACS, our remaining

2010 acquisitions contributed aggregate revenues of approximately

$140 to our 2010 total revenues from their respective acquisition dates.

The ACS acquisitions are included within our Services segment while the

other acquisitions, including the GIS acquisitions, are primarily included

within our Technology segment. The purchase prices were primarily

allocated to intangible assets and goodwill based on third-party

valuations and management’s estimates.

Goodwill of $2.3 billion is deductible for tax purposes as a result of

previous taxable acquisitions made by ACS. While the allocation of

goodwill among reporting units is not complete, we expect the majority

of the goodwill will be related to our Services segment.

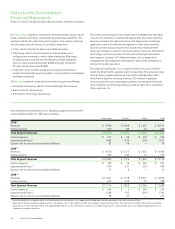

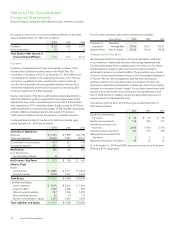

Pro-forma impact of the acquisition: The unaudited pro-forma

results presented below include the effects of the ACS acquisition as

if it had been consummated as of January 1, 2010 and 2009. The

pro-forma results include the amortization associated with an estimate

for the acquired intangible assets and interest expense associated

with debt used to fund the acquisition, as well as fair value adjustments

for unearned revenue, software and land, buildings and equipment.

To better reflect the combined operating results, material non-recurring

charges directly attributable to the transaction have been excluded.

In addition, the pro-forma results do not include any anticipated

synergies or other expected benefits of the acquisition. Accordingly,

the unaudited pro-forma financial information below is not necessarily

indicative of future results of operations or results that might

have been achieved had the acquisition been consummated as of

January 1, 2010 or 2009.

2010 2009

Revenue $ 22,252 $ 21,781

Net income – Xerox 592 795

Basic earnings per share 0.41 0.57

Diluted earnings per share 0.41 0.56

Note: The pro-forma information presented above is on a different basis

than the pro-forma information provided in Management’s Discussion

and Analysis of Financial Condition and Results of Operations of this

Annual Report for the year ended December 31, 2010.

Other Acquisitions

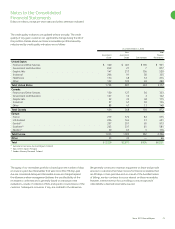

Irish Business Systems Limited: In January 2010, we acquired Irish

Business Systems Limited (“IBS”) for approximately $29 net of cash

acquired. This acquisition expands our reach into the small and mid-size

business market in Ireland. IBS has eight offices located throughout

Ireland and is a managed print services provider and the largest

independent supplier of digital imaging and printing solutions in Ireland.

Veenman B.V.: In 2008, we acquired Veenman B.V. (“Veenman”),

expanding our reach into the small and mid-size business market

in Europe, for approximately $69 (€44 million) in cash, including

transaction costs. Veenman is the Netherlands’ leading independent

distributor of office printers, copiers and multifunction devices serving

small and mid-size businesses.

ACS Acquisitions

Spur Information Solutions: In November 2010, ACS acquired Spur

Information Solutions, one of the United Kingdom’s leading providers

of computer software used for parking enforcement, for $12 in cash. The

acquisition strengthens ACS’s broad portfolio of services that support

the transportation industry.