Xerox 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27Xerox 2010 Annual Report

Management’s Discussion

The following is a summary of key 2010 highlights:

Exceeded on earnings and cash generation commitments

•

Strong services performance, realizing benefits from the ACS

•

acquisition

Technology revenue and activity growth; innovative products

•

launched in key segments

Disciplined cost and expense management yielding operating

•

margin improvement

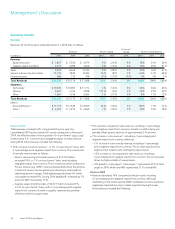

We completed the acquisition of ACS on February 5, 2010, and its results

subsequent to that date are included in our results. Total revenue of

$21.6 billion in 2010 increased 43% from the prior year, primarily as a

result of the ACS acquisition. Currency had a negligible impact on 2010

total revenues. In order to provide a clearer comparison of our results

to the prior year, we are also providing a discussion and analysis on a

pro-forma basis, where we include ACS’s 2009 estimated results from

February 6 through December 31 in our historical 2009 results(1). On

a pro-forma(1) basis, total revenue increased 3% in 2010, including a

negligible impact from currency.

2010 Annuity Revenue(2) increased 53% from the prior year, or 1%

on a pro-forma(1) basis. Currency had a 1-percentage point unfavorable

impact on pro-forma annuity revenue. 2010 Equipment Revenue

increased 9% from the prior year, including a 1-percentage point

negative impact from currency.

Net income attributable to Xerox for 2010 was $606 million and

included $690 million of after-tax costs and expenses related to

restructuring, intangibles amortization, acquisition-related costs and

other discrete and unusual items. Net income attributable to Xerox for

2009 was $485 million and included $128 million of similar after-tax

costs and expenses.

Cash flow from operations was $2.7 billion for 2010, primarily as a

result of increased earnings and working capital cash generation. Cash

used in investing activities of $2.2 billion primarily reflects the net

cash consideration of $1.5 billion for the ACS acquisition. Cash used in

financing activities was $3.1 billion, primarily reflecting the repayment of

ACS’s debt of $1.7 billion as well as net payments on other debt during

2010, including the early redemption of $660 million of debt.

Our 2011 priorities include:

Strengthening our leadership in Technology through competitively

•

advantaged products and increased distribution

Accelerating our services business – capture significant BPO

•

opportunity and continue improvements in ITO and document

outsourcing

Continued cost and expense discipline to enable operating margin

•

expansion

Driving cash flow, reducing debt and returning cash to shareholders

•

Our 2011 balance sheet and cash flow strategy includes: sustaining our

working capital improvements; continued reductions in non-financing

debt; leveraging of our financing assets (finance receivables and

equipment on operating leases); achieving an optimal cost of capital;

and effectively deploying cash to maximize shareholder value through

share repurchase, acquisitions and dividends.

In addition, as a result of providing lease equipment financing to our

customers, we expect to continue to make investments in lease contracts

(finance receivables and equipment on operating leases). Since we

maintain a certain level of debt to support this investment, we expect to

continue to leverage this investment in 2011 (see “Customer Financing

Activities” for additional information).

(1) The pro-forma information included within this MD&A is different from the pro-forma

information provided in Note 3 – Acquisitions. The pro-forma information included

in Note 3 presents the combined results for 2010 and 2009 as if the acquisition

was completed January 1st of each respective year. See the “Non-GAAP Financial

Measures” section for a further explanation and discussion of this non-GAAP measure.

(2) Annuity revenue = Service, outsourcing and rentals + Supplies, paper and other sales +

Finance income.

Currency Impacts

To understand the trends in our business, we believe that it is helpful to

analyze the impact of changes in the translation of foreign currencies

into U.S. Dollars on revenues and expenses. We refer to this analysis

as “currency impact” or “the impact from currency." This impact is

calculated by translating current-period activity in local currency using

the comparable prior-year period’s currency translation rate. This

impact is calculated for all countries where the functional currency is

the local-country currency. Revenues and expenses from our developing

market countries (Latin America, Brazil, the Middle East, India, Eurasia

and Central-Eastern Europe) are analyzed at actual exchange rates for

all periods presented, since these countries generally have unpredictable

currency and inflationary environments, and our operations in these

countries have historically implemented pricing actions to recover the

impact of inflation and devaluation. We do not hedge the translation

effect of revenues or expenses denominated in currencies where the

local currency is the functional currency.

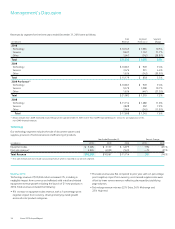

Approximately 36% of our consolidated revenues are derived from

operations outside of the United States where the U.S. Dollar is not the

functional currency. When compared with the average of the major

European currencies and Canadian Dollar on a revenue-weighted basis,

the U.S. Dollar was 2% stronger in 2010 and 7% stronger in 2009, each

compared to the prior year. As a result, the foreign currency translation

impact on revenue was negligible in 2010 and a 3% detriment in 2009.

Refer to the “Gross Margin” section for additional information regarding

the impact of currency on our product costs.