Xerox 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

85Xerox 2010 Annual Report

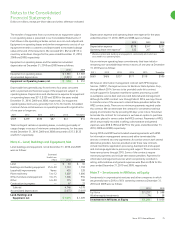

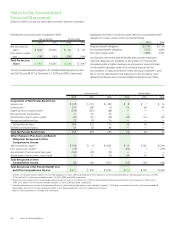

Accumulated Other Comprehensive Loss (“AOCL”)

The following table provides a summary of the activity associated

with all of our designated cash flow hedges (interest rate and

foreign currency) reflected in AOCL for the three years ended

December 31, 2010:

2010 2009 2008

Beginning cash flow hedges

balance, net of tax $ 1 $ — $ —

Changes in fair value gain (loss) 31 (1) 1

Reclass to earnings (18) 2 (1)

Ending Cash Flow Hedges

Balance, Net of Tax $ 14 $ 1 $ —

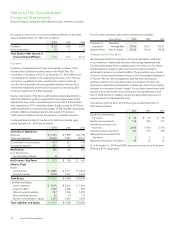

Derivatives NOT Designated as Hedging Instruments Location of Derivative Gain (Loss) 2010 2009 2008

Foreign exchange contracts Other expense – Currency losses, net $113 $49 $(147)

Non-Designated Derivative Instruments Gains (Losses)

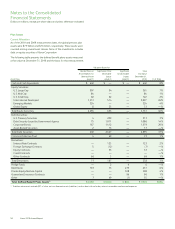

Non-designated derivative instruments are primarily instruments

used to hedge foreign currency-denominated assets and liabilities.

They are not designated as hedges because there is a natural offset for

the re-measurement of the underlying foreign currency-denominated

asset or liability.

The following table provides a summary of gains (losses) on

non-designated derivative instruments for the three years ended

December 31, 2010:

During the three years ended December 31, 2010, we recorded

total Currency losses, net of $11, $26 and $34, respectively. Currency

losses, net includes the mark-to-market of the derivatives not designated

as hedging instruments and the related cost of those derivatives, as

well as the re-measurement of foreign currency-denominated assets

and liabilities.