Xerox 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Management’s Discussion

Xerox 2010 Annual Report

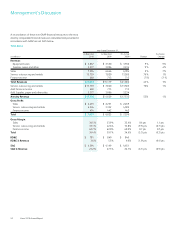

Net cash provided by financing activities was $692 million for the year

ended December 31, 2009. The $1,003 million increase in cash from

2008 was primarily due to the following:

$812 million increase because no purchases were made under our

•

share repurchase program in 2009.

$170 million increase from lower net repayments on secured debt.

•

$21 million increase due to lower share repurchases related to

•

employee withholding taxes on stock-based compensation vesting.

$3 million decrease due to lower net debt proceeds. 2009 reflects

•

the repayment of $1,029 million for Senior Notes due in 2009, net

payments of $448 million for Zero Coupon Notes, net payments

of $246 million on the Credit Facility, net payments of $35 million

primarily for foreign short-term borrowings and $44 million of debt

issuance costs for the Bridge Loan Facility commitment which was

terminated. These payments were partially offset by net proceeds

of $2,725 million from the issuance of Senior Notes in May and

December 2009. 2008 reflects the issuance of $1.4 billion in Senior

Notes, $250 million in Zero Coupon Notes and net payments of $354

million on the Credit Facility and $370 million on other debt.

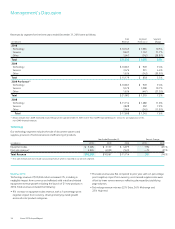

ACSAcquisition

On February 5, 2010 we acquired all of the outstanding equity of

ACS in a cash-and-stock transaction valued at approximately $6.2

billion, net of cash acquired. The consideration transferred to acquire

ACS was as follows:

(in millions) February 5, 2010

Xerox common stock issued $ 4,149

Cash consideration, net of cash acquired 1,495

Value of exchanged stock options 168

Series A convertible preferred stock 349

Net Consideration – Cash and Non-cash $ 6,161

In addition, we also repaid $1.7 billion of ACS’s debt at acquisition and

assumed an additional $0.6 billion.

Refer to Note 3 – Acquisitions in the Consolidated Financial Statements

for additional information regarding the ACS acquisition.

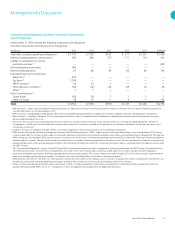

CashFlowsfromInvestingActivities

Net cash used in investing activities was $2,178 million for the year

ended December 31, 2010. The $1,835 million increase in the use of

cash from 2009 was primarily due to the following:

$1,571 million increase primarily due to the acquisitions of ACS for

•

$1,495 million, EHRO for $125 million, TMS Health for $48 million,

IBS for $29 million, Georgia for $21 million and Spur for $12 million.

$326 million increase due to higher capital expenditures (including

•

internal use software) primarily as a result of the inclusion of ACS

in 2010.

$35 million decrease due to higher cash proceeds from asset sales.

•

Net cash used in investing activities was $343 million for the year ended

December 31, 2009. The $98 million decrease in the use of cash from

2008 was primarily due to the following:

$142 million decrease due to lower capital expenditures (including

•

internal use software), reflecting very stringent spending controls.

$21 million increase due to lower cash proceeds from asset sales.

•

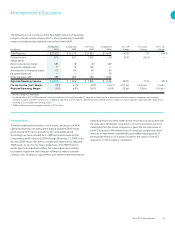

CashFlowsfromFinancingActivities

Net cash used in financing activities was $3,116 million for the year

ended December 31, 2010. The $3,808 million decrease in cash from

2009 was primarily due to the following:

$3,980 million decrease due to net debt activity. 2010 includes the

•

repayments of $1,733 million of ACS’s debt on the acquisition date,

$950 million of Senior Notes, $550 million early redemption of the

2013 Senior Notes, net payments of $110 million on other debt

and $14 million of debt issuance costs for the Bridge Loan Facility

commitment, which was terminated in 2009. These payments were

offset by net proceeds of $300 million from Commercial Paper issued

under a program we initiated during the fourth quarter 2010. 2009

reflects the repayment of $1,029 million for Senior Notes due in 2009,

net payments of $448 million for Zero Coupon Notes, net payments

of $246 million on the Credit Facility, net payments of $35 million

primarily for foreign short-term borrowings and $44 million of debt

issuance costs for the Bridge Loan Facility commitment which was

terminated. These payments were partially offset by net proceeds

of $2,725 million from the issuance of Senior Notes in May and

December 2009.

$66 million decrease, reflecting dividends on an increased number of

•

outstanding shares as a result of the acquisition of ACS.

$182 million increase due to proceeds from the issuance of common

•

stock primarily as a result of the exercise of stock options issued under

the former ACS plans as well as the exercise of stock options from

several expiring grants.

$58 million increase from lower net repayments on secured debt.

•