Xerox 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

73Xerox 2010 Annual Report

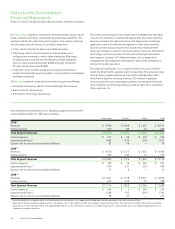

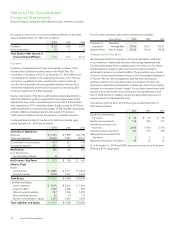

The credit quality indicators are updated at least annually. The credit

quality of any given customer can significantly change during the life of

the portfolio. Details about our finance receivables portfolio based by

industry and by credit quality indicators are as follows:

As of December 31, 2010

Non- Total

Investment investment Finance

Grade Grade Substandard Receivables

United States:

Finance and Other Services $ 360 $ 401 $ 190 $ 951

Government and Education 849 21 7 877

Graphic Arts 147 217 156 520

Industrial 206 91 38 335

Healthcare 134 48 32 214

Other 102 109 69 280

Total United States 1,798 887 492 3,177

Canada:

Finance and Other Services 150 127 56 333

Government and Education 127 12 3 142

Graphic Arts 32 35 48 115

Industrial 57 47 30 134

Other 88 47 13 148

Total Canada 454 268 150 872

Europe:

France 219 374 82 675

U.K./Ireland 206 164 51 421

Central(1) 297 551 65 913

Southern(2) 263 237 81 581

Nordics(3) 50 63 3 116

Total Europe 1,035 1,389 282 2,706

Other 33 33 — 66

Total $ 3,320 $ 2,577 $ 924 $ 6,821

(1) Switzerland, Germany, Austria, Belgium, Holland.

(2) Italy, Greece, Spain, Portugal.

(3) Sweden, Norway, Denmark, Finland.

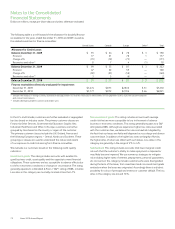

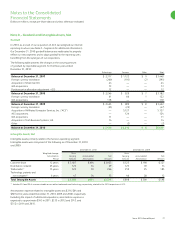

The aging of our receivables portfolio is based upon the number of days

an invoice is past due. Receivables that were more than 90 days past

due are considered delinquent. Receivable losses are charged against

the allowance when management believes the uncollectibility of the

receivable is confirmed and is generally based on individual credit

evaluations, results of collection efforts and specific circumstances of the

customer. Subsequent recoveries, if any, are credited to the allowance.

We generally continue to maintain equipment on lease and provide

services to customers that have invoices for finance receivables that

are 90 days or more past due and, as a result of the bundled nature

of billings, we also continue to accrue interest on those receivables.

However, interest revenue for such billings is only recognized if

collectability is deemed reasonably assured.