Xerox 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

83Xerox 2010 Annual Report

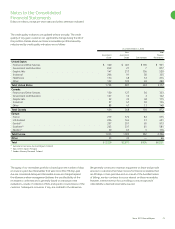

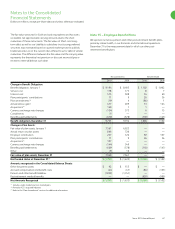

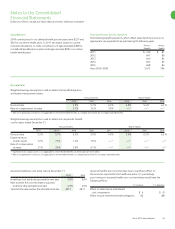

The following is a summary of our fair value hedges at December 31, 2010:

Year First Weighted

Designated Notional Net Fair Average Interest Interest

Debt Instrument as Hedge Amount Value Rate Paid Rate Received Basis Maturity

Senior Notes due 2013 2010 $ 400 $ — 4.71% 5.65% LIBOR 2013

Senior Notes due 2014 2009 450 10 6.19% 8.25% LIBOR 2014

Senior Notes due 2016 2010 100 1 3.96% 6.40% LIBOR 2016

Total Fair Value Hedges $ 950 $ 11

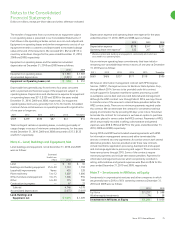

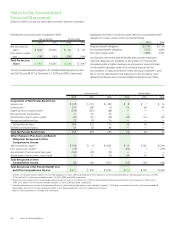

The following is a summary of the primary hedging positions and

corresponding fair values held as of December 31, 2010:

Gross Fair Value

Notional Asset

Currency Hedged (Buy/Sell) Value (Liability)(1)

U.K. Pound Sterling/Euro $ 217 $ (1)

Euro/U.S. Dollar 370 (3)

U.S. Dollar/Euro 585 9

Swedish Kronor/Euro 93 2

Swiss Franc/Euro 194 8

Japanese Yen/U.S. Dollar 397 8

Japanese Yen/Euro 367 11

Euro/U.K. Pound Sterling 211 1

U.K. Pound Sterling/Swiss Franc 74 (7)

Danish Krone/Euro 57 —

Mexican Peso/U.S. Dollar 52 —

All Other 351 (2)

Total Foreign Exchange Hedging $ 2,968 $ 26

(1) Represents the net receivable (payable) amount included in the Consolidated Balance

Sheet at December 31, 2010.

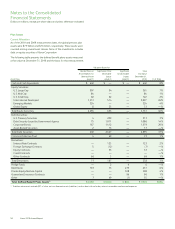

Foreign Currency Cash Flow Hedges

We designate a portion of our foreign currency derivative contracts

as cash flow hedges of our foreign currency-denominated inventory

purchases, sales and expenses. No amount of ineffectiveness was

recorded in the Consolidated Statements of Income for these

designated cash flow hedges and all components of each derivative’s

gain or loss was included in the assessment of hedge effectiveness. As of

December 31, 2010, the net asset fair value of these contracts was $18.

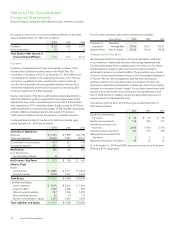

Terminated Swaps

During the period from 2004 to 2010, we terminated early several

interest rate swaps that were designated as fair value hedges of certain

debt instruments. The associated net fair value adjustments to the debt

instruments are being amortized to interest expense over the remaining

term of the related notes. In 2010, 2009 and 2008, the amortization

of these fair value adjustments reduced interest expense by $28, $17

and $12, respectively, and we expect to record a net decrease in interest

expense of $199 in future years through 2027.

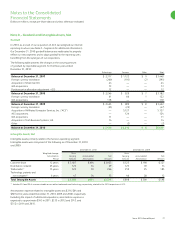

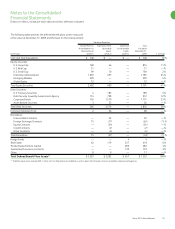

Foreign Exchange Risk Management

We are exposed to foreign currency exchange rate fluctuations in

the normal course of business. As a part of our foreign exchange risk

management strategy, we use derivative instruments, primarily forward

contracts and purchase option contracts, to hedge the following

foreign currency exposures, thereby reducing volatility of earnings and

protecting fair values of assets and liabilities:

Foreign currency-denominated assets and liabilities

•

Forecasted purchases and sales in foreign currency

•

Summary of Foreign Exchange Hedging Positions

At December 31, 2010, we had outstanding forward exchange and

purchased option contracts with gross notional values of $2,968 which

is reflective of the amounts that are normally outstanding at any point

during the year. These contracts generally mature in 12 months or less.