Xerox 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

81Xerox 2010 Annual Report

The Credit Facility also contains various events of default, the

occurrence of which could result in a termination by the lenders and the

acceleration of all our obligations under the Credit Facility. These events

of default include, without limitation: (i) payment defaults, (ii) breaches

of covenants under the Credit Facility (certain of which breaches do not

have any grace period), (iii) cross-defaults and acceleration to certain of

our other obligations and (iv) a change of control of Xerox.

Capital Market Activity

During 2010, we redeemed the following Notes prior to their

scheduled maturity:

7.625% Senior Notes due in 2013 for $550;

•

6.00% Medium-term Notes due 2011 for $25;

•

7.41% Medium-term Notes due 2011 for $25;

•

6.50% Medium-term Notes due 2013 for $10;

•

6.00% Medium-term Notes due 2014 for $25; and

•

6.125% Medium-term Notes due 2014 for $25.

•

We incurred a loss on extinguishment of approximately $16,

representing the call premium of approximately $7 on the Senior

Notes as well as the write-off of unamortized debt costs of $9.

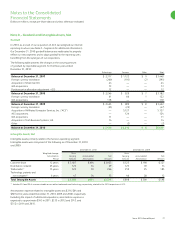

Interest

Interest paid on our short-term debt, long-term debt and liability

to subsidiary trust issuing preferred securities amounted to $586,

$531 and $527 for the years ended December 31, 2010, 2009 and

2008, respectively.

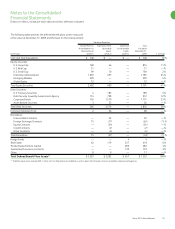

Interest expense and interest income for the three years ended

December 31, 2010 was as follows:

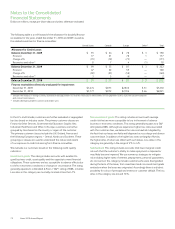

2010 2009 2008

Interest expense(1) $ 592 $ 527 $ 567

Interest income(2) 679 734 833

(1) Includes Equipment financing interest expense, as well as non-financing interest

expense included in Other expenses, net in the Consolidated Statements of Income.

(2) Includes Finance income, as well as other interest income that is included in Other

expenses, net in the Consolidated Statements of Income.

Equipment financing interest is determined based on an estimated

cost of funds, applied against the estimated level of debt required to

support our net finance receivables. The estimated cost of funds is

based on our overall corporate cost of borrowing adjusted to reflect a

rate that would be paid by a typical BBB rated leasing company. The

estimated level of debt is based on an assumed 7 to 1 leverage ratio

of debt/equity as compared to our average finance receivable balance

during the applicable period.

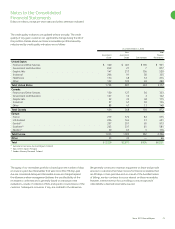

Scheduled principal payments due on our long-term debt for the next

five years and thereafter are as follows:

2011 2012 2013 2014 2015 Thereafter Total

$1,070(1) $1,126 $412 $771 $1,251 $3,450 $8,080

(1)

Quarterly total debt maturities for 2011 are $11, $9, $1,041 and $9 for the first,

second, third and fourth quarters, respectively.

Commercial Paper

In October 2010, Xerox’s Board of Directors authorized the company

to issue commercial paper (“CP”). Aggregate CP and Credit Facility

borrowings may not exceed $2 billion outstanding at any time. Under

the company’s current private placement CP program, we may issue

CP up to a maximum amount of $1.0 billion outstanding at any time.

The maturities of the CP Notes will vary, but may not exceed 390 days

from the date of issue. The CP Notes are sold at a discount from par or,

alternatively, sold at par and bear interest at market rates.

Credit Facility

The Credit Facility is a $2.0 billion unsecured revolving credit facility

including a $300 letter of credit subfacility. At December 31, 2010 we

had no outstanding borrowings or letters of credit. Approximately $1.8

billion, or 90% of the Credit Facility, has a maturity date of April 30,

2013. The remaining portion of the Credit Facility has a maturity date

of April 30, 2012.

The Credit Facility is available, without sublimit, to certain of our

qualifying subsidiaries and includes provisions that would allow us

to increase the overall size of the Credit Facility up to an aggregate

amount of $2.5 billion. Our obligations under the Credit Facility are

unsecured and are not currently guaranteed by any of our subsidiaries.

Any domestic subsidiary that guarantees more than $100 of Xerox

Corporation debt must also guaranty our obligations under the Credit

Facility. In the event that any of our subsidiaries borrows under the

Credit Facility, its borrowings thereunder would be guaranteed by us.

Borrowings under the Credit Facility bear interest at our choice, at either

(a) a Base Rate as defined in our Credit Facility agreement, plus an all-in

spread that varies between 1.5% and 3.5% depending on our credit

rating at the time of borrowing, or (b) LIBOR plus an all-in spread that

varies between 2.5% and 4.5% depending on our credit rating at the

time of borrowing. Based on our credit rating as of December 31, 2010,

the applicable all-in spreads for the Base Rate and LIBOR borrowing were

2.5% and 3.5%, respectively.

The Credit Facility contains various conditions to borrowing and

affirmative, negative and financial maintenance covenants. Certain of

the more significant covenants are summarized below:

(a) Maximum leverage ratio (a quarterly test that is calculated as

principal debt divided by consolidated EBITDA, as defined) of 3.75x

(b) Minimum interest coverage ratio (a quarterly test that is calculated

as consolidated EBITDA divided by consolidated interest expense)

may not be less than 3.00x

(c) Limitations on (i) liens of Xerox and certain of our subsidiaries

securing debt, (ii) certain fundamental changes to corporate

structure, (iii) changes in nature of business and (iv) limitations on

debt incurred by certain subsidiaries