Xerox 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

87Xerox 2010 Annual Report

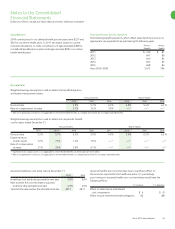

Note 15 – Employee Benefit Plans

We sponsor numerous pension and other post-retirement benefit plans,

primarily retiree health, in our domestic and international operations.

December 31 is the measurement date for all of our other post-

retirement benefit plans.

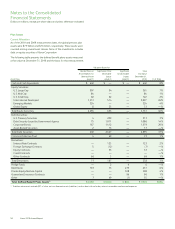

The fair value amounts for Cash and cash equivalents and Accounts

receivable, net approximate carrying amounts due to the short

maturities of these instruments. The fair value of Short- and Long-

term debt, as well as our Liability to subsidiary trust issuing preferred

securities, was estimated based on quoted market prices for publicly

traded securities or on the current rates offered to us for debt of similar

maturities. The difference between the fair value and the carrying value

represents the theoretical net premium or discount we would pay or

receive to retire all debt at such date.

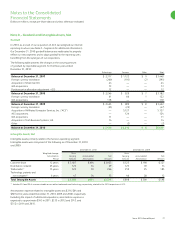

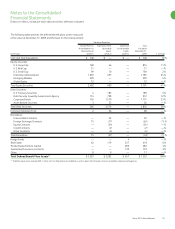

Pension Benefits Retiree Health

2010 2009 2010 2009

Change in Benefit Obligation:

Benefit obligation, January 1 $ 9,194 $ 8,495 $ 1,102 $ 1,002

Service cost 178 173 8 7

Interest cost 575 508 54 60

Plan participants’ contributions 11 9 26 36

Plan amendments(3) (19) 4 (86) 1

Actuarial loss (gain) 477 209 13 124

Acquisitions(2) 140 1 1 —

Currency exchange rate changes (154) 373 6 15

Curtailments (1) — — —

Benefits paid/settlements (670) (578) (118) (143)

Benefit obligation, December 31 9,731 9,194 1,006 1,102

Change in Plan Assets:

Fair value of plan assets, January 1 7,561 6,923 — —

Actual return on plan assets 846 720 — —

Employer contribution 237 122 92 107

Plan participants’ contributions 11 9 26 36

Acquisitions(3) 107 — — —

Currency exchange rate changes (144) 349 — —

Benefits paid/settlements (669) (578) (118) (143)

Other (9) 16 — —

Fair value of plan assets, December 31 7,940 7,561 — —

Net funded status at December 31(1) $ (1,791) $ (1,633) $ (1,006) $ (1,102)

Amounts recognized in the Consolidated Balance Sheets:

Other long-term assets $ 92 $ 155 $ — $ —

Accrued compensation and benefit costs (44) (47) (86) (103)

Pension and other benefit liabilities (1,839) (1,741) — —

Post-retirement medical benefits — — (920) (999)

Net Amounts Recognized $ (1,791) $ (1,633) $ (1,006) $ (1,102)

(1) Includes under-funded and non-funded plans.

(2) Primarily ACS’s acquired balances.

(3) Refer to the “Plan Amendment” section for additional information.