Xerox 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13Xerox 2010 Annual Report

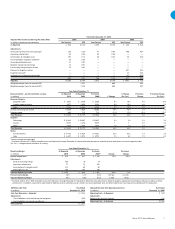

Business Model Fundamentals

Throughourannuity-basedbusinessmodel,wedeliversignicantcash

generation and have a strong foundation upon which we can expand

earnings.

Annuity Model

The fundamentals of our business rest upon an annuity model that

drivessignicantrecurringrevenueandcashgeneration.Over80%

of our 2010 total revenue was annuity-based revenue that includes

contracted services, equipment maintenance and consumable supplies,

among other elements. Some of the key indicators of annuity revenue

growth include:

• Thenumberofpage-producingmachinesintheeld(“MIF”),whichis

impacted by the number of equipment installations

• Page volume and the mix of color pages, as color pages generate more

revenue per page than black-and-white

• Services signings growth, which reflects the year-over-year increase in

estimated future revenues from contracts signed during the period as

measured on a trailing 12-month basis

• Services pipeline growth, which measures the year-over-year increase

in new business opportunities

• Expanding the digital production printing market, as this is key to

increasing pages.

Cash Generation

The combination of consistently strong cash flow from operations

and modest capital investments enabled us in 2010 to pay down a

signicantamountofthedebtassociatedwiththeACSacquisition.

Cash generation in the future will continue to provide a return to

shareholders through:

• Buying back shares under our share repurchase program once debt

leverage targets are met

• Expanding our distribution and business process outsourcing

capabilities through acquisitions

• Maintaining and, over time, increasing our quarterly dividend.

Expanded Earnings

We will expand our operating margin and future earnings through:

• Modest revenue growth

• Drivingcostefcienciestobalancegrossprotandexpense

• Repurchasing shares

• Making accretive acquisitions.

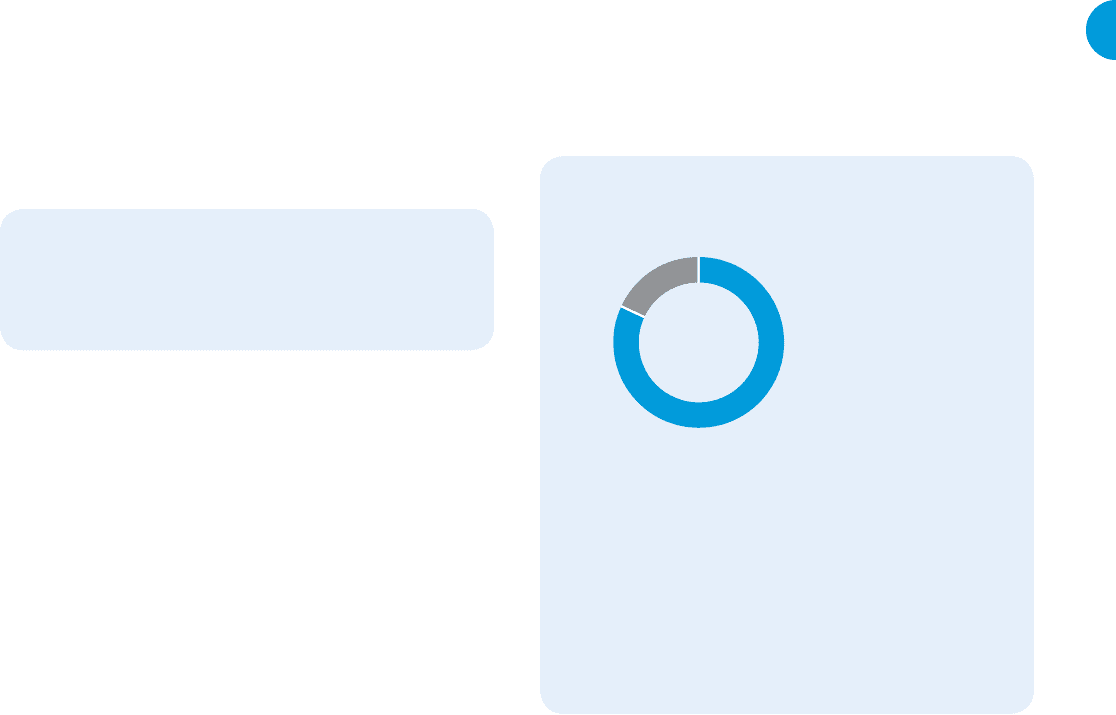

Revenue Stream

• 82% Annuity

Approximately 82% of our revenue, annuity includes

revenues from services, maintenance, supplies, rentals

andnancing.

• 18% Equipment Sales

The remaining 18% of our revenue comes from

equipment sales, from either lease arrangements that

qualify as sales for accounting purposes or outright

cash sales.

18%

82%

Our annuity-based business model yields

strong and stable cash generation and

earnings growth.