Xerox 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Management’s Discussion

Xerox 2010 Annual Report

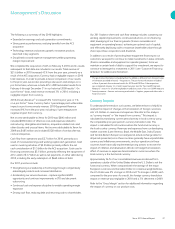

Revenue2009

Services revenue of $3,476 million decreased 9% including a

2-percentage point negative impact from currency. Services revenue

for 2009 and 2008 primarily reflects revenue from DO services.

The decrease in revenue is primarily due to lower usage, primarily

in black-and-white devices.

SegmentProt2009

Services operating profit of $231 million decreased $71 million from

2008. The decrease was primarily due to lower gross profit reflecting

a decrease in revenues partially offset by lower cost and expenses

reflecting benefits from restructuring and favorable currency.

Other

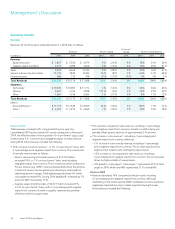

Revenue2010

Other revenue of $1,647 million increased 1%, including a negligible

impact from currency. Increases in GIS’s network integration and

electronic presentation systems and Wide Format sales offset a decline

in paper sales. Paper comprised approximately 58% of the Other

segment revenue.

SegmentLoss2010

Other segment loss of $342 million was flat with 2009, as higher gross

profit reflecting an increase in gross margins from the mix of revenues

was partially offset by higher interest expense associated with funding

for the ACS acquisition.

Revenue2009

Other revenue of $1,636 million decreased 21%, including a

2-percentage point negative impact from currency, primarily driven by

declines in revenue from paper, wide format systems, and licensing and

royalty arrangements. Paper comprised approximately, 60% of the

Other segment revenue.

SegmentLoss2009

Other operating loss of $342 million increased $97 million from

2008, primarily due to lower revenue, as well as lower interest and

equity income.

(1) Refer to the “Non-GAAP Financial Measures” section for an explanation of the

Pro-forma non-GAAP financial measure.

SegmentProt2010

Services operating profit of $1,132 million increased $901 million or

$124 million on a pro-forma(1) basis from 2009, driven primarily by BPO

growth and lower G&A expenses.

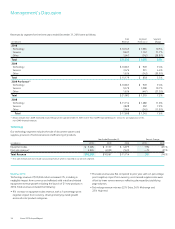

Metrics

Pipeline

Our BPO and ITO revenue pipeline including synergy opportunities

grew 25% over the fourth quarter 2009. The sales pipeline includes

the Total Contract Value (“TCV”) of new business opportunities that

could potentially be contracted within the next six months and excludes

business opportunities with estimated annual recurring revenue in excess

of $100 million. The DO sales pipeline grew approximately 17% over the

fourth quarter 2009. The DO sales pipeline includes all active deals with

$10 million or greater in TCV.

Signings

Signings (“Signings”) are defined as estimated future revenues from

contracts signed during the period, including renewals of existing

contracts. Services signings were an estimated $14.6 billion in TCV in

2010 and increased 13% as compared to the comparable prior-year

period. TCV represents estimated total revenue for future contracts for

pipeline or signed contracts for signings as applicable.

Signings were as follows:

(in billions) Year Ended December 31, 2010

BPO $ 10.0

DO 3.3

ITO 1.3

Total Signings $ 14.6

Signings growth was driven by strong signings in both our BPO and

DO businesses. In 2010 we signed significant new business in the

following areas:

Child support payment processing

•

Commercial healthcare

•

Customer care

•

Electronic payment cards

•

Enterprise print services

•

Government healthcare

•

Telecom and hardware services

•

Transportation

•