Xerox 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

75Xerox 2010 Annual Report

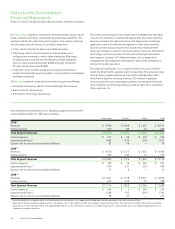

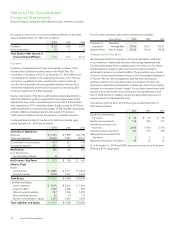

Depreciation expense and operating lease rent expense for the years

ended December 31, 2010, 2009 and 2008 were as follows:

2010 2009 2008

Depreciation expense $379 $247 $257

Operating lease rent expense(1) 632 267 252

(1) We lease certain land, buildings and equipment, substantially all of which are

accounted for as operating leases.

Future minimum operating lease commitments that have initial or

remaining non-cancelable lease terms in excess of one year at December

31, 2010 were as follows:

2011 2012 2013 2014 2015 Thereafter

$669 $486 $337 $171 $118 $106

We have an information management contract with HP Enterprise

Services (“HPES”), the legal successor to Electronic Data Systems Corp.,

through March 2014. Services to be provided under this contract

include support for European mainframe system processing, as well

as workplace, service desk and voice and data network management.

Although the HPES contract runs through March 2014, we may choose

to transfer some of the services to internal Xerox providers before the

HPES contract ends. There are no minimum payments required under

this contract. We can terminate the contract for convenience without

paying a termination fee by providing 60 days’ prior notice. Should we

terminate the contract for convenience, we have an option to purchase

the assets placed in service under the HPES contract. Payments to HPES,

which are primarily recorded in selling, administrative and general

expenses, were $98, $198 and $279 for the years ended December 31,

2010, 2009 and 2008, respectively.

During 2010 and 2009 we terminated several agreements with HPES

for information management services and either terminated the

services or entered into new agreements for similar services with several

alternative providers. Services provided under these new contracts

include mainframe application processing, development and support

and mid-range applications processing and support. These contracts

have various terms through 2015. Some of the contracts require

minimum payments and include termination penalties. Payments for

information management services which are primarily recorded in

selling, administrative and general expenses were $44 and $26 for the

years ended December 31, 2010 and 2009, respectively.

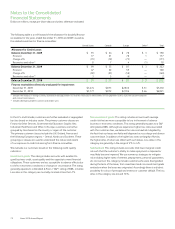

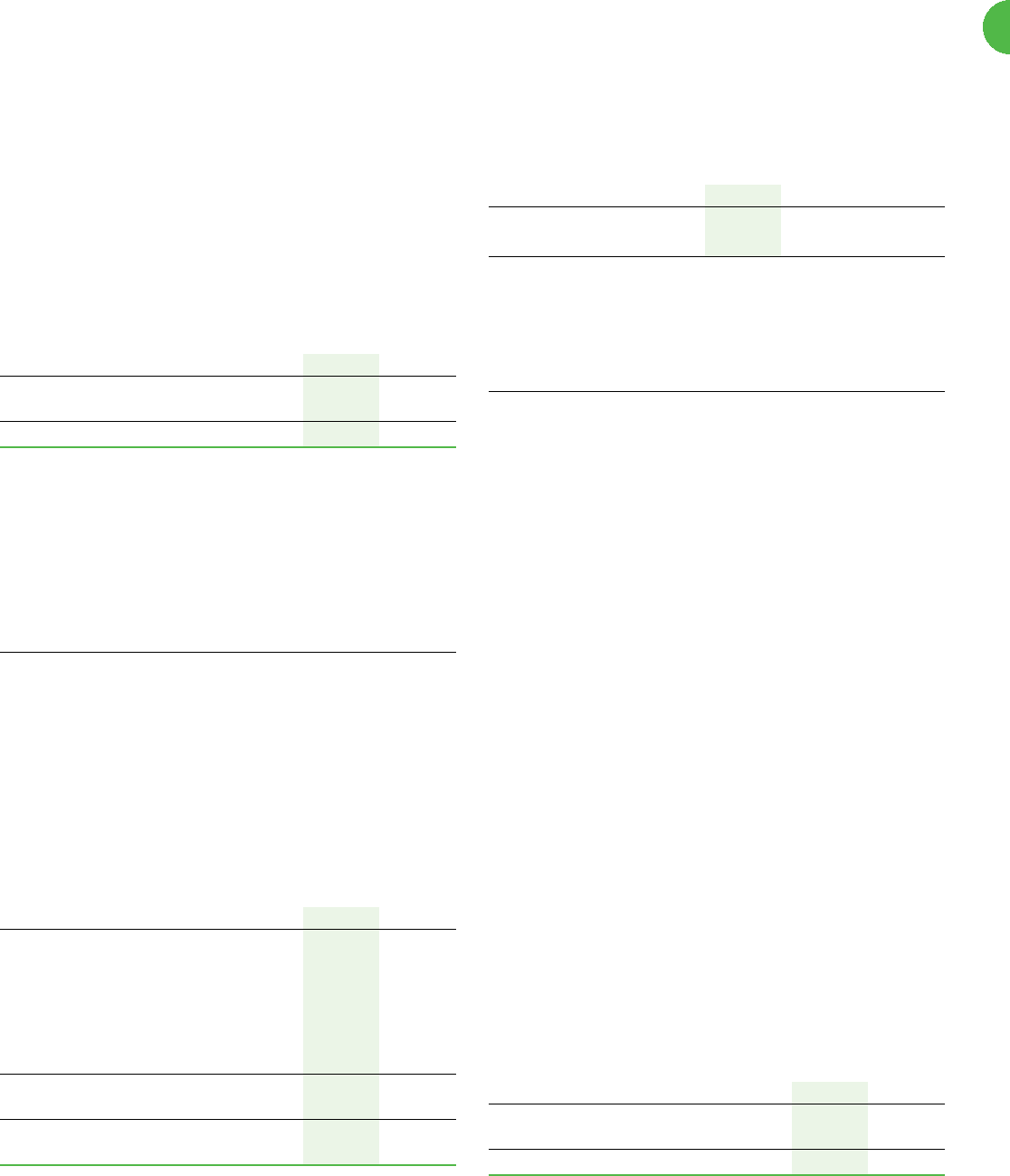

Note 7 – Investments in Affiliates, at Equity

Investments in corporate joint ventures and other companies in which

we generally have a 20% to 50% ownership interest at December 31,

2010 and 2009 were as follows:

2010 2009

Fuji Xerox $ 1,217 $ 998

All other equity investments 74 58

Investments in Affiliates, at Equity $ 1,291 $ 1,056

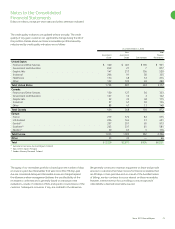

The transfer of equipment from our inventories to equipment subject

to an operating lease is presented in our Consolidated Statements of

Cash Flows in the operating activities section as a non-cash adjustment.

Equipment on operating leases and similar arrangements consists of our

equipment rented to customers and depreciated to estimated salvage

value at the end of the lease term. We recorded $31, $52 and $115 in

inventory write-down charges for the years ended December 31, 2010,

2009 and 2008, respectively.

Equipment on operating leases and the related accumulated

depreciation at December 31, 2010 and 2009 were as follows:

2010 2009

Equipment on operating leases $ 1,561 $ 1,583

Accumulated depreciation (1,031) (1,032)

Equipment on Operating Leases, net $ 530 $ 551

Depreciable lives generally vary from three to four years consistent

with our planned and historical usage of the equipment subject to

operating leases. Depreciation and obsolescence expense for equipment

on operating leases was $313, $329 and $298 for the years ended

December 31, 2010, 2009 and 2008, respectively. Our equipment

operating lease terms vary, generally from 12 to 36 months. Scheduled

minimum future rental revenues on operating leases with original terms

of one year or longer are:

2011 2012 2013 2014 2015 Thereafter

$389 $279 $180 $87 $41 $14

Total contingent rentals on operating leases, consisting principally of

usage charges in excess of minimum contracted amounts, for the years

ended December 31, 2010, 2009 and 2008 amounted to $133, $125

and $117, respectively.

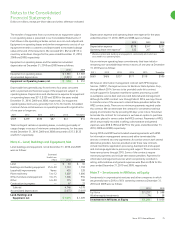

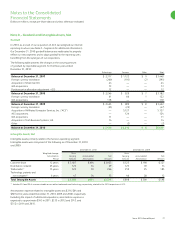

Note 6 – Land, Buildings and Equipment, Net

Land, buildings and equipment, net at December 31, 2010 and 2009

were as follows:

Estimated

Useful Lives

(Years) 2010 2009

Land — $ 63 $ 45

Buildings and building equipment 25 to 50 1,133 1,192

Leasehold improvements Varies 455 328

Plant machinery 5 to 12 1,607 1,686

Office furniture and equipment 3 to 15 1,306 994

Other 4 to 20 115 100

Construction in progress — 67 33

Subtotal 4,746 4,378

Accumulated depreciation (3,075) (3,069)

Land, Buildings and

Equipment, net

$ 1,671 $ 1,309