Xerox 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

Management’s Discussion

Xerox 2010 Annual Report

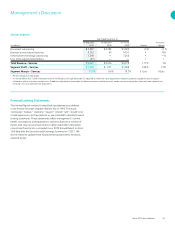

As of December 31, 2010, the total amounts related to the unreserved

portion of the tax and labor contingencies, inclusive of any related

interest, amounted to approximately $1,274 million, with the increase

from the December 31, 2009 balance of $1,225 million primarily related

to currency and current-year interest indexation partially offset by

matters that have been closed. With respect to the unreserved balance

of $1,274 million, the majority has been assessed by management as

being remote as to the likelihood of ultimately resulting in a loss to the

Company. In connection with the above proceedings, customary local

regulations may require us to make escrow cash deposits or post other

security of up to half of the total amount in dispute. As of December 31,

2010 we had $276 million of escrow cash deposits for matters we are

disputing and there are liens on certain Brazilian assets with a net book

value of $19 million and additional letters of credit of approximately

$160 million. Generally, any escrowed amounts would be refundable and

any liens would be removed to the extent the matters are resolved in our

favor. We routinely assess these matters as to probability of ultimately

incurring a liability against our Brazilian operations and record our best

estimate of the ultimate loss in situations where we assess the likelihood

of an ultimate loss as probable.

OtherContingenciesandCommitments

As more fully discussed in Note 17 – Contingencies in the

Consolidated Financial Statements, we are involved in a variety of

claims, lawsuits, investigations and proceedings concerning securities

law, intellectual property law, environmental law, employment law

and the Employee Retirement Income Security Act. In addition,

guarantees, indemnifications and claims may arise during the ordinary

course of business from relationships with suppliers, customers and

nonconsolidated affiliates. Nonperformance under a contract including

a guarantee, indemnification or claim could trigger an obligation

of the Company.

We determine whether an estimated loss from a contingency should

be accrued by assessing whether a loss is deemed probable and can

be reasonably estimated. Should developments in any of these areas

cause a change in our determination as to an unfavorable outcome and

result in the need to recognize a material accrual, or should any of these

matters result in a final adverse judgment or be settled for significant

amounts, they could have a material adverse effect on our results of

operations, cash flows and financial position in the period or periods in

which such change in determination, judgment or settlement occurs.

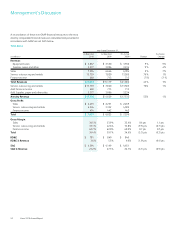

PensionandOtherPost-retirementBenetPlans

We sponsor defined benefit pension plans and retiree health

plans that require periodic cash contributions. Our 2010

contributions for these plans were $237 million for our defined

benefit pension plans and $92 million for our retiree health plans.

In 2011 we expect, based on current actuarial calculations, to

make contributions of approximately $500 million to our worldwide

defined benefit pension plans and approximately $90 million to our

retiree health benefit plans. Contributions to our defined benefit

pension plans have increased from the prior year due to a decrease

in the discount rate, prior years’ investment performance as well as

the requirement in the U.S. to make quarterly contributions for the

current plan year. Contributions in subsequent years will depend on

a number of factors, including the investment performance of plan

assets and discount rates as well as potential legislative and plan

changes. We currently expect contributions to our defined benefit

pension plans to decline in years subsequent to 2011.

Our retiree health benefit plans are non-funded and are almost entirely

related to domestic operations. Cash contributions are made each year

to cover medical claims costs incurred during the year. The amounts

reported in the above table as retiree health payments represent our

estimate of future benefit payments.

FujiXerox

We purchased products, including parts and supplies, from Fuji Xerox

totaling $2.1 billion, $1.6 billion and $2.1 billion in 2010, 2009 and

2008, respectively. Our purchase commitments with Fuji Xerox are

entered into in the normal course of business and typically have a

lead time of three months. Related party transactions with Fuji Xerox

are discussed in Note 7 – Investments in Affiliates, at Equity in the

Consolidated Financial Statements.

BrazilTaxandLaborContingencies

Our Brazilian operations are involved in various litigation matters

and have received or been the subject of numerous governmental

assessments related to indirect and other taxes, as well as disputes

associated with former employees and contract labor. The tax matters,

which comprise a significant portion of the total contingencies,

principally relate to claims for taxes on the internal transfer of inventory,

municipal service taxes on rentals and gross revenue taxes. We are

disputing these tax matters and intend to vigorously defend our

positions. Based on the opinion of legal counsel and current reserves

for those matters deemed probable of loss, we do not believe that the

ultimate resolution of these matters will materially impact our results of

operations, financial position or cash flows. The labor matters principally

relate to claims made by former employees and contract labor for the

equivalent payment of all social security and other related labor benefits,

as well as consequential tax claims, as if they were regular employees.