Xerox 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Management’s Discussion

Xerox 2010 Annual Report

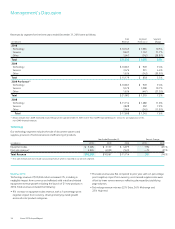

Income Taxes

Year Ended December 31,

2010 2009 2008

Income Income Income

Pre-Tax Tax Effective Pre-Tax Tax Effective Pre-Tax Tax Effective

(in millions) Income Expense Tax Rate Income Expense Tax Rate Income Expense Tax Rate

Reported $ 815 $ 256 31.4% $ 627 $ 152 24.2% $ (79) $ (231) 292.4%

Adjustments:

Xerox restructuring charge(1) 483 166 (8) (3) 426 134

Acquisition-related costs 77 19 72 23 — —

Amortization of intangible assets 312 118 60 22 54 19

Venezuela devaluation costs 21 — — — — —

Medicare subsidy tax law change — (16) — — — —

Equipment write-off — — — — 39 15

Provision for securities litigation — — — — 774 283

ACS Shareholders’ litigation settlement 36 — — — — —

Loss on early extinguishment of debt 15 5 — — — 41

Adjusted(2) $ 1,759 $ 548 31.2% $ 751 $ 194 25.8% $ 1,214 $ 261 21.5%

The 2010 effective tax rate was 31.4%, or 31.2%(2) on an adjusted

basis, which was lower than the U.S. statutory rate primarily due to the

geographical mix of income before taxes and the related effective tax

rates in those jurisdictions as well as the U.S. tax impacts on certain

foreign income and tax law changes.

The 2009 effective tax rate was 24.2%, or 25.8%(2) on an adjusted basis,

which was lower than the U.S. statutory tax rate primarily reflecting the

benefit to taxes from the geographical mix of income before taxes and

the related effective tax rates in those jurisdictions and the settlement

of certain previously unrecognized tax benefits partially offset by a

reduction in the utilization of foreign tax credits.

The 2008 effective tax rate was 292.4%, or 21.5%(2) on an adjusted

basis, which was lower than the U.S. statutory tax rate primarily reflecting

the benefit to taxes from the geographical mix of income before taxes

and the related effective tax rates in those jurisdictions, the utilization

of foreign tax credits and tax law changes.

Our effective tax rate will change based on nonrecurring events as well

as recurring factors including the geographical mix of income before

taxes and the related effective tax rates in those jurisdictions and the

U.S. tax impacts on certain foreign income. In addition, our effective tax

rate will change based on discrete or other nonrecurring events (such as

audit settlements) that may not be predictable. We anticipate that our

effective tax rate for 2011 will be approximately 31%, excluding the

effects of any discrete events.

Refer to Note 16 – Income and Other Taxes in the Consolidated Financial

Statements for additional information.

(1)

Income tax benefit from restructuring in 2010 includes a $19 million benefit from

the sale of our Venezuelan operations.

(2) See the “Non-GAAP Measures” section for additional information.

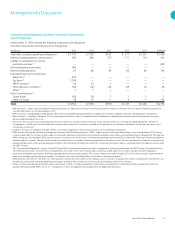

Equity in Net Income of Unconsolidated Affiliates

Year Ended December 31,

(in millions) 2010 2009 2008

Total equity in net income of

unconsolidated affiliates $ 78 $ 41 $ 113

Fuji Xerox after-tax

restructuring costs(1) 38 46 16

(1) Represents our 25% share of Fuji Xerox after-tax restructuring costs. Amounts are

included in Total equity in net income of unconsolidated affiliates.

Equity in net income of unconsolidated affiliates primarily reflects our

25% share in Fuji Xerox.

The 2010 increase of $37 million from 2009 was primarily due to an

increase in Fuji Xerox’s net income, which was primarily driven by higher

revenue and cost improvements, as well as lower restructuring costs.

The 2009 decrease of $72 million from 2008 was primarily due to

Fuji Xerox’s lower net income, which was negatively impacted by the

weakness in the worldwide economy, as well as $46 million related to our

share of Fuji Xerox after-tax restructuring costs.

Recent Accounting Pronouncements

Refer to Note 1 – Summary of Significant Accounting Policies in the

Consolidated Financial Statements for a description of recent accounting

pronouncements including the respective dates of adoption and the

effects on results of operations and financial condition.