Xerox 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Year-over-yearourrevenuefromserviceswasup3percent1 on a pro-

forma basis and indicators for future revenues remain strong. Business

signings were up about 13 percent on a trailing 12-month basis.

So positive results in both technology and services, good

opportunities going forward and a team that is focused on

excellent execution.

Delivering Shareholder Value

In 2010, we grew adjusted earnings, increased revenue, improved

operating margin and generated $2.7 billion in cash. We delivered

on our commitments across the board. And by doing so, we created

greater value for our shareholders. That was then; this is now.

We enter 2011 with building momentum and heightened

condence.Idon’tknowthatanyonehasthehubristopredictwith

any certainty what the post-recession business climate will be like.

But I do know this – businesses and governments, large and small,

willcontinuetostruggletocontaincosts,operatemoreefciently,

grow revenue and build better client relationships. In other words,

they will want to go about their real business and Xerox is ready to

help them.

We’recondent,butnotcomplacent.We’redifferentiatedinthe

marketplace through our world-class innovation and renowned

service. We operate in some 160 countries and that’s becoming

more and more important to our larger customers who are looking

for global solutions. Our world-class brand gives us a high degree of

trust that helps us open doors and build relationships. We’re relevant

to our customers who rely on us to make them better. Our business

model has been tested under the most trying conditions the past

few years and proven to be both resilient and flexible. We are

focused on the basics – containing cost, generating cash, growing

revenue and providing you with good returns.

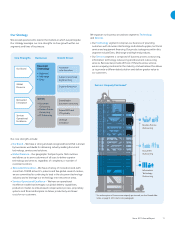

Our 2011 priorities and plans keep us on track to grow revenue,

generatesignicantcashandexpandearnings.Wewon’t

compromise our leadership position or give an inch in document

technology. By continuing to expand distribution, we’ll increase

install activity and equipment sales – with an emphasis on driving

color pages that help boost our annuity stream.

We’ll continue to grow our services business by leveraging our brand,

global scale, innovation and delivery platforms to win multimillion-

dollar deals in business process, IT and document outsourcing.

We’ll remain diligent on cost and expense management, capturing

keycostsynergiesfromtheACSacquisitionanddrivingefciencies

and productivity across the enterprise.

We’ll continue to focus on generating free cash flow1 – about $2

billion of it – all the while reducing debt, delivering dividends, closing

on“tuck-in”acquisitionsandallottingasignicantportionof

available cash to repurchasing stock.

We are now 136,000 people strong doing business in 160 countries

and all with an overreaching mission of delivering value to our

customers and our shareholders.

I’mcondentwehavetherightstrategy,asoundbusinessmodel,the

competitive strength, a seasoned leadership team, talented people,

and the discipline and focus to put it all together for you in 2011.

This is our real business, and we’re ready.

Ursula M. Burns

ChairmanandChiefExecutiveOfcer

Note: estimates regarding market size and growth are based on a combination of third-party

and internal information.

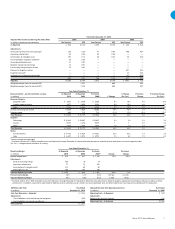

(1) We have discussed our results using non-GAAP measures. Management believes that these

non-GAAP financial measures provide an additional means of analyzing the current periods’

results against the corresponding prior periods’ results. However, these non-GAAP financial

measures should be viewed in addition to, and not as a substitute for, the Company’s reported

results prepared in accordance with GAAP. Our non-GAAP financial measures are not meant

to be considered in isolation or as a substitute for comparable GAAP measures and should be

read only in conjunction with our consolidated financial statements prepared in accordance

with GAAP. Our management regularly uses our supplemental non-GAAP financial measures

internally to understand, manage and evaluate our business and make operating decisions.

These non-GAAP measures are among the primary factors management uses in planning for

and forecasting future periods.

A reconciliation of these non-GAAP financial measures to the most directly comparable financial

measures calculated and presented in accordance with GAAP are set forth on the following page.

“ We are focused on the basics –

containing cost, generating cash,

growing revenue and providing

youwithgoodreturns.”