Xerox 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

65Xerox 2010 Annual Report

Foreign currency losses were $11, $26 and $34 in 2010, 2009 and

2008, respectively, and are included in Other expenses, net in the

accompanying Consolidated Statements of Income.

We sold our Venezuelan subsidiary during the fourth quarter of 2010 as

part of our restructuring actions – refer to Note 9 – Restructuring and

Asset Impairment Charges for further information. Prior to the sale, the

U.S. Dollar was the functional currency of our Venezuelan operations.

In January 2010, Venezuela announced a devaluation of the Bolivar to

an official rate of 4.30 Bolivars to the U.S. Dollar for the majority of our

products. As a result of this devaluation, we recorded a currency loss

of $21 in the first quarter of 2010 for the re-measurement of our net

Bolivar-denominated monetary assets. During 2010, the ability to obtain

U.S. Dollars remained severely restricted. As a result, during 2010 we

re-measured our net Bolivar-denominated monetary transactions based

on exchange rates available through alternative markets. The average

rate during 2010 was approximately 5.77 Bolivars to the U.S. Dollar.

The impact of this change in the exchange rate was not material to our

results for the year since we derived less than 0.5% of our total revenues

from Venezuela.

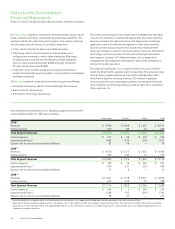

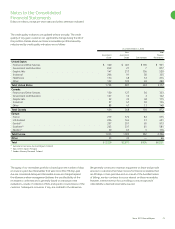

Accumulated Other Comprehensive Loss (“AOCL”)

AOCL is composed of the following for the three years ending

December 31, 2010:

2010 2009 2008

Cumulative translation

adjustments $ (835) $ (800) $ (1,395)

Benefit plans net actuarial losses

and prior service credits(1) (1,167) (1,190) (1,021)

Other unrealized gains, net 14 2 —

Total Accumulated Other

Comprehensive Loss $ (1,988) $ (1,988) $ (2,416)

(1) Includes our share of Fuji Xerox.

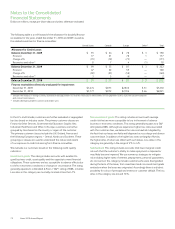

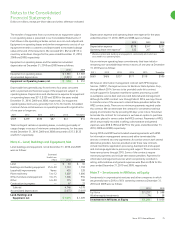

Note 2 – Segment Reporting

Our reportable segments are aligned with how we manage the business

and view the markets we serve. In 2010, as a result of our acquisition of

ACS, we realigned our internal financial reporting structure (refer to Note

3 – Acquisitions for information regarding the ACS acquisition). We now

report our financial performance based on the following two primary

reportable segments – Technology and Services. The Technology

segment represents the combination of our former Production and Office

segments excluding the document outsourcing business, which was

previously included in these reportable segments. The Services segment

represents the combination of our document outsourcing business and

ACS’s business process outsourcing (“BPO”) and information technology

outsourcing (“ITO”) businesses. We believe this realignment will help us

to better manage our business and view the markets we serve, which are

primarily centered around equipment systems and outsourcing services.

Our Technology segment operations involve the sale and support of

a broad range of document systems from entry level to the high-end.

Our Services segment operations involve delivery of a broad range of

outsourcing services including document, business processing and IT

outsourcing services. Our 2009 and 2008 segment disclosures have been

restated to reflect our new 2010 internal reporting structure.

on the plan asset component of our net periodic pension cost, we

apply our estimate of the long-term rate of return to the plan assets

that support our pension obligations, after deducting assets that are

specifically allocated to Transitional Retirement Accounts (which are

accounted for based on specific plan terms).

For purposes of determining the expected return on plan assets, we

utilize a calculated value approach in determining the value of the

pension plan assets, rather than a fair market value approach. The

primary difference between the two methods relates to systematic

recognition of changes in fair value over time (generally two years)

versus immediate recognition of changes in fair value. Our expected

rate of return on plan assets is applied to the calculated asset value

to determine the amount of the expected return on plan assets to

be used in the determination of the net periodic pension cost. The

calculated value approach reduces the volatility in net periodic pension

cost that would result from using the fair market value approach.

The discount rate is used to present value our future anticipated benefit

obligations. In estimating our discount rate, we consider rates of return

on high-quality fixed-income investments included in various published

bond indexes, adjusted to eliminate the effects of call provisions and

differences in the timing and amounts of cash outflows related to the

bonds, as well as the expected timing of pension and other benefit

payments. In the U.S. and the U.K., which comprise approximately

75% of our projected benefit obligation, we consider the Moody’s

Aa Corporate Bond Index and the International Index Company’s

iBoxx Sterling Corporate AA Cash Bond Index, respectively, in the

determination of the appropriate discount rate assumptions. Refer to

Note 15 – Employee Benefit Plans for further information.

Each year, the difference between the actual return on plan assets and

the expected return on plan assets, as well as increases or decreases in

the benefit obligation as a result of changes in the discount rate, are

added to or subtracted from any cumulative actuarial gain or loss that

arose in prior years. This resultant amount is the net actuarial gain or

loss recognized in Accumulated other comprehensive loss and is subject

to subsequent amortization to net periodic pension cost in future periods

over the remaining service lives of the employees participating in the

pension plan.

Foreign Currency Translation and Re-measurement

The functional currency for most foreign operations is the local currency.

Net assets are translated at current rates of exchange and income,

expense and cash flow items are translated at average exchange rates

for the applicable period. The translation adjustments are recorded in

Accumulated other comprehensive loss.

The U.S. Dollar is used as the functional currency for certain foreign

subsidiaries that conduct their business in U.S. Dollars. A combination

of current and historical exchange rates is used in re-measuring the local

currency transactions of these subsidiaries and the resulting exchange

adjustments are included in income.