Xerox 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

102 Xerox 2010 Annual Report

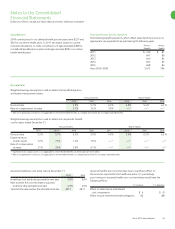

The following table provides information relating to stock option

exercises for the three years ended December 31, 2010:

2010 2009 2008

Total intrinsic value of

stock options $ 155 $ — $ 4

Cash received 183 1 6

Tax benefit realized for stock

option tax deductions 56 — 2

As of December 31, 2010, there was $35 of total unrecognized

compensation cost related to nonvested stock options. This cost is

expected to be recognized ratably over a remaining weighted-average

vesting period of three years.

Information relating to options outstanding and exercisable at

December 31, 2010 was as follows:

Options Outstanding Options Exercisable

Aggregate intrinsic value $267 $199

Weighted-average remaining

contractual life in years 4.42 3.46

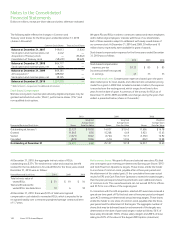

Note 20 – Earnings per Share

The following table sets forth the computation of basic and diluted

earnings per share of common stock for the three years ended

December 31, 2010 (shares in thousands):

2010 2009 2008

Basic Earnings per Share:

Net income attributable to Xerox $ 606 $ 485 $ 230

Accrued dividends on preferred stock (21) — —

Adjusted Net Income Available to Common Shareholders $ 585 $ 485 $ 230

Weighted average common shares outstanding 1,323,431 869,979 885,471

Basic Earnings per Share $ 0.44 $ 0.56 $ 0.26

Diluted Earnings per Share:

Net income attributable to Xerox $ 606 $ 485 $ 230

Accrued dividends on Preferred stock (21) — —

Interest on Convertible securities, net — 1 —

Adjusted Net Income Available to Common Shareholders $ 585 $ 486 $ 230

Weighted-average common shares outstanding 1,323,431 869,979 885,471

Common shares issuable with respect to:

Stock options 13,497 462 3,885

Restricted stock and performance shares 13,800 7,087 6,186

Convertible securities — 1,992 —

Adjusted Weighted Average Shares Outstanding 1,350,728 879,520 895,542

Diluted Earnings per Share $ 0.43 $ 0.55 $ 0.26

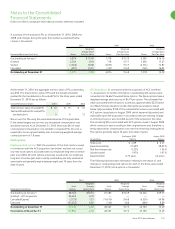

The following represents shares not included in the computation of diluted earnings per share,

because to do so would have been anti-dilutive (shares in thousands):

Stock options 57,541 27,901 41,300

Restricted stock and performance shares 25,983 22,574 14,969

Convertible preferred stock 26,966 — —

Convertible securities 1,992 — 1,992

112,482 50,475 58,261

Dividends Declared per Common Share $0.17 $0.17 $0.17