Xerox 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

69Xerox 2010 Annual Report

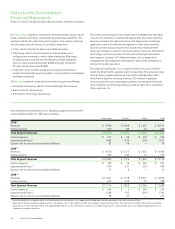

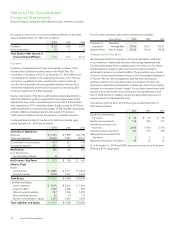

The following is a summary of the funded position of the assumed ACS

plans as of the acquisition date, as well as associated weighted-average

assumptions used to determine benefit obligations:

Estimated Fair Value

Projected benefit obligation $ 142

Fair value of plan assets 111

Net Unfunded Status $ (31)

Amounts recognized in the Consolidated Balance Sheets:

Other long-term assets $ 8

Pension liabilities (39)

Net Amount Recognized $ (31)

Weighted average assumption used to determine benefit obligations at

the acquisition date and net periodic benefit cost from the acquisition

date through December 31, 2010:

Discount rate 5.7%

Expected rate of return on plan assets 6.9%

Rate of compensation increase 3.9%

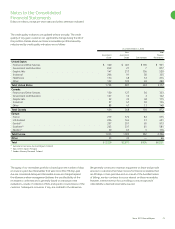

Change-in-control liabilities: We assumed liabilities due under

contractual change-in-control provisions in employment agreements

of certain ACS employees and its Chairman of approximately $95 ($15

current; $80 non-current). The liabilities include accruals for related

excise and other taxes we are obligated to pay on these obligations.

Contingent consideration: Although there is no contingent

consideration associated with our acquisition of ACS, ACS is obligated to

make contingent payments in connection with prior acquisitions upon

satisfaction of certain contractual criteria. Contingent consideration

obligations must be recorded at their respective fair value. As of the

acquisition date, the maximum aggregate amount of ACS’s outstanding

contingent obligations to former shareholders of acquired entities

was approximately $46, of which $11 was recorded representing the

estimated fair value of this obligation. We made contingent payments

of $8 in 2010 which are reflected within investing activities in the

Consolidated Statements of Cash Flows. As of December 31, 2010, the

maximum aggregate amount of the outstanding contingent obligations

to former shareholders of acquired entities was approximately $5.

Goodwill: Goodwill in the amount of $5.1 billion was recognized for

this acquisition and is calculated as the excess of the consideration

transferred over the net assets recognized and represents the future

economic benefits arising from other assets acquired that could not

be individually identified and separately recognized. Specifically, the

goodwill recorded as part of the acquisition of ACS includes:

The expected synergies and other benefits that we believe will result

•

from combining the operations of ACS with the operations of Xerox;

Any intangible assets that do not qualify for separate recognition such

•

as the assembled workforce; and

The value of the going-concern element of ACS’s existing businesses

•

(the higher rate of return on the assembled collection of net assets

versus acquiring all of the net assets separately).

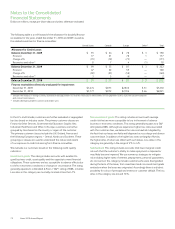

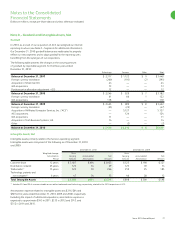

Intangible assets: The following table is a summary of the fair value

estimates of the identifiable intangible assets and their weighted-

average useful lives:

Estimated Fair Value Estimated Useful Life

Customer relationships/contracts $ 2,920 11.6 years

ACS tradename 100 4 years

Buck tradename 10 (1)

Title plant 5 (2)

Total Identifiable Intangible Assets $ 3,035

(1) Determined to be an indefinite-lived asset.

(2) Title plant is not subject to depreciation or charged to earnings based on ASC Topic

950 – Financial Services – Title Plant, unless circumstances indicate that the carrying

amount of the title plant has been impaired.

Deferred revenue: As part of our purchase price allocation, we revalued

ACS’s existing deferred revenue to fair value based on the remaining

post-acquisition service obligation. The total revaluation adjustment

was $133 ($53 current; $80 non-current) and represented the value

for services already rendered for which no future obligation to provide

services remains. Post-acquisition, revenue will accordingly be reduced

for the value of this adjustment. Accordingly, the remaining balance

of deferred revenue included in the above of $161 ($145 current; $16

non-current) primarily represents our estimate of the fair value for the

remaining service obligation.

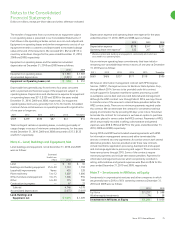

Deferred taxes: We provided deferred taxes and recorded other tax

adjustments as part of the accounting for the acquisition primarily

related to the estimated fair value adjustments for acquired intangible

assets, as well as the elimination of a previously recorded deferred tax

liability associated with ACS’s historical goodwill that was tax deductible.

In addition, we also provided deferred taxes of $48 for the outside basis

difference associated with certain foreign subsidiaries of ACS for which

no taxes have been previously provided. We expect to reverse the outside

basis difference primarily through repatriating earnings from those

subsidiaries in lieu of permanently reinvesting them as well as through

the reorganization of those subsidiaries.

Debt: We repaid $1.7 billion of ACS’s debt and assumed an additional

$0.6 billion. The following is a summary of the third-party debt assumed

and not repaid in connection with the close of the acquisition:

4.70% Senior Notes due June 2010 $ 250

5.20% Senior Notes due June 2015 250

Capital lease obligations and other debt 64

Principal debt balance 564

Fair value adjustments 13

Total Debt Assumed But Not Repaid $ 577

Pension obligations: We assumed several defined benefit pension

plans covering the employees of ACS’s human resources consulting and

outsourcing business in the U.S., U.K., Germany and Canada. The plans in

the U.S. and Canada are both funded and unfunded; the plan in the U.K.

is funded; and the plan in Germany is unfunded.