Xerox 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

86 Xerox 2010 Annual Report

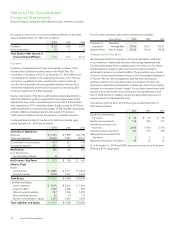

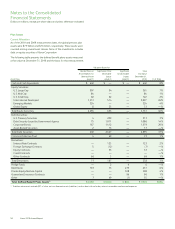

Note 14 – Fair Value of Financial Assets and Liabilities

The following table represents our assets and liabilities measured at fair

value on a recurring basis as of December 31, 2010 and 2009 and the

basis for that measurement:

Total Quoted Prices in Significant Other Significant

Fair Value Active Markets for Observable Unobservable

Measurement Identical Asset Inputs Inputs

December 31, 2010 (Level 1) (Level 2) (Level 3)

Assets:

Foreign exchange contracts-forwards $ 45 $ — $ 45 $ —

Interest rate swaps 11 — 11 —

Deferred compensation investments in cash surrender life insurance 70 — 70 —

Deferred compensation investments in mutual funds 22 — 22 —

Total $ 148 $ — $ 148 $ —

Liabilities:

Foreign exchange contracts-forwards $ 19 $ — $ 19 $ —

Deferred compensation plan liabilities 98 — 98 —

Total $ 117 $ — $ 117 $ —

Total Quoted Prices in Significant Other Significant

Fair Value Active Markets for Observable Unobservable

Measurement Identical Asset Inputs Inputs

December 31, 2009 (Level 1) (Level 2) (Level 3)

Assets:

Foreign exchange contracts – forwards $ 16 $ — $ 16 $ —

Interest rate swaps 10 — 10 —

Total $ 26 $ — $ 26 $ —

Liabilities:

Foreign exchange contracts – forwards $ 15 $ — $ 15 $ —

Interest rate swaps 9 — 9 —

Total $ 24 $ — $ 24 $ —

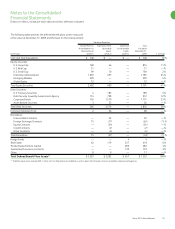

We utilized the income approach to measure fair value for our derivative

assets and liabilities. The income approach uses pricing models that rely

on market observable inputs such as yield curves, currency exchange

rates and forward prices, and therefore are classified as Level 2.

Fair value for our deferred compensation plan investments in Company-

owned life insurance is reflected at cash surrender value. Fair value for

our deferred compensation plan investments in mutual funds is based

on quoted market prices for actively traded investments similar to those

held by the plan. Fair value for deferred compensation plan liabilities

is based on the fair value of investments corresponding to employees’

investment selections, based on quoted prices for similar assets in

actively traded markets.

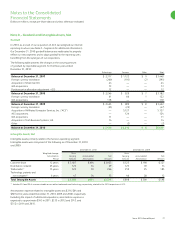

Summary of Other Financial Assets & Liabilities Not Measured

at Fair Value on a Recurring Basis

The estimated fair values of our other financial assets and liabilities not

measured at fair value on a recurring basis at December 31, 2010 and

2009 were as follows:

2010 2009

Carrying Fair Carrying Fair

Amount Value Amount Value

Cash and cash

equivalents $ 1,211 $ 1,211 $ 3,799 $ 3,799

Accounts receivable,

net 2,826 2,826 1,702 1,702

Short-term debt 1,370 1,396 988 1,004

Long-term debt 7,237 7,742 8,276 8,569

Liability to subsidiary

trust issuing

preferred securities 650 670 649 663