Xerox 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Annual Report

Table of contents

-

Page 1

2010 Annual Report -

Page 2

... 108 Letter to Shareholders Board of Directors Our Business Management's Discussion and Analysis Consolidated Financial Statements Notes to Consolidated Financial Statements Reports and Signatures Quarterly Results of Operations Five Years in Review Performance Graph Corporate Information Officers -

Page 3

...Generally Accepted Accounting Principles (GAAP) and the most directly comparable ï¬nancial measure calculated in accordance with GAAP. With ACS, we now serve a $500 Billion market. $150+ billion Business Process Outsourcing $130 billion Traditional Technology-driven Market $250 billion Information... -

Page 4

... - printers, multifunction devices, copiers, production publishing systems, managed print services, and related software and solutions. We're proud of that heritage and we continue to build on it today. And now we are also a leader in business process and IT outsourcing. We offer our customers... -

Page 5

... and disbursing payments, performing bank reconciliation and managing a customer service call center. All 50 states have contracts with us for a variety of business processing and other services that include child support, food stamps, Medicaid, disability, health and welfare. • Fiat Group... -

Page 6

... complex document and data-intensive transactions, like claims reimbursement and invoice processing. Our expertise in creating cloud-based platforms for these services and our extensive experience in labor management for delivering quality support become key differentiators for Xerox and position us... -

Page 7

... time we acquired ACS one year ago, we already had over a $3.5 billion services business - some of it through organic growth and some of it through smaller acquisitions. The ACS deal was a logical - albeit bold - leap forward. Overnight, we became a $10 billion services business. Xerox 2010 Annual... -

Page 8

... our services business by leveraging our brand, global scale, innovation and delivery platforms to win multimilliondollar deals in business process, IT and document outsourcing. We'll remain diligent on cost and expense management, capturing key cost synergies from the ACS acquisition and driving... -

Page 9

...fair-value adjustments related to property, equipment and computer software as well as customer contract costs. In addition, adjustments were made for deferred revenue, exited businesses, certain non-recurring product sales and other material non-recurring costs associated with the acquisition. Year... -

Page 10

...Chief Executive Officer Xerox Corporation Norwalk, CT 2. Richard J. Harrington A Dean, Tippie College of Business University of Iowa Iowa City, IA 6. N. J. Nicholas, Jr.B, D Chairman and Chief Executive Officer Time Warner Cable Inc. New York, NY (Not pictured) Robert J. KeeganB Retired President... -

Page 11

Xerox 2010 Annual Report 9 -

Page 12

...employees to deliver further value for our customers through our document outsourcing solutions, which help customers improve their productivity and reduce costs. We have transformed our business with the acquisition of Affiliated Computer Services, Inc. ("ACS") in February 2010, which allows Xerox... -

Page 13

... • High-end • Mid-range • Entry Growth Drivers Our Brand Accelerate color transition Advance customized digital printing Expand distribution Global Presence Xerox is Uniquely Positioned* Renowned Innovation Services • Document Outsourcing • Business Process Outsourcing... -

Page 14

... providing customer education, product sales and marketing, and clinical trial solutions, we build on our ITO and BPO services we are already delivering to the healthcare and pharmaceutical industries. • In November 2010, we acquired Spur Information Solutions, Limited ("Spur"), one of the United... -

Page 15

... of our business rest upon an annuity model that drives significant recurring revenue and cash generation. Over 80% of our 2010 total revenue was annuity-based revenue that includes contracted services, equipment maintenance and consumable supplies, among other elements. Some of the key indicators... -

Page 16

... production color pages produced on Xerox technology $1,647 $9,637 21 product launches in 2010 100 billion dollar + market opportunity 7 percent color revenue growth • $10,349 Technology • $9,637 Services Technology includes the sale of products and supplies, as well as the associated... -

Page 17

... principally through dedicated Xerox-branded partners and our direct sales force. We offer a wide range of multifunction printers, copiers, digital printing presses and light production devices that deliver ï¬,exibility and advanced features. In 2010, our Mid-range business continued to build on our... -

Page 18

... need them. Extensible Interface Platform Xerox Extensible Interface Platform ("EIP") is a software platform upon which developers can use standard Web-based tools to create server-based applications that can be configured for the multifunction printer's ("MFP's") touch-screen user interface. It... -

Page 19

...clients to concentrate on their core operations, respond rapidly to changing technologies and reduce expenses associated with their business processes and information processing. The majority of our Services business is the result of our acquisition of ACS in February 2010. Xerox 2010 Annual Report... -

Page 20

... transactional business solutions, which encompass both our global delivery model and domestic payer service centers. Services include: - Healthcare Payer Claim Processing - Healthcare Payer Customer Care - Cost Recovery, Audit, Cost Avoidance. 34% 53% • 53% Business Process Outsourcing • 34... -

Page 21

..., claims processing and health management. Our service offerings include: - Medicaid Program Administration - Healthcare and Quality Management - Eligibility and Enrollment Solutions - Pharmacy Benefits Management. • Transportation Solutions: We help transportation agencies worldwide address the... -

Page 22

...forms processing and records management • Manage in-house print operations and special events by handling technology procurement and print/copy centers • Make information easier to manage and find through digital imaging, archiving and indexing • Generate a better return on investment through... -

Page 23

...conducted in the United States in Webster, New York, and Palo Alto, California; in Canada in Mississauga, Ontario; in Europe in Grenoble, France; and in Asia both at the India Innovation Hub in Chennai, India, and in collaboration with Fuji Xerox, Ltd. ("Fuji Xerox"). Xerox 2010 Annual Report 21 -

Page 24

... distribution of our products and services by geography, channel type and line of business. We sell our products and services directly to customers through our worldwide sales force and through a network of independent agents, dealers, value-added resellers, systems integrators and the Web. In large... -

Page 25

... the United States and Canada. Xerox Europe covers 17 countries across Europe. Developing Markets supports more than 130 countries. Fuji Xerox, an unconsolidated entity of which we own 25%, develops, manufactures and distributes document management systems, supplies and services. Globally, we... -

Page 26

... Financial Statements in our 2010 Annual Report for additional information regarding our relationship with Fuji Xerox. Services Global Production Model We believe our global services production model is one of our key competitive advantages. This model encompasses employees in production centers... -

Page 27

... Our technology licensing agreements with Fuji Xerox ensure that the two companies retain uninterrupted access to each other's portfolio of patents, technology and products. Backlog We believe that backlog, or the value of unfilled orders, is not a meaningful indicator of future business prospects... -

Page 28

...includes printers, multifunction devices, production publishing systems, managed print services ("MPS") and related software. We also offer ï¬nancing, service and supplies, as part of our document technology offerings. In 2010, we acquired Afï¬liated Computer Services, Inc. ("ACS"). Through ACS we... -

Page 29

... products launched in key segments • Disciplined cost and expense management yielding operating margin improvement We completed the acquisition of ACS on February 5, 2010, and its results subsequent to that date are included in our results. Total revenue of $21.6 billion in 2010 increased... -

Page 30

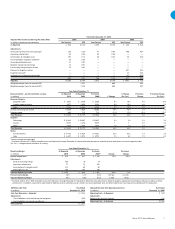

... 2009 Pro-forma(3) Change 2010 Percent of Total Revenue 2010 2009 2008 Revenue: Equipment sales Supplies, paper and other Sales Service, outsourcing and rentals Finance income Total Revenues Segments: Technology Services Other Total Revenues Memo: Annuity Revenue (1) Color (2) $ 3,857 3,377 7,234... -

Page 31

...: 2010 (in millions, except per-share amounts) Net Income EPS Net Income 2009 EPS Net Income 2008 EPS As Reported Adjustments: Xerox and Fuji Xerox restructuring charges Acquisition-related costs Amortization of intangible assets ACS shareholders' litigation settlement Venezuela devaluation costs... -

Page 32

... for Leases." We perform analyses of available veriï¬able objective evidence of equipment fair value based on cash selling prices during the applicable period. The cash selling prices are compared to the range of values included in our lease accounting systems. The range of cash selling prices must... -

Page 33

... future events are used in calculating the expense, liability and asset values related to our pension and retiree health beneï¬t plans. These factors include assumptions we make about the discount rate, expected return on plan assets, rate of increase in healthcare costs, the rate of future... -

Page 34

... the U.S. plan in 2010. Beneï¬t plan costs are included in several income statement components based on the related underlying employee costs. Pension and retiree health beneï¬t plan assumptions are included in Note 15 - Employee Beneï¬t Plans in the Consolidated Financial Statements. Holding all... -

Page 35

... help us to better manage our business which is primarily centered around equipment systems and outsourcing services. Our Technology segment operations involve the sale and support of a broad range of document systems from entry level to the high-end. Our Services segment operations involve delivery... -

Page 36

... to prior year, with a 1-percentage point negative impact from currency, as increased supplies sales were offset by lower service revenues reï¬,ecting decreased but stabilizing page volumes. • Technology revenue mix was 22% Entry, 56% Mid-range and 22% High-end. 34 Xerox 2010 Annual Report -

Page 37

... the Xerox® 700. High-end • 29% decrease in installs of high-end black-and-white systems, reï¬,ecting declines in all product areas. • 37% decrease in installs of high-end color systems as entry production color declines were partially offset by increased iGen4 installs. Services Our Services... -

Page 38

... following areas: • Child support payment processing • Commercial healthcare • Customer care • Electronic payment cards • Enterprise print services • Government healthcare • Telecom and hardware services • Transportation Refer to the "Non-GAAP Financial Measures" section for... -

Page 39

Management's Discussion Costs, Expenses and Other Income Gross Margin Gross margins by revenue classiï¬cation were as follows: Pro-forma(1) Change 2009 2010 Year Ended December 31, 2010 2009 2008 2010 Change Sales Service, outsourcing and rentals Finance income Total Gross Margin 34.5% 33.1% ... -

Page 40

..., software and services. We believe our R&D spending is sufï¬cient to remain technologically competitive. Our R&D is strategically coordinated with that of Fuji Xerox. Year Ended December 31, (in millions) 2010 2009 2008 2010 Change 2009 Pro-forma(1) Change 2010 R&D Sustaining Engineering Total RD... -

Page 41

... and manufacturing - Back-ofï¬ce administration - Development and engineering • $28 million for lease termination costs, primarily reï¬,ecting the continued rationalization and optimization of our worldwide operating locations, including consolidations with ACS. Xerox 2010 Annual Report 39 -

Page 42

...• Capturing efï¬ciencies in technical services, managed services, and supply chain and manufacturing infrastructure • Optimizing product development and engineering resources In addition, related to these activities, we also recorded lease cancellation and other costs of $19 million and asset... -

Page 43

... of claims by ACS shareholders arising from our acquisition of ACS. The total settlement for all defendants was approximately $69 million, with Xerox paying approximately $36 million net of insurance proceeds. Litigation matters: The 2010 and 2009 amounts for litigation matters primarily relate to... -

Page 44

... impacted by the weakness in the worldwide economy, as well as $46 million related to our share of Fuji Xerox after-tax restructuring costs. Recent Accounting Pronouncements Refer to Note 1 - Summary of Signiï¬cant Accounting Policies in the Consolidated Financial Statements for a description of... -

Page 45

... and acquisition costs. • $139 million decrease due to higher restructuring payments related to prior years' actions. • $54 million decrease due to lower accounts payable and accrued compensation, primarily related to lower purchases and the timing of payments to suppliers. Xerox 2010 Annual... -

Page 46

...ACS Acquisition On February 5, 2010 we acquired all of the outstanding equity of ACS in a cash-and-stock transaction valued at approximately $6.2 billion, net of cash acquired. The consideration transferred to acquire ACS was as follows: (in millions) February 5, 2010 Xerox common stock issued Cash... -

Page 47

... as of December 2010 and 2009, respectively, of debt associated with Total ï¬nance receivables, net and is the basis for our calculation of "equipment ï¬nancing interest" expense. The remainder of the ï¬nancing debt is associated with Equipment on operating leases. Xerox 2010 Annual Report 45 -

Page 48

...-off of unamortized debt costs of $8 million. Refer to Note 11 - Debt in the Consolidated Financial Statements for additional information regarding 2010 Debt activity. Liquidity and Financial Flexibility We manage our worldwide liquidity using internal cash management practices, which are subject... -

Page 49

... trust issuing preferred securities(3) Deï¬ned beneï¬t pension plans Retiree health payments Estimated Purchase Commitments: Flextronics(4) Fuji Xerox(5) HPES Contracts(6) Other IM service contracts(7) Other(8) Other Commitments(9): Surety Bonds Letters of Credit Total (1) $ 1,370 669 - 500... -

Page 50

... claims costs incurred during the year. The amounts reported in the above table as retiree health payments represent our estimate of future beneï¬t payments. Fuji Xerox We purchased products, including parts and supplies, from Fuji Xerox totaling $2.1 billion, $1.6 billion and $2.1 billion in 2010... -

Page 51

...liates, primarily Xerox Limited, Fuji Xerox, Xerox Canada Inc. and Xerox do Brasil, and translated into U.S. Dollars using the year-end exchange rates, was $5.3 billion at December 31, 2010. Interest Rate Risk Management The consolidated weighted-average interest rates related to our total debt and... -

Page 52

.... Acquisition-related costs include transaction and integration costs, which represent external incremental costs directly related to completing the acquisition and the integration of ACS and Xerox. We believe it is useful for investors to understand the effects of these costs on our total operating... -

Page 53

...ï¬,ect fair value adjustments related to property, equipment and computer software as well as customer contract costs. In addition, adjustments were made for deferred revenue, exited businesses, certain non-recurring product sales and other material nonrecurring costs associated with the acquisition... -

Page 54

... measures calculated and presented in accordance with GAAP are set forth below. Total Xerox Year Ended December 31, (in millions) As Reported 2010 As Reported 2009 Pro-forma 2009(1) Change Pro-forma Change Revenue: Equipment sales Supplies, paper and other Sales Service, outsourcing and rentals... -

Page 55

..., equipment and computer software as well as customer contract costs. In addition, adjustments were made for deferred revenue, exited businesses, certain non-recurring product sales and other material nonrecurring costs associated with the acquisition. Forward-Looking Statements This Annual Report... -

Page 56

Xerox Corporation Consolidated Statements of Income Year Ended December 31, (in millions, except per-share data) 2010 2009 2008 Revenues Sales Service, outsourcing and rentals Finance income Total Revenues Costs and Expenses Cost of sales Cost of service, outsourcing and rentals Equipment ï¬... -

Page 57

Xerox Corporation Consolidated Balance Sheets December 31, (in millions, except share data in thousands) 2010 2009 Assets Cash and cash equivalents Accounts receivable, net Billed portion of ï¬nance receivables, net Finance receivables, net Inventories Other current assets Total current assets ... -

Page 58

... operating, net Net cash provided by operating activities Cash Flows from Investing Activities: Cost of additions to land, buildings and equipment Proceeds from sales of land, buildings and equipment Cost of additions to internal use software Acquisitions, net of cash acquired Net change in escrow... -

Page 59

... per share in the ï¬rst quarter of 2010 and $20 per share in each of the second, third and fourth quarters of 2010. Refer to Note 19 - Shareholders' Equity for rollforward of shares. The accompanying notes are an integral part of these Consolidated Financial Statements. Xerox 2010 Annual Report 57 -

Page 60

... Computer Services, Inc. ("ACS"), which we acquired in February 2010. We develop, manufacture, market, service and ï¬nance a complete range of document equipment, software, solutions and services. Basis of Consolidation The Consolidated Financial Statements include the accounts of Xerox Corporation... -

Page 61

... products and (b) software components of tangible products that are sold, licensed or leased with tangible products when the software components and non-software components of the tangible product function together to deliver the tangible product's essential functionality. Xerox 2010 Annual Report... -

Page 62

... processing revenues are recognized as services are provided to the customer, generally at the contractual selling prices of resources consumed or capacity utilized by our customers. In those service arrangements where ï¬nal acceptance of a system or solution by the 60 Xerox 2010 Annual Report -

Page 63

...period between the initiations of the ongoing services through the end of the contract term. Sales to distributors and resellers: We utilize distributors and resellers to sell certain of our products to end-user customers. We refer to our distributor and reseller network as our two-tier distribution... -

Page 64

...-lease deliverables as described above. • Sales of equipment with a related full-service maintenance agreement. • Contracts for multiple types of outsourcing services, as well as professional and value-added services. For instance, we may contract for an implementation or development project... -

Page 65

... Buildings and Equipment, Net for further discussion. Software - Internal Use and Product We capitalize direct costs associated with developing, purchasing or otherwise acquiring software for internal use and amortize these costs on a straight-line basis over the expected useful life of the software... -

Page 66

...to the Consolidated Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. We also capitalize certain costs related to the development of software solutions to be sold to our customers upon reaching technological feasibility and amortize these costs based on... -

Page 67

...share of Fuji Xerox. Note 2 - Segment Reporting Our reportable segments are aligned with how we manage the business and view the markets we serve. In 2010, as a result of our acquisition of ACS, we realigned our internal ï¬nancial reporting structure (refer to Note 3 - Acquisitions for information... -

Page 68

... Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. Our Technology segment is centered on strategic product groups, which share common technology, manufacturing and product platforms. This segment includes the sale of document systems and supplies... -

Page 69

... 5, 2010 ("the acquisition date"), we acquired all of the outstanding equity of ACS in a cash-and-stock transaction valued at approximately $6.5 billion. ACS provides business process outsourcing and information technology ("ITO") services and solutions to commercial and government clients worldwide... -

Page 70

... Calculation Estimated Fair Value Form of Consideration ACS Class A shares outstanding as of the acquisition date ACS Class B shares outstanding as of the acquisition date Total ACS Shares Outstanding Xerox stock price as of the acquisition date Multiplied by the exchange ratio Equity Consideration... -

Page 71

...higher rate of return on the assembled collection of net assets versus acquiring all of the net assets separately). Xerox 2010 Annual Report 69 Pension obligations: We assumed several deï¬ned beneï¬t pension plans covering the employees of ACS's human resources consulting and outsourcing business... -

Page 72

... in cash, including transaction costs. Veenman is the Netherlands' leading independent distributor of ofï¬ce printers, copiers and multifunction devices serving small and mid-size businesses. ACS Acquisitions Spur Information Solutions: In November 2010, ACS acquired Spur Information Solutions, one... -

Page 73

...changes in our customer collection trends. Finance Receivables: Finance receivables include sales-type leases, direct ï¬nancing leases and installment loans. Our ï¬nance receivable portfolios are primarily in the US, Canada and Europe. We generally establish customer credit limits and estimate the... -

Page 74

...events of non-payment such as customer accommodations and contract terminations. Includes developing market countries and smaller units. In the U.S. and Canada, customers are further evaluated or segregated by class based on industry sector. The primary customer classes are Finance & Other Services... -

Page 75

... Grade Total Finance Receivables Substandard United States: Finance and Other Services Government and Education Graphic Arts Industrial Healthcare Other Total United States Canada: Finance and Other Services Government and Education Graphic Arts Industrial Other Total Canada Europe: France... -

Page 76

...Billed Finance Receivables Unbilled Finance Receivables Total Finance Receivables Finance Receivables >90 Days and Accruing Current >90 days Past Due United States: Finance and Other Services Government and Education Graphic Arts Industrial Healthcare Other Total United States Total Canada Europe... -

Page 77

... contract. Payments to HPES, which are primarily recorded in selling, administrative and general expenses, were $98, $198 and $279 for the years ended December 31, 2010, 2009 and 2008, respectively. During 2010 and 2009 we terminated several agreements with HPES for information management services... -

Page 78

... sales. These adjustments may result in recorded equity income that is different than that implied by our 25% ownership interest. Equity income for 2010 and 2009 includes after-tax restructuring charges of $38 and $46, respectively, primarily reï¬,ecting employee-related costs as part of Fuji Xerox... -

Page 79

... Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. Note 8 - Goodwill and Intangible Assets, Net Goodwill In 2010, as a result of our acquisition of ACS, we realigned our internal reporting structure (see Note 2 - Segments for additional information... -

Page 80

... per-share data and unless otherwise indicated. Note 9 - Restructuring and Asset Impairment Charges The net restructuring and asset impairment charges (credits) in the Consolidated Statements of Income totaled $483, $(8) and $429 in 2010, 2009 and 2008, respectively. Detailed information related to... -

Page 81

..., managed services, and supply chain and manufacturing infrastructure • Optimizing product development and engineering resources. In addition, related to these activities, we also recorded lease cancellation and other costs of $19 and asset impairment charges of $53. The lease termination and... -

Page 82

... at December 31, 2010(2) Other Long-term Assets Prepaid pension costs Net investment in discontinued operations(1) Internal use software, net Product software, net Restricted cash Debt issuance costs, net Customer contract costs, net Derivative instruments Other Total Other Long-term Assets Other... -

Page 83

... corporate cost of borrowing adjusted to reï¬,ect a rate that would be paid by a typical BBB rated leasing company. The estimated level of debt is based on an assumed 7 to 1 leverage ratio of debt/equity as compared to our average ï¬nance receivable balance during the applicable period. Xerox 2010... -

Page 84

Notes to the Consolidated Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. Net (payments) proceeds on debt other than secured borrowings as shown on the Consolidated Statements of Cash Flows for the three years ended December 31, 2010 was as follows: ... -

Page 85

...recorded in the Consolidated Statements of Income for these designated cash ï¬,ow hedges and all components of each derivative's gain or loss was included in the assessment of hedge effectiveness. As of December 31, 2010, the net asset fair value of these contracts was $18. Xerox 2010 Annual Report... -

Page 86

... Cost of sales $- 28 $28 $- 2 $ 2 $- 2 $ 2 No amount of ineffectiveness was recorded in the Consolidated Statements of Income for these designated cash ï¬,ow hedges and all components of each derivative's gain or loss was included in the assessment of hedge effectiveness. 84 Xerox 2010 Annual... -

Page 87

Notes to the Consolidated Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. Non-Designated Derivative Instruments Gains (Losses) Non-designated derivative instruments are primarily instruments used to hedge foreign currency-denominated assets and ... -

Page 88

... and liabilities. The income approach uses pricing models that rely on market observable inputs such as yield curves, currency exchange rates and forward prices, and therefore are classiï¬ed as Level 2. Fair value for our deferred compensation plan investments in Companyowned life insurance is re... -

Page 89

... beneï¬t plans. Pension Benefits 2010 2009 2010 Retiree Health 2009 Change in Beneï¬t Obligation: Beneï¬t obligation, January 1 Service cost Interest cost Plan participants' contributions Plan amendments(3) Actuarial loss (gain) Acquisitions(2) Currency exchange rate changes Curtailments... -

Page 90

Notes to the Consolidated Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. Beneï¬t plans pre-tax amounts recognized in AOCL: Pension Beneï¬ts 2010 2009 Retiree Health 2010 2009 Aggregate information for pension plans with an Accumulated beneï¬t ... -

Page 91

... plans, along with the results for our other deï¬ned beneï¬t plans, are shown above in the "actual return on plan assets" caption. To the extent that investment results relate to TRA, such results are charged directly to these accounts as a component of interest cost. Xerox 2010 Annual Report... -

Page 92

Notes to the Consolidated Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. Plan Assets Current Allocation As of the 2010 and 2009 measurement dates, the global pension plan assets were $7.9 billion and $7.6 billion, respectively. These assets were ... -

Page 93

... Markets Global Equity Total Equity Securities Debt Securities: U.S. Treasury Securities Debt Security Issued by Government Agency Corporate Bonds Asset-Backed Securities Total Debt Securities Common/Collective Trust Derivatives: Interest Rate Contracts Foreign Exchange Contracts Equity Contracts... -

Page 94

...investment portfolio reviews. Expected Long-term Rate of Return We employ a "building block" approach in determining the long-term rate of return for plan assets. Historical markets are studied and longterm relationships between equities and ï¬xed income are assessed. Current market factors such as... -

Page 95

...to the Consolidated Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. Contributions 2010 contributions for our deï¬ned beneï¬t pension plans were $237 and $92 for our retiree health plans. In 2011 we expect, based on current actuarial calculations, to... -

Page 96

... related to lapse of statute of limitations Currency Balance at December 31 (1) $ 148 46 38 24 (16) (19) (35) - $ 186 $ 170 - 6 27 (33) (7) (29) 14 $ 148 $ 303 - 12 13 (65) (28) (45) (20) $ 170 Majority of settlements did not result in the utilization of cash. 94 Xerox 2010 Annual Report -

Page 97

Notes to the Consolidated Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. Included in the balances at December 31, 2010, 2009 and 2008 are $39, $67 and $67, respectively, of tax positions that are highly certain of realizability but for which there is... -

Page 98

... or cash ï¬,ows. The labor matters principally relate to claims made by former employees and contract labor for the equivalent payment of all social security and other related labor beneï¬ts, as well as consequential tax claims, as if they were regular employees. As of December 31, 2010, the total... -

Page 99

... the costs and disbursements of the action. On May 19, 2010, the parties in the Delaware and Texas Actions entered into a Stipulation and Agreement of Compromise and Settlement ("Settlement") resolving all claims by ACS shareholders arising out of Xerox's acquisition of ACS, including all claims in... -

Page 100

... lease term or the expected useful life under a cash sale. The service agreements involve the payment of fees in return for our performance of repairs and maintenance. As a consequence, we do not have any signiï¬cant product warranty obligations including any obligations under customer satisfaction... -

Page 101

...time, at the option of the holder, into 89.8876 shares of common stock for a total of 26,966 thousand shares (reï¬,ecting an initial conversion price of approximately $11.125 per share of common stock and is a 25% premium over $8.90, the average closing price of Xerox common stock Xerox 2010 Annual... -

Page 102

...pre-tax Income tax beneï¬t recognized in earnings $ 123 47 $ 85 33 $ 85 33 Refer to Note 3 - Acquisitions for additional information. Stock-Based Compensation We have a long-term incentive plan whereby eligible employees may be granted restricted stock units ("RSUs"), performance shares ("PSs... -

Page 103

... Vested Performance Shares 2010 2009 2008 Total intrinsic value of vested PSs Tax beneï¬t realized for vested PSs tax deductions $ 12 5 $ 15 6 $ 41 13 We account for PSs using fair value determined as of the grant date. If the stated targets are not met, any recognized compensation cost would... -

Page 104

Notes to the Consolidated Financial Statements Dollars in millions, except per-share data and unless otherwise indicated. As of December 31, 2010, there was $35 of total unrecognized compensation cost related to nonvested stock options. This cost is expected to be recognized ratably over a ... -

Page 105

...Responsibility for Financial Statements Our management is responsible for the integrity and objectivity of all information presented in this annual report. The consolidated ï¬nancial statements were prepared in conformity with accounting principles generally accepted in the United States of America... -

Page 106

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the ï¬nancial statements are free of material misstatement and whether effective internal control over ï¬nancial reporting was... -

Page 107

... (Unaudited) (in millions, except per-share data) First Quarter Second Quarter Third Quarter Fourth Quarter Full Year 2010 Revenues Costs and Expenses(1) (Loss) Income before Income Taxes and Equity Income Income tax expenses(2) Equity in net (loss) income of unconsolidated afï¬liates(3) Net... -

Page 108

... stock Xerox shareholders' equity Noncontrolling interests Total Consolidated Capitalization Selected Data and Ratios Common shareholders of record at year-end Book value per common share Year-end common stock market price Employees at year-end Gross margin Sales gross margin Service, outsourcing... -

Page 109

... 2010 High Low Dividends Paid per Share 2009 High Low Dividends Paid per Share * Prices as of close of business $ 10.11 8.38 0.0425 $ 9.10 4.17 0.0425 $ 11.35 8.04 0.0425 $ 7.25 4.70 0.0425 $ 10.55 7.91 0.0425 $ 9.57 6.05 0.0425 $ 12.01 10.44 0.0425 $ 8.66 7.25 0.0425 Xerox 2010 Annual Report... -

Page 110

... Armando Zagalo de Lima Executive Vice President President, Global Customer Operations Willem T. Appelo Senior Vice President President, Global Business and Services Group M. Stephen Cronin Senior Vice President President, Global Document Outsourcing Don H. Liu Senior Vice President General Counsel... -

Page 111

..., TX 75204 United States 214.841.6111 www.acs-inc.com Products and Services www.xerox.com or by phone: 800.ASK.XEROX (800.275.9376) Additional Information The Xerox Foundation 203.849.2478 Contact: Evelyn Shockley, Manager Diversity Programs and EEO-1 Reports 585.423.6157 www.xerox.com/diversity... -

Page 112

...Norwalk, CT 06856-4505 United States 203-968-3000 www.xerox.com © 2011 Xerox Corporation. All rights reserved. XEROX® and design®, ColorQube®, DocuColor®, FreeFlow®, Phaser®, Proï¬tAccelerator®, WorkCentre®, iGen4®, Xerox Extensible Interface Platform®, and Xerox Nuvera® are trademarks...