Wells Fargo 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

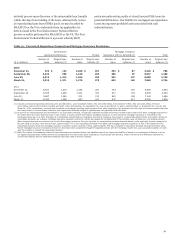

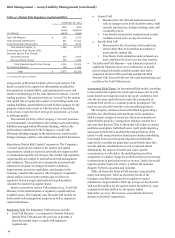

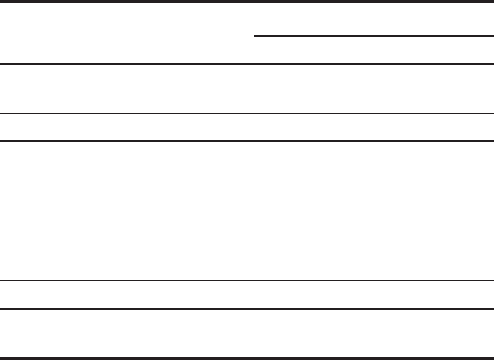

Table 43 presents total revenue from trading activities.

Table 43: Income from Trading Activities

Year ended December 31,

(in millions) 2013 2012 2011

Interest income (1) $ 1,376 1,358 1,440

Less: Interest expense (2) 307 245 316

Net interest income 1,069 1,113 1,124

Noninterest income:

Net gains (losses) from

trading activities (3):

Customer accommodation 1,278 1,347 1,029

Economic hedges and other (4) 332 345 (1)

Proprietary trading 13 15 (14)

Total net trading gains 1,623 1,707 1,014

Total trading-related net interest

and noninterest income $ 2,692 2,820 2,138

(1) Represents interest and dividend income earned on trading securities.

(2) Represents interest and dividend expense incurred on trading securities we have

sold but have not yet purchased.

(3) Represents realized gains (losses) from our trading activity and unrealized gains

(losses) due to changes in fair value of our trading positions, attributable to the

type of business activity.

(4) Excludes economic hedging of mortgage banking activities and asset/liability

management.

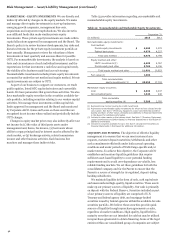

Customer accommodation Customer accommodation activities

are conducted to help customers manage their investment needs

and risk management and hedging activities. We engage in

market-making activities or act as an intermediary to purchase

or sell financial instruments in anticipation of or in response to

customer needs. This category also includes positions we use to

manage our exposure to such transactions.

For the majority of our customer accommodation trading, we

serve as intermediary between buyer and seller. For example, we

may purchase or sell a derivative to a customer who wants to

manage interest rate risk exposure. We typically enter into

offsetting derivative or security positions with a separate

counterparty or exchange to manage our exposure to the

derivative with our customer. We earn income on this activity

based on the transaction price difference between the customer

and offsetting derivative or security positions, which is reflected

in the fair value changes of the positions recorded in net gains

(losses) on trading activities.

Customer accommodation trading also includes net gains

related to market-making activities in which we take positions to

facilitate customer order flow. For example, we may own

securities recorded as trading assets (long positions) or sold

securities we have not yet purchased, recorded as trading

liabilities (short positions), typically on a short-term basis, to

facilitate anticipated buying and selling demand from our

customers. As market-maker in these securities, we earn income

due (1) to the difference between the price paid or received for

the purchase and sale of the security (bid-ask spread) and (2) the

net interest income and change in fair value of the long or short

positions during the short-term period held on our balance

sheet. Additionally, we may enter into separate derivative or

security positions to manage our exposure related to our long or

short security positions. Collectively, income earned on this type

of market-making activity is reflected in the fair value changes of

these positions recorded in net gain (losses) on trading activities.

Economic hedges and other Economic hedges in trading are not

designated in a hedge accounting relationship and exclude

economic hedging related to our asset/liability risk management

and substantially all mortgage banking risk management

activities. Economic hedging activities include the use of trading

securities to economically hedge risk exposures related to non-

trading activities or derivatives to hedge risk exposures related

to trading assets or trading liabilities. Economic hedges are

unrelated to our customer accommodation activities. Other

activities include financial assets held for investment purposes

that we elected to carry at fair value with changes in fair value

recorded to earnings in order to mitigate accounting

measurement mismatches or avoid embedded derivative

accounting complexities.

Proprietary trading Proprietary trading consists of security or

derivative positions executed for our own account based upon

market expectations or to benefit from price differences between

financial instruments and markets. Proprietary trading activity

has been substantially restricted by the Dodd-Frank Act

provisions known as the “Volcker Rule.” On December 10, 2013,

federal banking regulators, the SEC and CFTC jointly released a

final rule to implement the Volcker Rule’s restrictions. Banking

entities are not required to come into compliance with the

Volcker Rule’s restrictions until July 21, 2015, however, we will

be required to report certain trading metrics beginning

June 30, 2014. During the conformance period, banking entities

are expected to engage in “good faith” planning efforts,

appropriate for their activities and investments, to enable them

to conform all of their activities and investments to the Volcker

Rule’s restrictions by no later than July 21, 2015. Accordingly, we

reduced and are exiting certain business activities in anticipation

of the final Volcker Rule. As discussed within this section and

the noninterest income section of our financial results,

proprietary trading activity is insignificant to our business and

financial results. For more details on the Volcker Rule, see the

“Regulatory Reform” section in this Report.

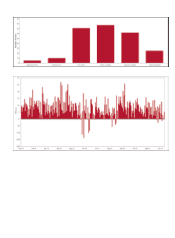

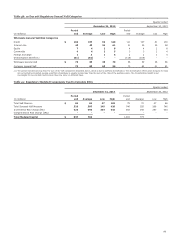

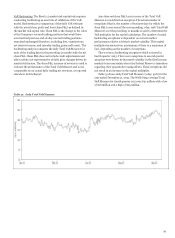

Daily Trading Revenue Table 44 and Table 45 provide

information on daily trading-related revenues for the Company’s

trading portfolio. This trading-related revenue is defined as the

change in value of the trading assets and trading liabilities,

trading-related net interest income and trading-related intra-day

gains and losses. Net trading-related revenue does not include

activity related to long-term positions held for economic hedging

purposes, period-end adjustments and other activity not

representative of daily price changes driven by market factors.

Risk Management – Asset/Liability Management (continued)

88