Wells Fargo 2013 Annual Report Download - page 112

Download and view the complete annual report

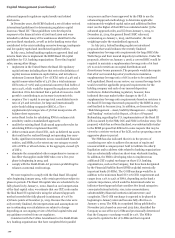

Please find page 112 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Critical Accounting Policies (continued)

(2) other changes, representing changes due to

collection/realization of expected cash flows. Changes in fair

value due to changes in significant model inputs and

assumptions include prepayment speeds (which are influenced

by changes in mortgage interest rates and borrower behavior,

including estimates for borrower default), discount rates, and

servicing and foreclosure costs.

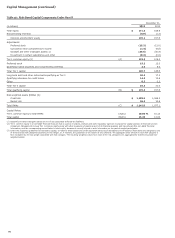

We use a dynamic and sophisticated model to estimate the

value of our MSRs. The model is validated by an internal model

validation group operating in accordance with Company policies.

Senior management reviews all significant assumptions

quarterly. Mortgage loan prepayment speed – a key assumption

in the model – is the annual rate at which borrowers are

forecasted to repay their mortgage loan principal including

estimates for borrower default. The discount rate used to

determine the present value of estimated future net servicing

income – another key assumption in the model – is the required

rate of return investors in the market would expect for an asset

with similar risk. To determine the discount rate, we consider the

risk premium for uncertainties from servicing operations (e.g.,

possible changes in future servicing costs, ancillary income and

earnings on escrow accounts). Both assumptions can, and

generally will, change quarterly as market conditions and

interest rates change. For example, an increase in either the

prepayment speed or discount rate assumption results in a

decrease in the fair value of the MSRs, while a decrease in either

assumption would result in an increase in the fair value of the

MSRs. In recent years, there have been significant market-driven

fluctuations in loan prepayment speeds and the discount rate.

These fluctuations can be rapid and may be significant in the

future. Therefore, estimating prepayment speeds within a range

that market participants would use in determining the fair value

of MSRs requires significant management judgment.

Additionally, in recent years, we have made significant

adjustments to the assumptions for servicing and foreclosure

costs as a result of an increase in the number of defaulted loans

as well as changes in servicing processes associated with default

and foreclosure management. While our current valuation

reflects our best estimate of these costs, future regulatory

changes in servicing standards, as well as changes in individual

state foreclosure legislation, may have an impact on these

assumptions and our MSR valuation in future periods.

The valuation and sensitivity of MSRs is discussed further in

Note 1 (Summary of Significant Accounting Policies), Note 8

(Securitizations and Variable Interest Entities), Note 9

(Mortgage Banking Activities) and Note 17 (Fair Values of Assets

and Liabilities) to Financial Statements in this Report.

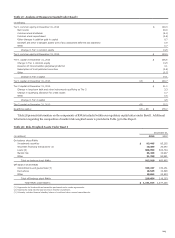

Liability for Mortgage Loan Repurchase Losses

We sell residential mortgage loans to various parties, including

(1) GSEs, which include the mortgage loans in GSE-guaranteed

mortgage securitizations, (2) special purpose entities that issue

private label MBS, and (3) other financial institutions that

purchase mortgage loans for investment or private label

securitization. In addition, we pool FHA-insured and VA-

guaranteed mortgage loans, which back securities guaranteed by

GNMA. The agreements under which we sell mortgage loans and

the insurance or guaranty agreements with FHA and VA contain

provisions that include various representations and warranties

regarding the origination and characteristics of the mortgage

loans. Although the specific representations and warranties vary

among different sales, insurance or guarantee agreements, they

typically cover ownership of the loan, compliance with loan

criteria set forth in the applicable agreement, validity of the lien

securing the loan, absence of delinquent taxes or liens against

the property securing the loan, compliance with applicable

origination laws, and other matters. For more information about

these loan sales and the related risks that may result in liability

see the “Risk Management – Credit Risk Management – Liability

for Mortgage Loan Repurchase Losses” section in this Report.

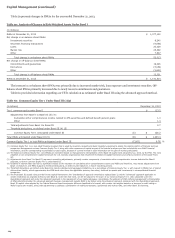

We may be required to repurchase mortgage loans, indemnify

the securitization trust, investor or insurer, or reimburse the

securitization trust, investor or insurer for credit losses incurred

on loans (collectively “repurchase”) in the event of a breach of

contractual representations or warranties that is not remedied

within a period (usually 90 days or less) after we receive notice of

the breach. Our loan sale contracts to private investors (non-

GSE) typically contain an additional provision where we would

only be required to repurchase loans if any such breach is

deemed to have a material and adverse effect on the value of the

mortgage loan or to the interests of the investors or interests of

security holders in the mortgage loan. The time periods specified

in our mortgage loan sales contracts to respond to repurchase

requests vary, but are generally 90 days or less. While many

contracts do not include specific remedies if the applicable time

period for a response is not met, contracts for mortgage loan

sales to the GSEs include various types of specific remedies and

penalties that could be applied to inadequate responses to

repurchase requests. Similarly, the agreements under which we

sell mortgage loans require us to deliver various documents to

the securitization trust or investor, and we may be obligated to

repurchase any mortgage loan for which the required documents

are not delivered or are defective. In addition, as part of our

representations and warranties in our loan sales contracts, we

typically represent to GSEs and private investors that certain

loans have mortgage insurance to the extent there are loans that

have loan to value ratios in excess of 80% that require mortgage

insurance. To the extent the mortgage insurance is rescinded by

the mortgage insurer due to a claim of breach of a contractual

representation or warranty, the lack of insurance may result in a

repurchase demand from an investor. Upon receipt of a

repurchase request or a mortgage insurance rescission, we work

with securitization trusts, investors or insurers to arrive at a

mutually agreeable resolution. Repurchase demands are typically

reviewed on an individual loan by loan basis to validate the

claims made by the securitization trust, investor or insurer, and

to determine whether a contractually required repurchase event

occurred. Occasionally, in lieu of conducting a loan level

evaluation, we may negotiate global settlements in order to

resolve a pipeline of demands in lieu of repurchasing the loans.

We manage the risk associated with potential repurchases or

other forms of settlement through our underwriting and quality

assurance practices and by servicing mortgage loans to meet

investor and secondary market standards.

We establish mortgage repurchase liabilities related to

various representations and warranties that reflect

110