Wells Fargo 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.surcharges prior to implementation based on additional or

future data.

Capital Planning and Stress Testing

Under the FRB’s capital plan rule, large BHCs are required to

submit capital plans annually for review to determine if the FRB

has any objections before making any capital distributions. The

rule requires updates to capital plans in the event of material

changes in a BHC’s risk profile, including as a result of any

significant acquisitions.

On March 14, 2013, the FRB notified us that it did not object

to our 2013 capital plan included in the 2013 CCAR. Since the

FRB notification, the Company took several capital actions,

including increasing its quarterly common stock dividend rate to

$0.30 per share, redeeming Wachovia Preferred Funding Corp.

preferred securities that will no longer count as Tier 1 capital

under the Dodd-Frank Act and the final Basel III capital

standards, and repurchasing shares of our common stock.

Our 2014 CCAR, which was submitted on January 3, 2014,

included a comprehensive capital plan supported by an

assessment of expected uses and sources of capital over a given

planning horizon under a range of expected and stress scenarios,

similar to the process the FRB used to conduct the CCAR in

2013. As part of the 2014 CCAR, the FRB also generated a

supervisory stress test, which assumed a sharp decline in the

economy and significant decline in asset pricing using the

information provided by the Company to estimate performance.

The FRB is expected to review the supervisory stress results both

as required under the Dodd-Frank Act using a common set of

capital actions for all large BHCs and by taking into account the

Company’s proposed capital actions. The FRB has indicated that

it will publish its supervisory stress test results as required

under the Dodd-Frank Act, and the related CCAR results taking

into account the Company’s proposed capital actions, in March

2014.

In addition to CCAR, federal banking regulators also require

stress tests to evaluate whether an institution has sufficient

capital to continue to operate during periods of adverse

economic and financial conditions. In October 2012, the FRB

issued final rules regarding stress testing requirements as

required under the Dodd-Frank Act provision imposing

enhanced prudential standards on large BHCs such as Wells

Fargo. The OCC issued and finalized similar rules during 2012

for stress testing of large national banks. The FRB issued interim

final rules in September 2013 clarifying how companies should

incorporate the Basel III capital rules into their capital planning

and stress testing exercises. These stress testing rules, which

became effective for Wells Fargo on November 15, 2012, set

forth the timing and type of stress test activities large BHCs and

banks must undertake as well as rules governing stress testing

controls, oversight and disclosure requirements. As required

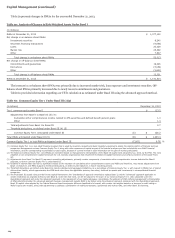

under the FRB’s stress testing rule, we completed a mid-cycle

stress test based on March 31, 2013, data and scenarios

developed by the Company. We submitted the results of the mid-

cycle stress test to the FRB in July 2013 and disclosed a

summary of the results in September 2013.

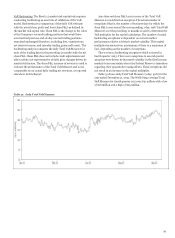

Securities Repurchases

From time to time the Board authorizes the Company to

repurchase shares of our common stock. Although we announce

when the Board authorizes share repurchases, we typically do

not give any public notice before we repurchase our shares.

Future stock repurchases may be private or open-market

repurchases, including block transactions, accelerated or

delayed block transactions, forward transactions, and similar

transactions. Additionally, we may enter into plans to purchase

stock that satisfy the conditions of Rule 10b5-1 of the Securities

Exchange Act of 1934. Various factors determine the amount

and timing of our share repurchases, including our capital

requirements, the number of shares we expect to issue for

employee benefit plans and acquisitions, market conditions

(including the trading price of our stock), and regulatory and

legal considerations, including the FRB’s response to our capital

plan and to changes in our risk profile.

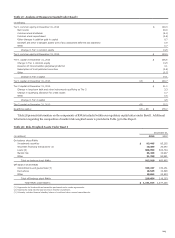

In October 2012, the Board authorized the repurchase of

200 million shares. At December 31, 2013, we had remaining

authority under this authorization to purchase approximately

74 million shares, subject to regulatory and legal conditions. For

more information about share repurchases during 2013, see Part

II, Item 2 in this Report.

Historically, our policy has been to repurchase shares under

the “safe harbor” conditions of Rule 10b-18 of the Securities

Exchange Act of 1934 including a limitation on the daily volume

of repurchases. Rule 10b-18 imposes an additional daily volume

limitation on share repurchases during a pending merger or

acquisition in which shares of our stock will constitute some or

all of the consideration. Our management may determine that

during a pending stock merger or acquisition when the safe

harbor would otherwise be available, it is in our best interest to

repurchase shares in excess of this additional daily volume

limitation. In such cases, we intend to repurchase shares in

compliance with the other conditions of the safe harbor,

including the standing daily volume limitation that applies

whether or not there is a pending stock merger or acquisition.

In connection with our participation in the Capital Purchase

Program (CPP), a part of the Troubled Asset Relief Program

(TARP), we issued to the U.S. Treasury Department warrants to

purchase 110,261,688 shares of our common stock with an

exercise price of $34.01 per share expiring on October 28, 2018.

The Board authorized the repurchase by the Company of up to

$1 billion of the warrants. On May 26, 2010, in an auction by the

U.S. Treasury, we purchased 70,165,963 of the warrants at a

price of $7.70 per warrant. We have purchased an additional

986,426 warrants, all on the open market, since the U.S.

Treasury auction. At December 31, 2013, there were

39,108,864 warrants outstanding and exercisable and

$452 million of unused warrant repurchase authority.

Depending on market conditions, we may purchase from time to

time additional warrants in privately negotiated or open market

transactions, by tender offer or otherwise.

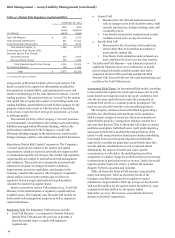

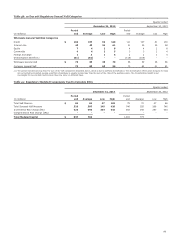

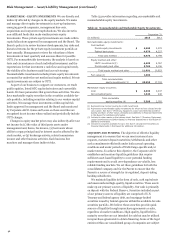

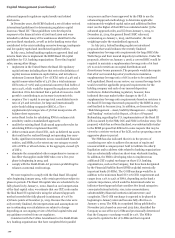

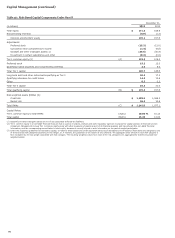

Risk-Based Capital and Risk-Weighted Assets

Table 56 and Table 57 provide information regarding the

composition of and change in our risk-based capital,

respectively, under Basel I.

101