Wells Fargo 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We separately estimate impairment for consumer loans that

have been modified in a TDR (including trial modifications),

whether on accrual or nonaccrual status.

OTHER ACL MATTERS The allowance for credit losses for both

portfolio segments includes an amount for imprecision or

uncertainty that may change from period to period. This amount

represents management’s judgment of risks inherent in the

processes and assumptions used in establishing the allowance.

This imprecision considers economic environmental factors,

modeling assumptions and performance, process risk, and other

subjective factors, including industry trends and risk

assessments for our commitments to regulatory and government

agencies regarding settlements of mortgage foreclosure-related

matters.

Securitizations and Beneficial Interests

In certain asset securitization transactions that meet the

applicable criteria to be accounted for as a sale, assets are sold to

an entity referred to as an SPE, which then issues beneficial

interests in the form of senior and subordinated interests

collateralized by the assets. In some cases, we may retain

beneficial interests issued by the entity. Additionally, from time

to time, we may also re-securitize certain assets in a new

securitization transaction.

The assets and liabilities transferred to an SPE are excluded

from our consolidated balance sheet if the transfer qualifies as a

sale and we are not required to consolidate the SPE.

For transfers of financial assets recorded as sales, we

recognize and initially measure at fair value all assets obtained

(including beneficial interests) and liabilities incurred. We

record a gain or loss in noninterest income for the difference

between the carrying amount and the fair value of the assets

sold. Fair values are based on quoted market prices, quoted

market prices for similar assets, or if market prices are not

available, then the fair value is estimated using discounted cash

flow analyses with assumptions for credit losses, prepayments

and discount rates that are corroborated by and verified against

market observable data, where possible. Retained interests and

liabilities incurred from securitizations with off-balance sheet

entities, including SPEs and VIEs, where we are not the primary

beneficiary, are classified as investment securities, trading

account assets, loans, MSRs or other liabilities (including

liabilities for mortgage repurchase losses) and are accounted for

as described herein.

Mortgage Servicing Rights (MSRs)

We recognize the rights to service mortgage loans for others, or

MSRs, as assets whether we purchase the MSRs or the MSRs

result from a sale or securitization of loans we originate (asset

transfers). We initially record all of our MSRs at fair value.

Subsequently, residential loan MSRs are carried at fair value. All

of our MSRs related to our commercial mortgage loans are

subsequently measured at LOCOM.

We base the fair value of MSRs on the present value of

estimated future net servicing income cash flows. We estimate

future net servicing income cash flows with assumptions that

market participants would use to estimate fair value, including

estimates of prepayment speeds (which are influenced by

changes in mortgage interest rates and borrower behavior,

including estimates for borrower default), discount rates, cost to

service (including delinquency and foreclosure costs), escrow

account earnings, contractual servicing fee income, ancillary

income and late fees. Our valuation approach is validated by our

internal valuation model validation group, and our valuation

estimates are benchmarked to third party appraisals on a

quarterly basis.

Changes in the fair value of MSRs occur primarily due to the

collection/realization of expected cash flows, as well as changes

in valuation inputs and assumptions. For MSRs carried at fair

value, changes in fair value are reported in noninterest income in

the period in which the change occurs. MSRs subsequently

measured at LOCOM are amortized in proportion to, and over

the period of, estimated net servicing income. The amortization

of MSRs is reported in noninterest income, analyzed monthly

and adjusted to reflect changes in prepayment speeds, as well as

other factors.

MSRs accounted for at LOCOM are periodically evaluated for

impairment based on the fair value of those assets. For purposes

of impairment evaluation and measurement, we stratify MSRs

based on the predominant risk characteristics of the underlying

loans, including investor and product type. If, by individual

stratum, the carrying amount of these MSRs exceeds fair value, a

valuation reserve is established. The valuation reserve is

adjusted as the fair value changes.

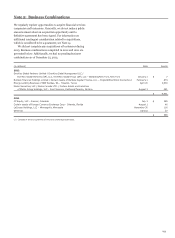

Premises and Equipment

Premises and equipment are carried at cost less accumulated

depreciation and amortization. Capital leases, where we are the

lessee, are included in premises and equipment at the capitalized

amount less accumulated amortization.

We primarily use the straight-line method of depreciation

and amortization. Estimated useful lives range up to 40 years for

buildings, up to 10 years for furniture and equipment, and the

shorter of the estimated useful life (up to 8 years) or the lease

term for leasehold improvements. We amortize capitalized

leased assets on a straight-line basis over the lives of the

respective leases.

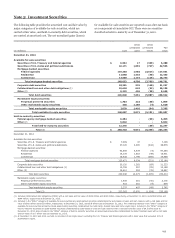

Goodwill and Identifiable Intangible Assets

Goodwill is recorded in business combinations under the

purchase method of accounting when the purchase price is

higher than the fair value of net assets, including identifiable

intangible assets.

We assess goodwill for impairment at a reporting unit level

on an annual basis or more frequently in certain circumstances.

We have determined that our reporting units are one level below

the operating segments. We have the option of performing a

qualitative assessment of goodwill. We may also elect to bypass

the qualitative test and proceed directly to a quantitative test.

We initially perform a qualitative assessment of goodwill to test

for impairment. If, based on our qualitative review, we conclude

that more likely than not a reporting unit’s fair value is less than

its carrying amount, then we complete quantitative steps as

described below to determine if there is goodwill impairment. If

we conclude that a reporting unit’s fair value is not less than its

147