Wells Fargo 2013 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

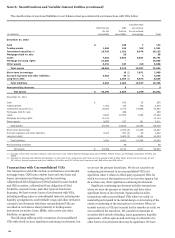

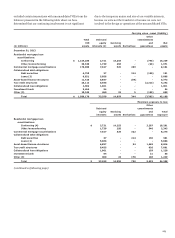

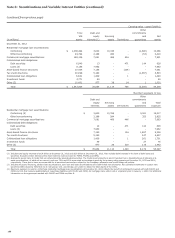

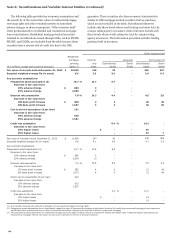

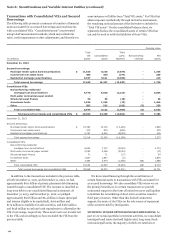

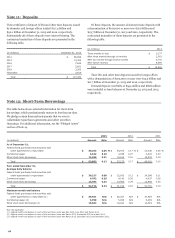

Note 8: Securitizations and Variable Interest Entities (continued)

The following table provides key economic assumptions and

the sensitivity of the current fair value of residential mortgage

servicing rights and other retained interests to immediate

adverse changes in those assumptions. “Other interests held”

relate predominantly to residential and commercial mortgage

loan securitizations. Residential mortgage-backed securities

retained in securitizations issued through GSEs, such as FNMA,

FHLMC and GNMA, are excluded from the table because these

securities have a remote risk of credit loss due to the GSE

guarantee. These securities also have economic characteristics

similar to GSE mortgage-backed securities that we purchase,

which are not included in the table. Subordinated interests

include only those bonds whose credit rating was below AAA by

a major rating agency at issuance. Senior interests include only

those bonds whose credit rating was AAA by a major rating

agency at issuance. The information presented excludes trading

positions held in inventory.

Other interests held

Consumer Commercial (2)

($ in millions, except cost to service amounts)

Residential

mortgage

servicing

rights (1)

Interest-

only

strips

Subordinated

bonds

Senior

bonds

Subordinated

bonds

Senior

bonds

Fair value of interests held at December 31, 2013 $ 15,580 135 39 -283 587

Expected weighted-average life (in years) 6.4 3.8 5.9 - 3.6 6.3

Key economic assumptions:

Prepayment speed assumption (3) 10.7 % 10.7 6.7 -

Decrease in fair value from:

10% adverse change $ 864 3 - -

25% adverse change 2,065 7--

Discount rate assumption 7.8 % 18.3 4.4 - 4.5 3.6

Decrease in fair value from:

100 basis point increase $ 840 2 2 -30 30

200 basis point increase 1,607 5 4 -38 58

Cost to service assumption ($ per loan) 191

Decrease in fair value from:

10% adverse change 636

25% adverse change 1,591

Credit loss assumption 0.4 % - 14.2 -

Decrease in fair value from:

10% higher losses $ - - 29 -

25% higher losses -- 39 1

Fair value of interests held at December 31, 2012 $ 11,538 187 40 -249 982

Expected weighted-average life (in years) 4.8 4.1 5.9 -4.7 5.3

Key economic assumptions:

Prepayment speed assumption (3) 15.7 % 10.6 6.8 -

Decrease in fair value from:

10% adverse change $ 869 5 --

25% adverse change 2,038 12 --

Discount rate assumption 7.4 % 16.9 8.9 -3.5 2.2

Decrease in fair value from:

100 basis point increase $ 562 4 2 -12 43

200 basis point increase 1,073 8 4 -21 84

Cost to service assumption ($ per loan) 219

Decrease in fair value from:

10% adverse change 615

25% adverse change 1,537

Credit loss assumption 0.4 % -10.0 -

Decrease in fair value from:

10% higher losses $ - -12 -

25% higher losses --19 -

(1) See narrative following this table for a discussion of commercial mortgage servicing rights.

(2) Prepayment speed assumptions do not significantly impact the value of commercial mortgage securitization bonds as the underlying commercial mortgage loans experience

significantly lower prepayments due to certain contractual restrictions, impacting the borrower’s ability to prepay the mortgage.

(3) The prepayment speed assumption for residential mortgage servicing rights includes a blend of prepayment speeds and default rates. Prepayment speed assumptions are

influenced by mortgage interest rate inputs as well as our estimation of drivers of borrower behavior.

190