Wells Fargo 2013 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

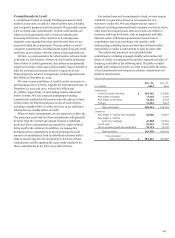

Commitments to Lend

A commitment to lend is a legally binding agreement to lend

funds to a customer, usually at a stated interest rate, if funded,

and for specific purposes and time periods. We generally require

a fee to extend such commitments. Certain commitments are

subject to loan agreements with covenants regarding the

financial performance of the customer or borrowing base

formulas on an ongoing basis that must be met before we are

required to fund the commitment. We may reduce or cancel

consumer commitments, including home equity lines and credit

card lines, in accordance with the contracts and applicable law.

We may, as a representative for other lenders, advance funds

or provide for the issuance of letters of credit under syndicated

loan or letter of credit agreements. Any advances are generally

repaid in less than a week and would normally require default of

both the customer and another lender to expose us to loss.

These temporary advance arrangements totaled approximately

$87 billion at December 31, 2013.

We issue commercial letters of credit to assist customers in

purchasing goods or services, typically for international trade. At

December 31, 2013 and 2012, we had $1.2 billion and

$1.5 billion, respectively, of outstanding issued commercial

letters of credit. We also originate multipurpose lending

commitments under which borrowers have the option to draw

on the facility for different purposes in one of several forms,

including a standby letter of credit. See Note 14 for additional

information on standby letters of credit.

When we make commitments, we are exposed to credit risk.

The maximum credit risk for these commitments will generally

be lower than the contractual amount because a significant

portion of these commitments are expected to expire without

being used by the customer. In addition, we manage the

potential risk in commitments to lend by limiting the total

amount of commitments, both by individual customer and in

total, by monitoring the size and maturity structure of these

commitments and by applying the same credit standards for

these commitments as for all of our credit activities.

For certain loans and commitments to lend, we may require

collateral or a guarantee, based on our assessment of a

customer’s credit risk. We may require various types of

collateral, including commercial and consumer real estate, autos,

other short-term liquid assets such as accounts receivable or

inventory and long-lived asset, such as equipment and other

business assets. Collateral requirements for each loan or

commitment may vary according to the specific credit

underwriting, including terms and structure of loans funded

immediately or under a commitment to fund at a later date.

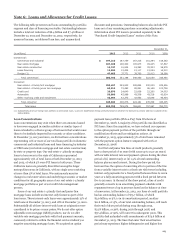

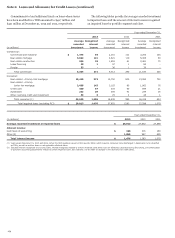

The contractual amount of our unfunded credit

commitments, including unissued standby and commercial

letters of credit, is summarized by portfolio segment and class of

financing receivable in the following table. The table excludes

standby and commercial letters of credit issued under the terms

of our commitments and temporary advance commitments on

behalf of other lenders.

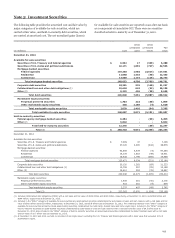

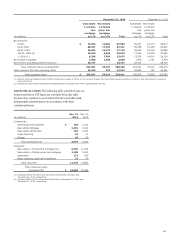

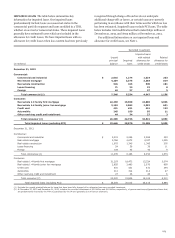

Dec. 31, Dec. 31,

(in millions) 2013 2012

Commercial:

Commercial and industrial $ 238,962 215,626

Real estate mortgage 5,910 6,165

Real estate construction 12,593 9,109

Foreign 12,216 8,423

Total commercial 269,681 239,323

Consumer:

Real estate 1-4 family first mortgage 32,908 42,657

Real estate 1-4 family

junior lien mortgage 47,668 50,934

Credit card 78,961 70,960

Other revolving credit and installment 24,213 19,791

Total consumer 183,750 184,342

Total unfunded

credit commitments $ 453,431 423,665

165