Wells Fargo 2013 Annual Report Download - page 47

Download and view the complete annual report

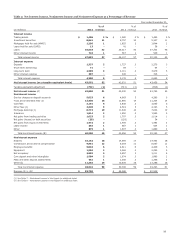

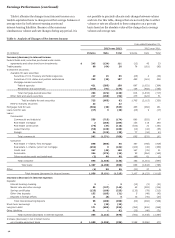

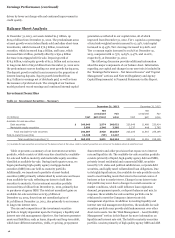

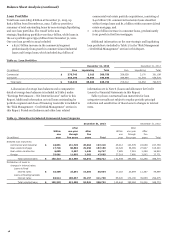

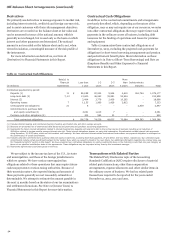

Please find page 47 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.credit losses of $2.8 billion in 2013 was 60% lower than 2012,

which was $1.1 billion, or 14%, lower than 2011, due to improved

portfolio performance in both 2013 and 2012.

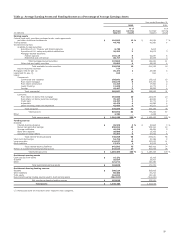

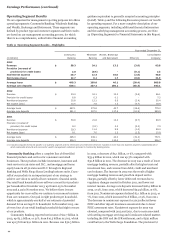

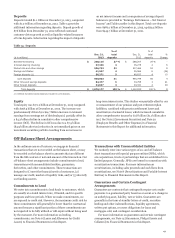

Wholesale Banking provides financial solutions to businesses

across the United States and globally with annual sales generally

in excess of $20 million. Products and business segments

include Middle Market Commercial Banking, Government and

Institutional Banking, Corporate Banking, Commercial Real

Estate, Treasury Management, Wells Fargo Capital Finance,

Insurance, International, Real Estate Capital Markets,

Commercial Mortgage Servicing, Corporate Trust, Equipment

Finance, Wells Fargo Securities, Principal Investments, Asset

Backed Finance, and Asset Management. Wholesale Banking

cross-sell was a record 7.1 products per customer in

September 2013, up from 6.8 in September 2012 and 6.5 in

September 2011.

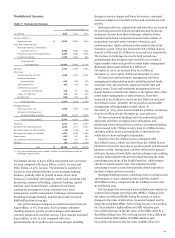

Wholesale Banking reported net income of $8.1 billion in

2013, up $359 million, or 5%, from $7.8 billion in 2012, which

was up 11% from $7.0 billion in 2011. The year over year

increase in net income during 2013 was the result of

improvement in provision for credit losses and stable revenue

performance partially offset by increased noninterest expense.

The year over year increase in net income during 2012 was the

result of strong revenue growth partially offset by increased

noninterest expense and a higher provision for credit losses.

Revenue in 2013 of $24.1 billion was flat from 2012, as business

growth from asset backed finance, asset management, capital

markets and commercial real estate was offset by lower PCI

resolution income. Revenue in 2012 of $24.1 billion increased

$2.5 billion, or 12%, from 2011, due to broad-based business

growth as well as growth from acquisitions. Net interest income

of $12.3 billion in 2013 decreased $350 million, or 3%, from

2012, which was up 9% from 2011. The decrease in 2013 was due

to a strong loan and deposit growth, which was more than offset

by lower PCI resolutions and net interest margin compression.

The increase in 2012 was driven by strong loan and deposit

growth. Average loans of $290.0 billion in 2013 increased

$16.2 billion, or 6%, from $273.8 billion in 2012, which was up

10% from $249.1 billion in 2011. The loan growth in both 2013

and 2012 was driven by strong customer demand as well as

growth from acquisitions. Average core deposits of $237.2

billion in 2013 increased $10.2 billion, or 4%, from 2012 which

was up 12%, from 2011, reflecting continued strong customer

liquidity for both years. Noninterest income of $11.8 billion in

2013 increased $322 million, or 3%, from 2012 due to strong

growth in asset backed finance, asset management, capital

markets, commercial banking, commercial real estate and

corporate banking. Noninterest income of $11.4 billion in 2012

increased $1.5 billion, or 15%, from 2011 due to strong growth in

asset backed finance, capital markets, commercial banking,

commercial real estate and real estate capital markets. Total

noninterest expense in 2013 increased $296 million, or 2%,

compared with 2012, which was up 8%, or $905 million, from

2011. The increase in both 2013 and 2012 was due to higher

personnel expenses and higher non-personnel expenses related

to growth initiatives and compliance and regulatory

requirements, partially offset in 2013 by lower foreclosed asset

expenses. The provision for credit losses decreased $731 million

from 2012, due to lower loan losses, while the provision for

credit losses increased $396 million in 2012 from 2011, as a

$319 million decline in loan losses was more than offset by a

provision for increase in loans, particularly from acquisitions.

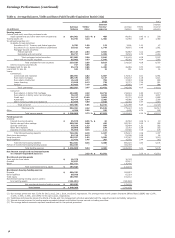

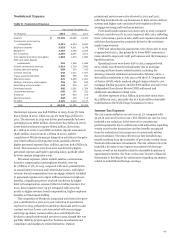

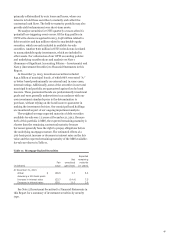

Wealth, Brokerage and Retirement provides a full range of

financial advisory services to clients using a planning approach

to meet each client's financial needs. Wealth Management

provides affluent and high net worth clients with a complete

range of wealth management solutions, including financial

planning, private banking, credit, investment management and

fiduciary services. Abbot Downing, a Wells Fargo business,

provides comprehensive wealth management services to ultra

high net worth families and individuals as well as endowments

and foundations. Brokerage serves customers' advisory,

brokerage and financial needs as part of one of the largest full-

service brokerage firms in the United States. Retirement is a

national leader in providing institutional retirement and trust

services (including 401(k) and pension plan record keeping) for

businesses, retail retirement solutions for individuals, and

reinsurance services for the life insurance industry. Wealth,

Brokerage and Retirement cross-sell reached a record

10.42 products per household in November 2013, up from

10.27 in November 2012 and 10.05 in November 2011.

Wealth, Brokerage and Retirement reported net income of

$1.7 billion in 2013, up $384 million, or 29%, from 2012, which

was up 4% from $1.3 billion in 2011. Net income growth in 2013

was driven by higher noninterest income and improved credit

quality. Growth in net income for 2012 was affected by the

$153 million gain on the sale of the H.D. Vest Financial Services

business included in the 2011 results. Revenue of $13.2 billion in

2013 increased $1.0 billion from 2012, which was flat compared

with 2011. The increase in revenue for 2013 was due to increases

in both net interest income and noninterest income. Net interest

income increased 4% in 2013, due to growth in loan balances

and low-cost core deposits, partially offset by lower interest rates

on the loan and investment portfolios. Net interest income

decreased 3% in 2012 due to lower interest rates on the loan and

investment portfolios partially offset by the impact of growth in

low-cost core deposits. Average core deposits in 2013 of

$150.1 billion increased 9% from 2012, which was up 6% from

2011. Noninterest income increased 10% in 2013 from 2012,

largely due to strong growth in asset-based fees from improved

market performance and growth in assets under management,

partially offset by reduced securities gains in the brokerage

business. A slight increase of $59 million in noninterest income

in 2012 compared with 2011 was due to higher asset-based fees

and gains on deferred compensation plan investments (offset in

expense), partially offset by the 2011 gain on the sale of H.D.

Vest Financial Services business, lower transaction revenue and

reduced securities gains in the brokerage business. Noninterest

expense for 2013 was up 6% from 2012, which was flat from

2011. The increase in 2013 was predominantly due to higher

personnel expenses, primarily reflecting increased broker

commissions. Noninterest expense for 2012 included the impact

of deferred compensation plan expense (offset in revenue). Total

provision for credit losses improved for both 2013 and 2012,

45