Wells Fargo 2013 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

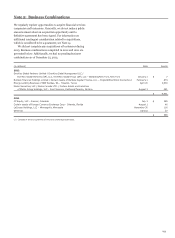

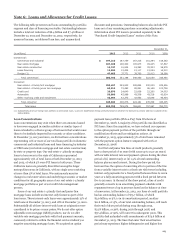

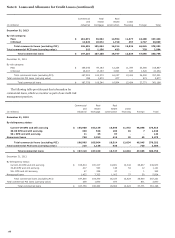

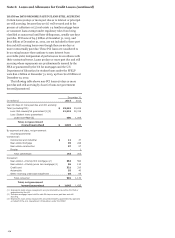

Note 6: Loans and Allowance for Credit Losses

The following table presents total loans outstanding by portfolio

segment and class of financing receivable. Outstanding balances

include a total net reduction of $6.4 billion and $7.4 billion at

December 31, 2013 and December 31, 2012, respectively, for

unearned income, net deferred loan fees, and unamortized

discounts and premiums. Outstanding balances also include PCI

loans net of any remaining purchase accounting adjustments.

Information about PCI loans is presented separately in the

“Purchased Credit-Impaired Loans” section of this Note.

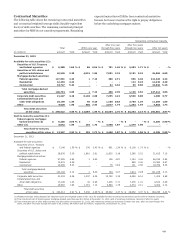

December 31,

(in millions) 2013 2012 2011 2010 2009

Commercial:

Commercial and industrial $ 197,210 187,759 167,216 151,284 158,352

Real estate mortgage 107,100 106,340 105,975 99,435 97,527

Real estate construction 16,747 16,904 19,382 25,333 36,978

Lease financing 12,034 12,424 13,117 13,094 14,210

Foreign (1) 47,665 37,771 39,760 32,912 29,398

Total commercial 380,756 361,198 345,450 322,058 336,465

Consumer:

Real estate 1-4 family first mortgage 258,497 249,900 228,894 230,235 229,536

Real estate 1-4 family junior lien mortgage 65,914 75,465 85,991 96,149 103,708

Credit card 26,870 24,640 22,836 22,260 24,003

Automobile 50,808 45,998 43,508 43,516 42,624

Other revolving credit and installment 42,954 42,373 42,952 43,049 46,434

Total consumer 445,043 438,376 424,181 435,209 446,305

Total loans $ 825,799 799,574 769,631 757,267 782,770

(1) Substantially all of our foreign loan portfolio is commercial loans. Loans are classified as foreign primarily based on whether the borrower’s primary address is outside of the

United States.

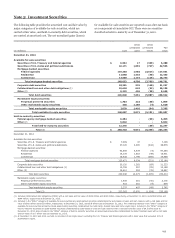

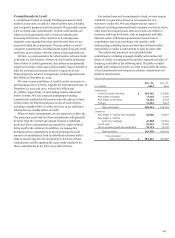

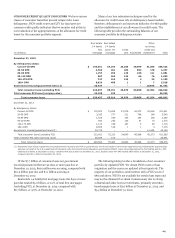

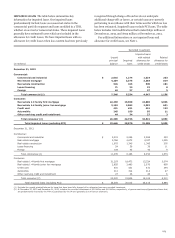

Loan Concentrations

Loan concentrations may exist when there are amounts loaned

to borrowers engaged in similar activities or similar types of

loans extended to a diverse group of borrowers that would cause

them to be similarly impacted by economic or other conditions.

At December 31, 2013 and 2012, we did not have concentrations

representing 10% or more of our total loan portfolio in domestic

commercial and industrial loans and lease financing by industry

or CRE loans (real estate mortgage and real estate construction)

by state or property type. Our real estate 1-4 family mortgage

loans to borrowers in the state of California represented

approximately 13% of total loans at both December 31, 2013

and 2012, of which 2% were PCI loans in both years. These

California loans are generally diversified among the larger

metropolitan areas in California, with no single area consisting

of more than 3% of total loans. We continuously monitor

changes in real estate values and underlying economic or market

conditions for all geographic areas of our real estate 1-4 family

mortgage portfolio as part of our credit risk management

process.

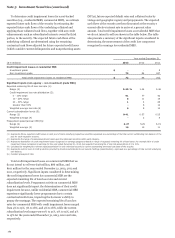

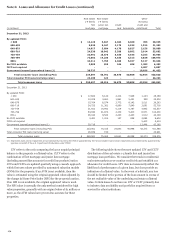

Some of our real estate 1-4 family first and junior lien

mortgage loans include an interest-only feature as part of the

loan terms. These interest-only loans were approximately 15% of

total loans at December 31, 2013, and 18% at December 31, 2012.

Substantially all of these interest-only loans at origination were

considered to be prime or near prime. We do not offer option

adjustable-rate mortgage (ARM) products, nor do we offer

variable-rate mortgage products with fixed payment amounts,

commonly referred to within the financial services industry as

negative amortizing mortgage loans. We acquired an option

payment loan portfolio (Pick-a-Pay) from Wachovia at

December 31, 2008. A majority of the portfolio was identified as

PCI loans. Since the acquisition, we have reduced our exposure

to the option payment portion of the portfolio through our

modification efforts and loss mitigation actions. At

December 31, 2013, approximately 3% of total loans remained

with the payment option feature compared with 10% at

December 31, 2008.

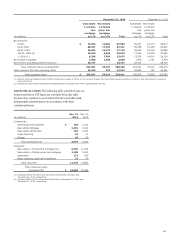

Our first and junior lien lines of credit products generally

have a draw period of 10 years (with some up to 15 or 20 years)

with variable interest rate and payment options during the draw

period of (1) interest only or (2) 1.5% of total outstanding

balance plus accrued interest. During the draw period, the

borrower has the option of converting all or a portion of the line

from a variable interest rate to a fixed rate with terms including

interest-only payments for a fixed period between three to seven

years or a fully amortizing payment with a fixed period between

five to 30 years. At the end of the draw period, a line of credit

generally converts to an amortizing payment schedule with

repayment terms of up to 30 years based on the balance at time

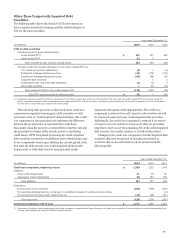

of conversion. At December 31, 2013, our lines of credit portfolio

had an outstanding balance of $75.7 billion, of which

$3.9 billion, or 5%, is in its amortization period, another

$11.6 billion, or 15%, of our total outstanding balance, will reach

their end of draw period during 2014 through 2015,

$22.8 billion, or 30%, during 2016 through 2018, and

$37.4 billion, or 50%, will convert in subsequent years. This

portfolio had unfunded credit commitments of $73.6 billion at

December 31, 2013. The lines that enter their amortization

period may experience higher delinquencies and higher loss

163