Wells Fargo 2013 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

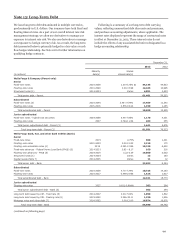

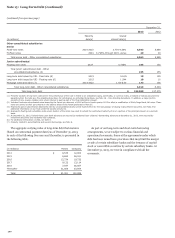

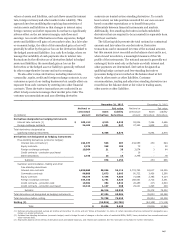

CONTINGENT CONSIDERATION In connection with certain

brokerage, asset management, insurance agency and other

acquisitions we have made, the terms of the acquisition

agreements provide for deferred payments or additional

consideration, based on certain performance targets.

OTHER GUARANTEES We are members of exchanges and

clearing houses that we use to clear our trades and those of our

customers. It is common that all members in these organizations

are required to collectively guarantee the performance of other

members. Our obligations under the guarantees are based on

either a fixed amount or a multiple of the collateral we are

required to maintain with these organizations. We have not

recorded a liability for these arrangements as of the dates

presented in the previous table because we believe the likelihood

of loss is remote.

We also have contingent performance arrangements related

to various customer relationships and lease transactions. We are

required to pay the counterparties to these agreements if third

parties default on certain obligations.

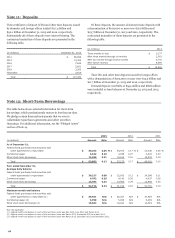

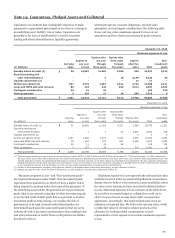

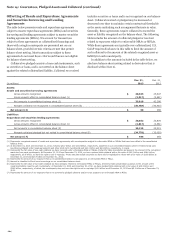

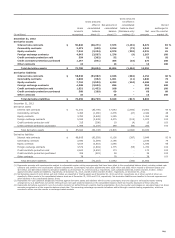

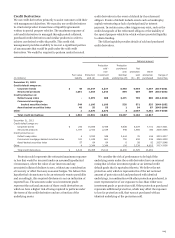

Pledged Assets

As part of our liquidity management strategy, we pledge assets to

secure trust and public deposits, borrowings and letters of credit

from the FHLB and FRB, securities sold under agreements to

repurchase (repurchase agreements), and for other purposes as

required or permitted by law or insurance statutory

requirements. The types of collateral we pledge include

securities issued by federal agencies, government-sponsored

entities (GSEs), domestic and foreign companies and various

commercial and consumer loans. The following table provides

the total carrying amount of pledged assets by asset type, of

which substantially all are pursuant to agreements that do not

permit the secured party to sell or repledge the collateral. The

table excludes pledged consolidated VIE assets of $8.1 billion

and $14.6 billion at December 31, 2013, and December 31, 2012,

respectively, which can only be used to settle the liabilities of

those entities. The table also excludes $15.3 billion and

$22.3 billion in assets pledged in transactions accounted for as

secured borrowings at December 31, 2013 and

December 31, 2012, respectively. See Note 8 for additional

information on consolidated VIE assets and secured borrowings.

$

$

(in millions)

Dec. 31,

2013

Dec. 31,

2012

Trading assets and other (1) 30,288 28,031

Investment securities (2) 85,468 96,018

Loans (3) 381,597 360,171

Total pledged assets 497,353 484,220

(1) Represent assets pledged to collateralize repurchase agreements and other securities financings. Balance includes $29.0 billion and $27.4 billion at December 31, 2013, and

December 31, 2012, respectively, under agreements that permit the secured parties to sell or repledge the collateral.

(2) Includes $8.7 billion and $8.4 billion in collateral for repurchase agreements at December 31, 2013, and December 31, 2012, respectively, which are pledged under

agreements that do not permit the secured parties to sell or repledge the collateral.

(3) Represent loans carried at amortized cost, which are pledged under agreements that do not permit the secured parties to sell or repledge the collateral.

203