Wells Fargo 2013 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

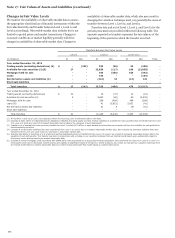

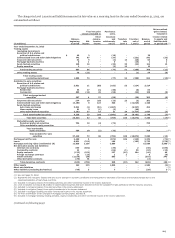

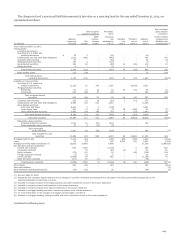

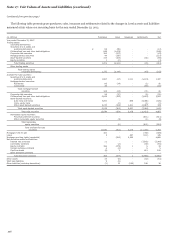

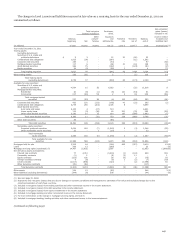

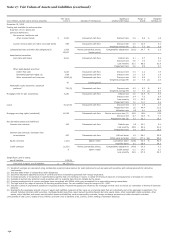

(continued from previous page)

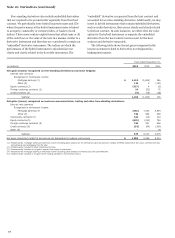

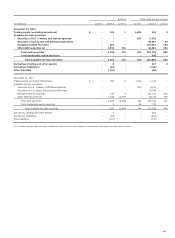

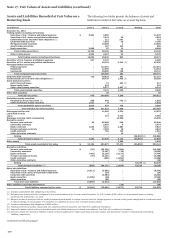

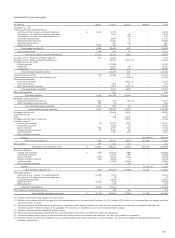

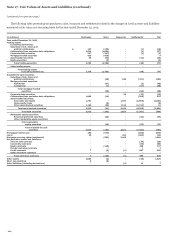

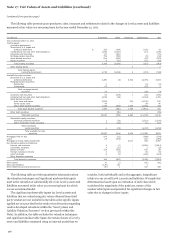

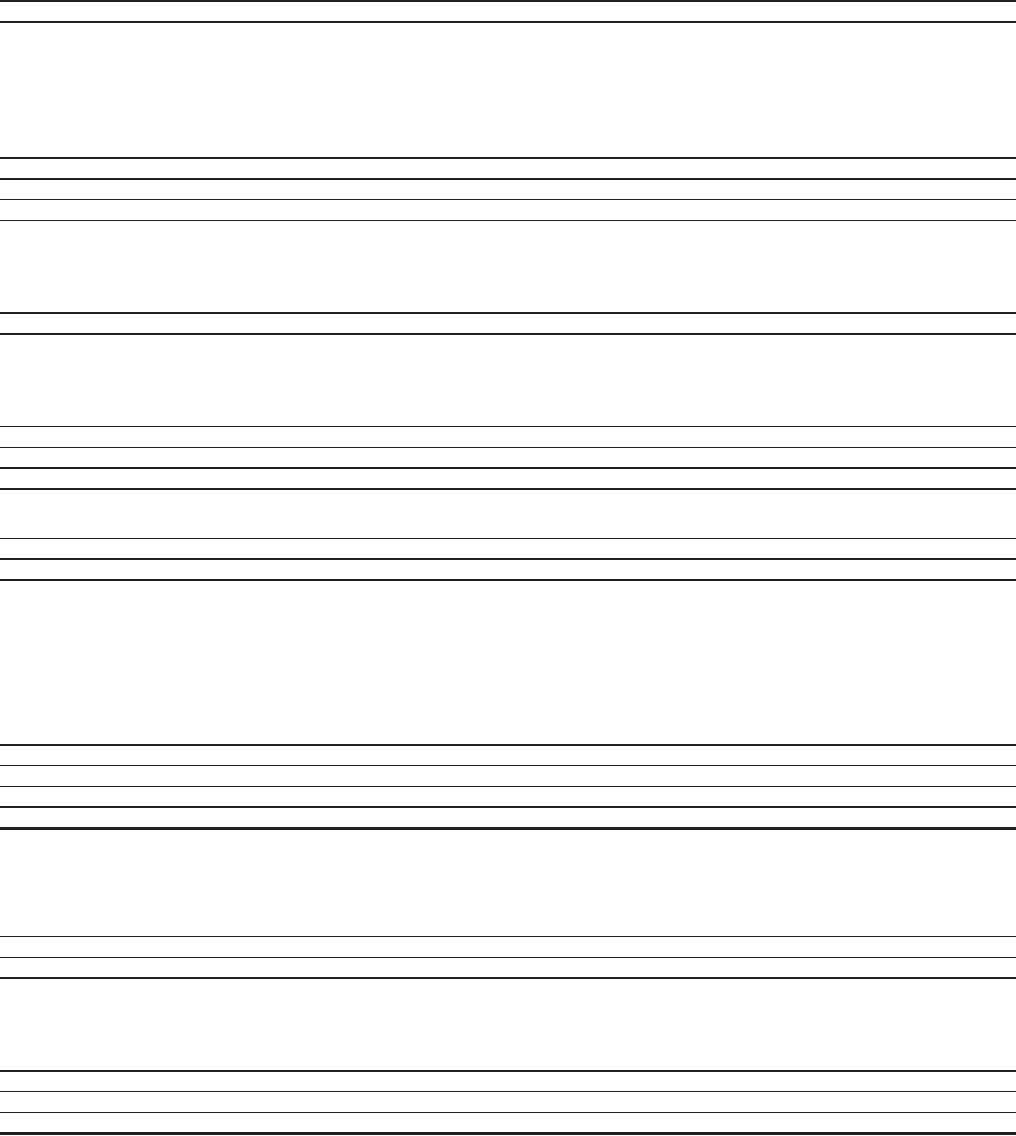

(in millions) Level 1 Level 2 Level 3 Netting Total

--

- -

- - -

- -

- -

- -

-

-

-

-

--

- -

- - -

--

--

- -

-

- - -

- -

- -

- -

- -

- - -

-

-

--

-

-

-

-

-

- -

-

-

-

-

-

-

- -

-

-

- -

- - - - -

- - -

-

-

- -

-

-

- -

- - -

- - -

- -

- - -

- - -

- -

- - -

- -

- -

$

$

$

$

December 31, 2012

Trading assets (excluding derivatives)

Securities of U.S. Treasury and federal agencies 5,104 3,774 8,878

Securities of U.S. states and political subdivisions 1,587 46 1,633

Collateralized loan and other debt obligations (1) 742 742

Corporate debt securities 6,664 52 6,716

Mortgage-backed securities 13,380 6 13,386

Asset-backed securities 722 138 860

Equity securities 3,481 356 3 3,840

Total trading securities(2) 8,585 26,483 987 36,055

Other trading assets 2,150 887 76 3,113

Total trading assets (excluding derivatives) 10,735 27,370 1,063 39,168

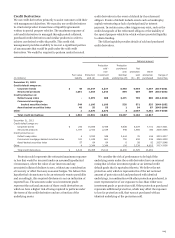

Securities of U.S. Treasury and federal agencies 915 6,231 7,146

Securities of U.S. states and political subdivisions 35,045 3,631 (3) 38,676

Mortgage-backed securities:

Federal agencies 97,285 97,285

Residential 15,837 94 15,931

Commercial 19,765 203 19,968

Total mortgage-backed securities 132,887 297 133,184

Corporate debt securities 125 20,934 274 21,333

Collateralized loan and other debt obligations (4) 13,188 (3) 13,188

Asset-backed securities:

Auto loans and leases 7 5,921 (3) 5,928

Home equity loans 867 51 918

Other asset-backed securities 7,828 3,283 (3) 11,111

Total asset-backed securities 8,702 9,255 17,957

Other debt securities 930 930

Total debt securities 1,040 204,729 26,645 232,414

Marketable equity securities:

Perpetual preferred securities (5) 629 753 794 (3) 2,176

Other marketable equity securities 554 55 609

Total marketable equity securities 1,183 808 794 2,785

Total available-for-sale securities 2,223 205,537 27,439 235,199

Mortgages held for sale 39,055 3,250 42,305

Loans held for sale 6 6

Loans 185 6,021 6,206

Mortgage servicing rights (residential) 11,538 11,538

Derivative assets:

Interest rate contracts 16 70,277 1,058 71,351

Commodity contracts 3,386 70 3,456

Equity contracts 432 2,747 604 3,783

Foreign exchange contracts 19 5,481 24 5,524

Credit contracts 1,160 650 1,810

Other derivative contracts

Netting (62,108) (6) (62,108)

Total derivative assets (7) 467 83,051 2,406 (62,108) 23,816

Other assets 136 123 162 421

Total assets recorded at fair value 13,561 355,327 51,879 (62,108) 358,659

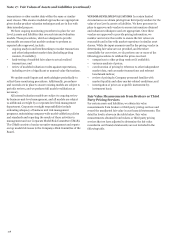

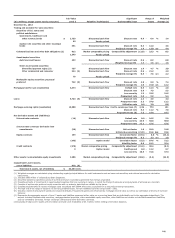

Derivative liabilities:

Interest rate contracts (52) (68,244) (399) (68,695)

Commodity contracts (3,541) (49) (3,590)

Equity contracts (199) (3,239) (726) (4,164)

Foreign exchange contracts (23) (3,553) (3) (3,579)

Credit contracts (1,152) (1,800) (2,952)

Other derivative contracts (78) (78)

Netting 71,116 (6) 71,116

Total derivative liabilities (7) (274) (79,729) (3,055) 71,116 (11,942)

Short sale liabilities:

Securities of U.S. Treasury and federal agencies (4,225) (875) (5,100)

Securities of U.S. states and political subdivisions (9) (9)

Corporate debt securities (3,941) (3,941)

Equity securities (1,233) (35) (1,268)

Other securities (47) (47)

Total short sale liabilities (5,458) (4,907) (10,365)

Other liabilities (excluding derivatives) (34) (49) (83)

Total liabilities recorded at fair value (5,732) (84,670) (3,104) 71,116 (22,390)

(1) Includes collateralized debt obligations of $21 million.

(2) Net gains from trading activities recognized in the income statement for the year ended December 31, 2012 include $305 million in net unrealized gains on trading securities

held at December 31, 2012.

(3) Balances consist of securities that are predominantly investment grade based on ratings received from the ratings agencies or internal credit grades categorized as

investment grade if external ratings are not available. The securities are classified as Level 3 due to limited market activity.

(4) Includes collateralized debt obligations of $644 million.

(5) Perpetual preferred securities include ARS and corporate preferred securities. See Note 8 for additional information.

(6) Represents balance sheet netting of derivative asset and liability balances and related cash collateral. See Note 16 for additional information.

(7) Derivative assets and derivative liabilities include contracts qualifying for hedge accounting, economic hedges, and derivatives included in trading assets and trading

liabilities, respectively.

221