Wells Fargo 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the sum of 21 cents per transaction and 5 basis points

multiplied by the value of the transaction. On July 31, 2013,

the U.S. District Court for the District of Columbia ruled

that the approach used by the FRB in setting the maximum

allowable interchange transaction fee impermissibly

included costs that were specifically excluded from

consideration under the Durbin Amendment. The District

Court’s decision maintained the current interchange

transaction fee standards until the FRB drafts new

regulations or interim standards. In August 2013, the FRB

filed a notice of appeal of the decision to the United States

Court of Appeals for the District of Columbia. In

September 2013, the Court of Appeals granted a joint

motion for an expedited appeal, and the District Court’s

order has been stayed pending the appeal. The Court of

Appeals held oral arguments on the appeal in January 2014.

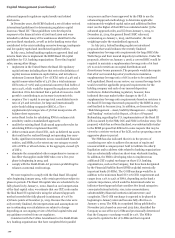

Regulatory Capital Guidelines and Capital Plans

During 2013, federal banking regulators issued final rules that

substantially amended the risk-based capital rules for banking

organizations. The rules implement the Basel III regulatory

capital reforms in the U.S., comply with changes required by the

Dodd-Frank Act, and replace the existing Basel I-based capital

requirements. We were required to begin complying with the

rules on January 1, 2014, subject to phase-in periods that are

scheduled to be fully phased in by January 1, 2022. Federal

banking regulators have also issued proposals to impose a

supplementary leverage ratio on large BHCs like Wells Fargo

and our insured depository institutions and to implement the

Basel III liquidity coverage ratio. For more information on the

final capital rules, the proposed leverage and liquidity rules, and

additional capital requirements under consideration by federal

banking regulators, see the “Capital Management” section in this

Report.

“Living Will” Requirements and Related Matters

Rules adopted by the FRB and the FDIC under the Dodd-Frank

Act require large financial institutions, including Wells Fargo, to

prepare and periodically revise resolution plans, so called

“living-wills”, that would facilitate their resolution in the event

of material distress or failure. Under the rules, resolution plans

are required to provide strategies for resolution under the

Bankruptcy Code and other applicable insolvency regimes that

can be accomplished in a reasonable period of time and in a

manner that mitigates the risk that failure would have serious

adverse effects on the financial stability of the United States.

Wells Fargo submitted its resolution plan under these rules on

June 29, 2013. If the FRB and FDIC determine that our

resolution plan is deficient, the Dodd-Frank Act authorizes the

FRB and FDIC to impose more stringent capital, leverage or

liquidity requirements on us or restrict our growth or activities

until we submit a plan remedying the deficiencies. If the FRB

and FDIC ultimately determine that we have been unable to

remedy the deficiencies, they could order us to divest assets or

operations in order to facilitate our orderly resolution in the

event of our material distress or failure. Our national bank

subsidiary, Wells Fargo Bank, N.A., is also required to prepare a

resolution plan for the FDIC under separate regulatory authority

and submitted the plan on June 29, 2013.

The Dodd-Frank Act also establishes an orderly liquidation

process which allows for the appointment of the FDIC as a

receiver of a systemically important financial institution that is

in default or in danger of default. The FDIC has issued rules to

implement its orderly liquidation authority and recently released

a notice regarding a proposed resolution strategy, known as

“single point of entry,” designed to resolve a large financial

institution in a manner that holds management responsible for

its failure, maintains market stability, and imposes losses on

shareholders and creditors in accordance with statutory

priorities, without imposing a cost on U.S. taxpayers.

Implementation of the strategy would require that institutions

maintain a sufficient amount of available equity and unsecured

debt to absorb losses and recapitalize operating subsidiaries.

The FDIC has requested public comment on this proposed

resolution strategy.

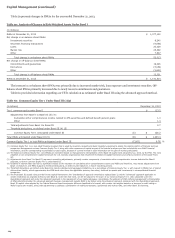

Critical Accounting Policies

Our significant accounting policies (see Note 1 (Summary of

Significant Accounting Policies) to Financial Statements in this

Report) are fundamental to understanding our results of

operations and financial condition because they require that we

use estimates and assumptions that may affect the value of our

assets or liabilities and financial results. Six of these policies are

critical because they require management to make difficult,

subjective and complex judgments about matters that are

inherently uncertain and because it is likely that materially

different amounts would be reported under different conditions

or using different assumptions. These policies govern:

x

x

x

x

x

x

the allowance for credit losses;

PCI loans;

the valuation of residential MSRs;

liability for mortgage loan repurchase losses;

the fair valuation of financial instruments; and

income taxes.

Management has reviewed and approved these critical

accounting policies and has discussed these policies with the

Board’s Audit and Examination Committee.

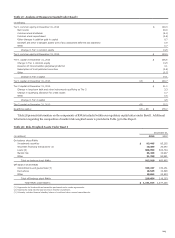

Allowance for Credit Losses

The allowance for credit losses, which consists of the allowance

for loan losses and the allowance for unfunded credit

commitments, is management’s estimate of credit losses

inherent in the loan portfolio, including unfunded credit

commitments, at the balance sheet date, excluding loans carried

at fair value. We develop and document our allowance

methodology at the portfolio segment level. Our loan portfolio

consists of a commercial loan portfolio segment and a consumer

loan portfolio segment.

We employ a disciplined process and methodology to

establish our allowance for credit losses. The total allowance for

107