Wells Fargo 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272

|

|

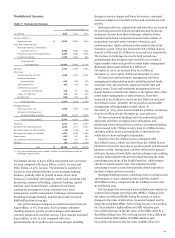

Overview (continued)

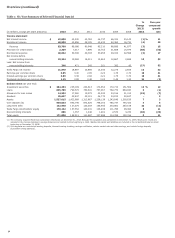

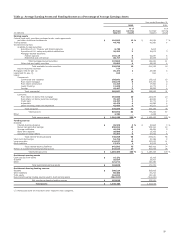

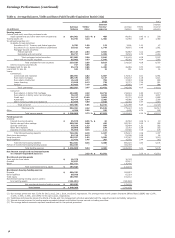

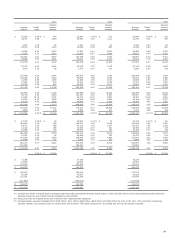

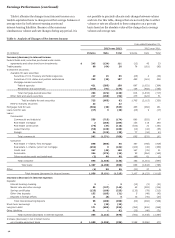

Table 1: Six-Year Summary of Selected Financial Data (1)

(in millions, except per share amounts) 2013 2012 2011 2010 2009 2008

%

Change

2013/

2012

Five-year

compound

growth

rate

Income statement

Net interest income $ 42,800 43,230 42,763 44,757 46,324 25,143 (1) % 11

Noninterest income 40,980 42,856 38,185 40,453 42,362 16,734 (4) 20

Revenue 83,780 86,086 80,948 85,210 88,686 41,877 (3) 15

Provision for credit losses 2,309 7,217 7,899 15,753 21,668 15,979 (68) (32)

Noninterest expense 48,842 50,398 49,393 50,456 49,020 22,598 (3) 17

Net income before

noncontrolling interests 22,224 19,368 16,211 12,663 12,667 2,698 15 52

Less: Net income from

noncontrolling interests 346 471 342 301 392 43 (27) 52

Wells Fargo net income 21,878 18,897 15,869 12,362 12,275 2,655 16 52

Earnings per common share 3.95 3.40 2.85 2.23 1.76 0.70 16 41

Diluted earnings per common share 3.89 3.36 2.82 2.21 1.75 0.70 16 41

Dividends declared per common share 1.15 0.88 0.48 0.20 0.49 1.30 31 (2)

Balance sheet (at year end)

Investment securities $ 264,353 235,199 222,613 172,654 172,710 151,569 12 % 12

Loans 825,799 799,574 769,631 757,267 782,770 864,830 3 (1)

Allowance for loan losses 14,502 17,060 19,372 23,022 24,516 21,013 (15) (7)

Goodwill 25,637 25,637 25,115 24,770 24,812 22,627 - 3

Assets 1,527,015 1,422,968 1,313,867 1,258,128 1,243,646 1,309,639 7 3

Core deposits (2) 980,063 945,749 872,629 798,192 780,737 745,432 4 6

Long-term debt 152,998 127,379 125,354 156,983 203,861 267,158 20 (11)

Wells Fargo stockholders' equity 170,142 157,554 140,241 126,408 111,786 99,084 8 11

Noncontrolling interests 866 1,357 1,446 1,481 2,573 3,232 (36) (23)

Total equity 171,008 158,911 141,687 127,889 114,359 102,316 8 11

(1) The Company acquired Wachovia Corporation (Wachovia) on December 31, 2008. Because the acquisition was completed on December 31, 2008, Wachovia's results are

included in the income statement, average balances and related metrics beginning in 2009. Wachovia's assets and liabilities are included in the consolidated balance sheet

beginning on December 31, 2008.

(2) Core deposits are noninterest-bearing deposits, interest-bearing checking, savings certificates, certain market rate and other savings, and certain foreign deposits

(Eurodollar sweep balances).

32