Wells Fargo 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

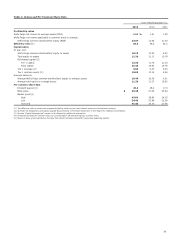

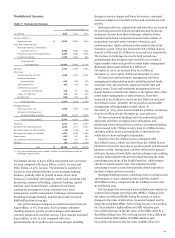

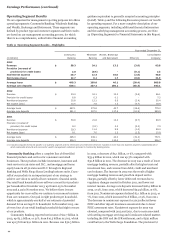

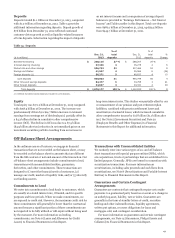

Noninterest Expense

Table 8: Noninterest Expense

Year ended December 31,

(in millions) 2013 2012 2011

Salaries $ 15,152 14,689 14,462

Commission and incentive

compensation 9,951 9,504 8,857

Employee benefits 5,033 4,611 4,348

Equipment 1,984 2,068 2,283

Net occupancy 2,895 2,857 3,011

Core deposit and other intangibles 1,504 1,674 1,880

FDIC and other deposit

assessments 961 1,356 1,266

Outside professional services 2,519 2,729 2,692

Outside data processing 983 910 935

Contract services 935 1,011 1,407

Travel and entertainment 885 839 821

Operating losses 821 2,235 1,261

Postage, stationery and supplies 756 799 942

Advertising and promotion 610 578 607

Foreclosed assets 605 1,061 1,354

Telecommunications 482 500 523

Insurance 437 453 515

Operating leases 204 109 112

All other 2,125 2,415 2,117

Total $ 48,842 50,398 49,393

Noninterest expense was $48.8 billion in 2013, down 3% from

$50.4 billion in 2012, which was up 2% from $49.4 billion in

2011. The decrease in 2013 was driven predominantly by lower

operating losses ($821 million, down from $2.2 billion in 2012),

lower foreclosed assets expense ($605 million, down from

$1.1 billion in 2012), lower FDIC and other deposit assessments

($961 million, down from $1.4 billion in 2012), and the

completion of Wachovia merger integration activities in the prior

year ($218 million in first quarter 2012), partially offset by

higher personnel expense ($30.1 billion, up from $28.8 billion in

2012). The increase in 2012 from 2011 was driven by higher

personnel expense and higher operating losses, partially offset

by lower merger integration costs.

Personnel expenses, which include salaries, commissions,

incentive compensation and employee benefits, were up

$1.3 billion, or 5%, in 2013 compared with 2012, primarily due

to annual salary increases and related salary taxes, and higher

revenue-based compensation (non-mortgage-related). Included

in personnel expense was a $422 million increase in employee

benefits, a significant portion of which was driven by higher

deferred compensation expense (offset in trading income). For

2012, these expenses were up 4% compared with 2011 due

mostly to higher revenue-based compensation, higher employee

benefits, and increased staffing.

The completion of Wachovia integration activities in the prior

year contributed to a year-over-year reduction in noninterest

expense for 2013, primarily in outside professional services and

contract services. Lower costs associated with our mortgage

servicing regulatory consent orders also contributed to the

decline in outside professional services in 2013, though this was

partially offset by project spend on business investments and

compliance and regulatory related initiatives. Outside

professional services were also elevated in 2012 and 2011,

reflecting investments by our businesses in their service delivery

systems and higher costs associated with regulatory driven

mortgage servicing and foreclosure matters.

Foreclosed assets expense was down 43% in 2013 compared

with 2012 and down 22% in 2012 compared with 2011, reflecting

lower write-downs, gains on sale, and lower expenses associated

with foreclosed properties, primarily driven by the real estate

market improvement.

FDIC and other deposit assessments were down 29% in 2013

compared with 2012, due primarily to lower FDIC assessment

rates related to improved credit performance and the Company’s

liquidity position.

Operating losses were down 63% in 2013 compared with

2012, which was elevated predominantly due to mortgage

servicing and foreclosure-related matters, including the

Attorneys General settlement announced in February 2012, a

$175 million settlement in July 2012 with the U.S. Department

of Justice (DOJ), which resolved alleged claims related to our

mortgage lending practices, and the $766 million accrual for the

Independent Foreclosure Review (IFR) settlement and

additional remediation-related costs.

All other expenses of $2.1 billion in 2013 were down from

$2.4 billion in 2012, primarily due to a $250 million charitable

contribution to the Wells Fargo Foundation in 2012.

Income Tax Expense

The 2013 annual effective tax rate was 32.2% compared with

32.5% in 2012 and 31.9% in 2011. The effective tax rate for 2013

included a net reduction in the reserve for uncertain tax

positions primarily due to settlements with authorities regarding

certain cross border transactions and tax benefits recognized

from the realization for tax purposes of a previously written

down investment. The 2012 effective tax rate included a tax

benefit resulting from the surrender of previously written-down

Wachovia life insurance investments. The 2011 effective tax rate

included a decrease in tax expense associated with leverage

leases, as well as tax benefits related to charitable donations of

appreciated securities. See Note 21 (Income Taxes) to Financial

Statements in this Report for information regarding tax matters

related to undistributed foreign earnings.

43