Wells Fargo 2013 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

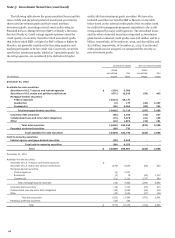

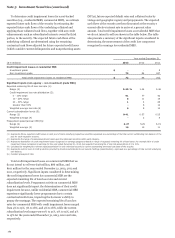

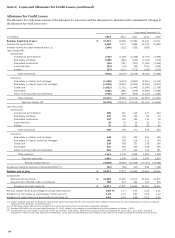

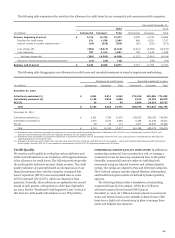

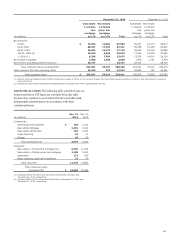

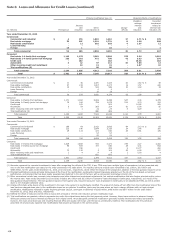

The following table summarizes the activity in the allowance for credit losses by our commercial and consumer portfolio segments.

Year ended December 31,

2013 2012

(in millions) Commercial Consumer Total Commercial Consumer Total

Balance, beginning of period $ 5,714 11,763 17,477 6,358 13,310 19,668

Provision for credit losses 671 1,638 2,309 666 6,551 7,217

Interest income on certain impaired loans (54) (210) (264) (95) (220) (315)

Loan charge-offs (993) (5,417) (6,410) (2,014) (8,959) (10,973)

Loan recoveries 787 1,114 1,901 799 1,140 1,939

Net loan charge-offs (206) (4,303) (4,509) (1,215) (7,819) (9,034)

Allowance related to business combinations/other (22) (20) (42) - (59) (59)

Balance, end of period $ 6,103 8,868 14,971 5,714 11,763 17,477

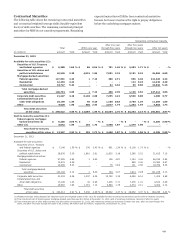

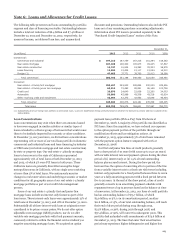

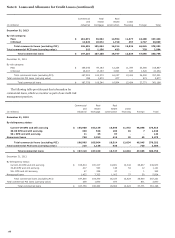

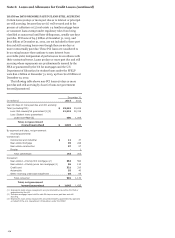

The following table disaggregates our allowance for credit losses and recorded investment in loans by impairment methodology.

Allowance for credit losses Recorded investment in loans

(in millions) Commercial onsumer C Total Commercial Consumer Total

December 31, 2013

Collectively evaluated (1) $ 4,921 5,011 9,932 372,918 398,084 771,002

Individually evaluated (2) 1,156 3,853 5,009 5,334 22,736 28,070

PCI (3) 26 4 30 2,504 24,223 26,727

Total $ 6,103 8,868 14,971 380,756 445,043 825,799

December 31, 2012

Collectively evaluated (1) $ 3,951 7,524 11,475 349,035 389,559 738,594

Individually evaluated (2) 1,675 4,210 5,885 8,186 21,826 30,012

PCI (3) 88 29 117 3,977 26,991 30,968

Total $ 5,714 11,763 17,477 361,198 438,376 799,574

(1) Represents loans collectively evaluated for impairment in accordance with Accounting Standards Codification (ASC) 450-20, Loss Contingencies (formerly FAS 5), and

pursuant to amendments by ASU 2010-20 regarding allowance for non-impaired loans.

(2) Represents loans individually evaluated for impairment in accordance with ASC 310-10, Receivables (formerly FAS 114), and pursuant to amendments by ASU 2010-20

regarding allowance for impaired loans.

(3) Represents the allowance and related loan carrying value determined in accordance with ASC 310-30, Receivables – Loans and Debt Securities Acquired with Deteriorated

Credit Quality (formerly SOP 03-3) and pursuant to amendments by ASU 2010-20 regarding allowance for PCI loans.

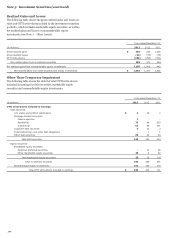

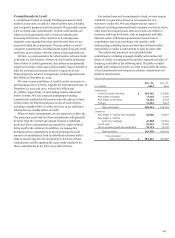

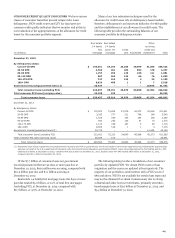

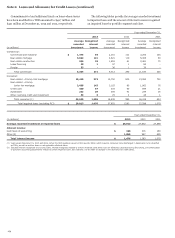

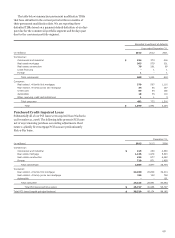

Credit Quality

We monitor credit quality by evaluating various attributes and

utilize such information in our evaluation of the appropriateness

of the allowance for credit losses. The following sections provide

the credit quality indicators we most closely monitor. The credit

quality indicators are generally based on information as of our

financial statement date, with the exception of updated Fair

Isaac Corporation (FICO) scores and updated loan-to-value

(LTV)/combined LTV (CLTV), which are obtained at least

quarterly. Generally, these indicators are updated in the second

month of each quarter, with updates no older than September

30, 2013. See the “Purchased Credit-Impaired Loans” section of

this Note for credit quality information on our PCI portfolio.

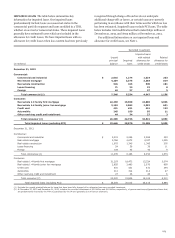

COMMERCIAL CREDIT QUALITY INDICATORS In addition to

monitoring commercial loan concentration risk, we manage a

consistent process for assessing commercial loan credit quality.

Generally, commercial loans are subject to individual risk

assessment using our internal borrower and collateral quality

ratings. Our ratings are aligned to Pass and Criticized categories.

The Criticized category includes Special Mention, Substandard,

and Doubtful categories which are defined by bank regulatory

agencies.

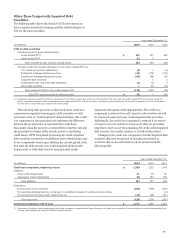

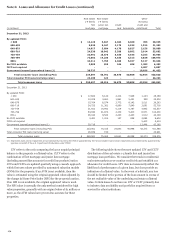

The following table provides a breakdown of outstanding

commercial loans by risk category. Of the $12.7 billion in

criticized commercial real estate (CRE) loans at

December 31, 2013, $2.7 billion has been placed on nonaccrual

status and written down to net realizable collateral value. CRE

loans have a high level of monitoring in place to manage these

assets and mitigate loss exposure.

167