Wells Fargo 2013 Annual Report Download - page 220

Download and view the complete annual report

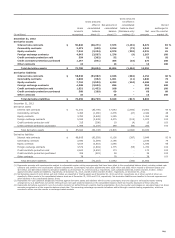

Please find page 220 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 17: Fair Values of Assets and Liabilities (continued)

transactions or other market data within the same or similar

asset classes. This ensures modeled approaches are appropriate

given similar product valuation techniques and are in line with

their intended purpose.

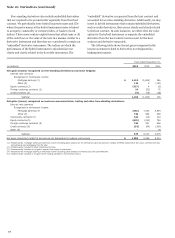

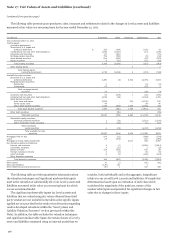

We have ongoing monitoring procedures in place for our

Level 3 assets and liabilities that use such internal valuation

models. These procedures, which are designed to provide

reasonable assurance that models continue to perform as

expected after approved, include:

• ongoing analysis and benchmarking to market transactions

and other independent market data (including pricing

vendors, if available);

•back-testing of modeled fair values to actual realized

transactions; and

•review of modeled valuation results against expectations,

including review of significant or unusual value fluctuations.

We update model inputs and methodologies periodically to

reflect these monitoring procedures. Additionally, procedures

and controls are in place to ensure existing models are subject to

periodic reviews, and we perform full model revalidations as

necessary.

All internal valuation models are subject to ongoing review

by business-unit-level management, and all models are subject

to additional oversight by a corporate-level risk management

department. Corporate oversight responsibilities include

evaluating adequacy of business unit risk management

programs, maintaining company-wide model validation policies

and standards and reporting the results of these activities to

management and our Corporate Model Risk Committee (CMoR).

The CMoR consists of senior executive management and reports

on top model risk issues to the Company’s Risk Committee of the

Board.

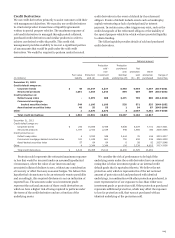

VENDOR-DEVELOPED VALUATIONS In certain limited

circumstances we obtain pricing from third party vendors for the

value of our Level 3 assets or liabilities. We have processes in

place to approve such vendors to ensure information obtained

and valuation techniques used are appropriate. Once these

vendors are approved to provide pricing information, we

monitor and review the results to ensure the fair values are

reasonable and in line with market experience in similar asset

classes. While the input amounts used by the pricing vendor in

determining fair value are not provided, and therefore

unavailable for our review, we do perform one or more of the

following procedures to validate the prices received:

• comparison to other pricing vendors (if available);

• variance analysis of prices;

• corroboration of pricing by reference to other independent

market data, such as market transactions and relevant

benchmark indices;

• review of pricing by Company personnel familiar with

market liquidity and other market-related conditions; and

• investigation of prices on a specific instrument-by-

instrument basis.

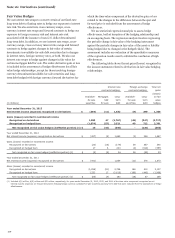

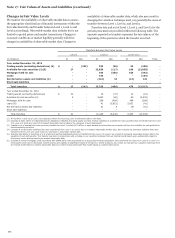

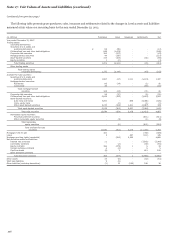

Fair Value Measurements from Brokers or Third

Party Pricing Services

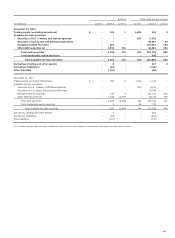

For certain assets and liabilities, we obtain fair value

measurements from brokers or third party pricing services and

record the unadjusted fair value in our financial statements. The

detail by level is shown in the table below. Fair value

measurements obtained from brokers or third party pricing

services that we have adjusted to determine the fair value

recorded in our financial statements are not included in the

following table.

218