Wells Fargo 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our liability for mortgage repurchases, included in “Accrued

expenses and other liabilities” in our consolidated balance sheet,

was $899 million at December 31, 2013 and $2.2 billion at

December 31, 2012. In 2013, we provided $428 million, which

reduced net gains on mortgage loan origination/sales activities,

compared with a provision of $1.9 billion for 2012 and

$1.3 billion for 2011. Our provision in 2013 reflected an increase

in projected repurchase losses for the GSE pre-2009 vintages to

incorporate the impact of trends in file requests and repurchase

demand activity observed in the first quarter (comprising

approximately 58% of the 2013 provision), an increase for

indemnifications and specific private investor demands

(approximately 8%) and new loan sales (approximately 34%).

Our provision in 2012 reflected an increase in projections of

future GSE repurchase demands, net of appeals, for the pre-

2009 vintages to incorporate the impact of trends in file requests

and repurchase demand activity (comprising approximately 58%

of the 2012 provision), an increase in probable loss estimates for

mortgage insurance rescissions (approximately 10%), new loan

sales (approximately 14%), an increase in probable loss

estimates for non-agency risk (approximately 9%), and various

other observed trends affecting our repurchase liability including

higher than anticipated loss severity (approximately 9%). The

increase in projected future GSE repurchase demands in 2012

was predominantly a result of an increase in the expected file

reviews by the GSEs as well as an increase in observed demand

rates on these file reviews based on our experience with them at

that time.

The mortgage repurchase liability of $899 million at

December 31, 2013, represents our best estimate of the probable

loss that we expect to incur for various representations and

warranties in the contractual provisions of our sales of mortgage

loans. The mortgage repurchase liability estimation process

requires management to make difficult, subjective and complex

judgments about matters that are inherently uncertain,

including demand expectations, economic factors, and the

specific characteristics of the loans subject to repurchase. Our

evaluation considers all vintages and the collective actions of the

GSEs and their regulator, the Federal Housing Finance Agency

(FHFA), mortgage insurers and our correspondent lenders. We

maintain regular contact with the GSEs, the FHFA, and other

significant investors to monitor their repurchase demand

practices and issues as part of our process to update our

repurchase liability estimate as new information becomes

available.

Because of the uncertainty in the various estimates

underlying the mortgage repurchase liability, there is a range of

losses in excess of the recorded mortgage repurchase liability

that are reasonably possible. The estimate of the range of

possible loss for representations and warranties does not

represent a probable loss, and is based on currently available

information, significant judgment, and a number of assumptions

that are subject to change. The high end of this range of

reasonably possible losses in excess of our recorded liability was

$896 million at December 31, 2013, and was determined based

upon modifying the assumptions (particularly to assume

significant changes in investor repurchase demand practices)

utilized in our best estimate of probable loss to reflect what we

believe to be the high end of reasonably possible adverse

assumptions. For additional information on our repurchase

liability, see the “Critical Accounting Policies – Liability for

Mortgage Loan Repurchase Losses” section and Note 9

(Mortgage Banking Activities) to Financial Statements in this

Report.

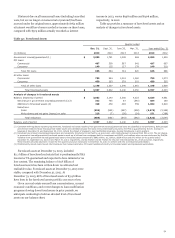

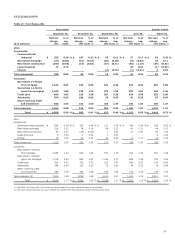

Table 41: Mortgage Repurchase Liability - Sensitivity

Assumptions

(in millions)

Mortgage

repurchase

liability

Balance at December 31, 2013 $ 899

Loss on repurchases (1) 28.3 %

Increase in liability from:

10% higher losses $ 80

25% higher losses 200

Repurchase rate assumption (2) 0.2 %

Increase in liability from:

10% higher repurchase rates $ 65

25% higher repurchase rates 162

(1) Represents total estimated average loss rate on repurchased loans, net of

recovery from third party originators, based on historical experience and current

economic conditions. The average loss rate includes the impact of repurchased

loans for which no loss is expected to be realized.

(2) Represents the combination of the estimated investor audit/file review rate, the

investor demand rate on those audited loans, and the unsuccessful appeal rate on

those demands. As such, the repurchase rate can be significantly impacted by

changes in investor behavior if they decide to review/audit more loans or demand

more repurchases on the loans they audit. These behavior changes drive a

significant component of our estimated high end of the range of reasonably

possible losses in excess of our recorded repurchase liability, which includes

adverse assumptions in excess of the sensitivity ranges presented in this table.

To the extent that economic conditions and the housing

market do not recover or future investor repurchase demands

and appeals success rates differ from past experience, we could

continue to have increased demands and increased loss severity

on repurchases, causing future additions to the repurchase

liability. However, some of the underwriting standards that were

permitted by the GSEs for conforming loans in the 2006 through

2008 vintages, which significantly contributed to recent levels of

repurchase demands, were tightened starting in mid to late 2008

and as of December 31, 2013, we have resolved substantially all

of our repurchase exposures on the pre-2009 vintages with

FNMA and FHLMC. Given the tightening of underwriting

standards in late 2008, we do not expect a similar rate of

repurchase requests from the 2009 and prospective vintages,

absent deterioration in economic conditions or changes in

investor behavior.

RISKS RELATING TO SERVICING ACTIVITIES In addition to

servicing loans in our portfolio, we act as servicer and/or master

servicer of residential mortgage loans included in GSE-

guaranteed mortgage securitizations, GNMA-guaranteed

mortgage securitizations of FHA-insured/VA-guaranteed

mortgages and private label mortgage securitizations, as well as

for unsecuritized loans owned by institutional investors. The

following discussion summarizes the primary duties and

requirements of servicing and related industry developments.

81