Wells Fargo 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management – Credit Risk Management (continued)

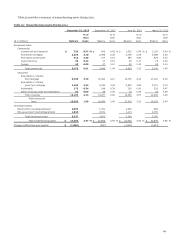

In addition to the allowance for credit losses, there was

$5.2 billion at December 31, 2013, and $7.0 billion at

December 31, 2012, of nonaccretable difference to absorb losses

for PCI loans. The allowance for credit losses is lower than

otherwise would have been required without PCI loan

accounting. As a result of PCI loans, certain ratios of the

Company may not be directly comparable with credit-related

metrics for other financial institutions. For additional

information on PCI loans, see the “Risk Management – Credit

Risk Management – Purchased Credit-Impaired Loans” section,

Note 1 (Summary of Significant Accounting Policies) and Note 6

(Loans and Allowance for Credit Losses) to Financial Statements

in this Report.

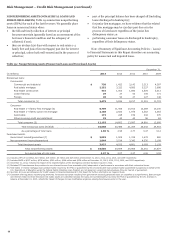

The ratio of the allowance for credit losses to total nonaccrual

loans may fluctuate significantly from period to period due to

such factors as the mix of loan types in the portfolio, borrower

credit strength and the value and marketability of collateral.

Over one-half of nonaccrual loans were home mortgages at

December 31, 2013.

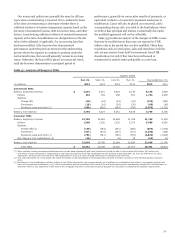

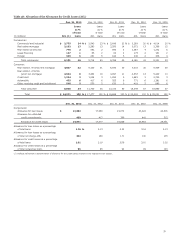

The allowance for credit losses again declined in 2013, which

reflected continued improvement in consumer loss severity,

delinquency trends and improved portfolio performance,

particularly in residential real estate and primarily associated

with continued improvement in the housing market. The total

provision for credit losses was $2.3 billion in 2013, $7.2 billion

in 2012 and $7.9 billion in 2011.

The 2013 provision for credit losses was $2.3 billion,

$2.2 billion less than net charge-offs, due to strong underlying

credit, and home prices and market fundamentals improving

faster and in more markets than forecasted.

The 2012 provision was $7.2 billion, $1.8 billion less than net

charge-offs, and the 2011 provision was $7.9 billion, $3.4 billion

less than net charge-offs. In each of 2012 and 2011 the provision

was influenced by continually improving credit performance.

We believe the allowance for credit losses of $15.0 billion at

December 31, 2013, was appropriate to cover credit losses

inherent in the loan portfolio, including unfunded credit

commitments, at that date. The allowance for credit losses is

subject to change and reflects existing factors as of the date of

determination, including economic or market conditions and

ongoing internal and external examination processes. Due to the

sensitivity of the allowance for credit losses to changes in the

economic and business environment, it is possible that we will

incur incremental credit losses not anticipated as of the balance

sheet date. Given current favorable conditions, we continue to

expect future allowance releases, absent a significant

deterioration in the economy. Our process for determining the

allowance for credit losses is discussed in the “Critical

Accounting Policies – Allowance for Credit Losses” section and

Note 1 (Summary of Significant Accounting Policies) to Financial

Statements in this Report.

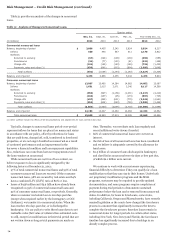

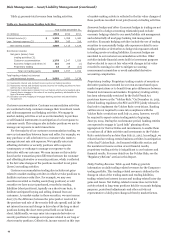

LIABILITY FOR MORTGAGE LOAN REPURCHASE LOSSES

We sell residential mortgage loans to various parties, including

(1) government-sponsored entities (GSEs) Federal Home Loan

Mortgage Corporation (FHLMC) and Federal National Mortgage

Association (FNMA) who include the mortgage loans in GSE-

guaranteed mortgage securitizations, (2) SPEs that issue private

label MBS, and (3) other financial institutions that purchase

mortgage loans for investment or private label securitization. In

addition, we pool FHA-insured and VA-guaranteed mortgage

loans that are then used to back securities guaranteed by the

Government National Mortgage Association (GNMA). We may

be required to repurchase these mortgage loans, indemnify the

securitization trust, investor or insurer, or reimburse the

securitization trust, investor or insurer for credit losses incurred

on loans (collectively, repurchase) in the event of a breach of

contractual representations or warranties that is not remedied

within a period (usually 90 days or less) after we receive notice

of the breach.

We have established a mortgage repurchase liability, initially

at fair value, related to various representations and warranties

that reflect management’s estimate of losses for loans for which

we could have a repurchase obligation, whether or not we

currently service those loans, based on a combination of factors.

Our mortgage repurchase liability estimation process also

incorporates a forecast of repurchase demands associated with

mortgage insurance rescission activity.

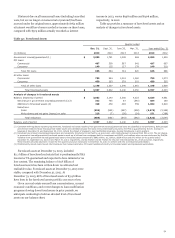

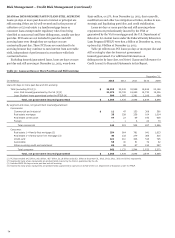

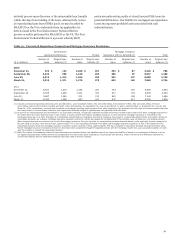

The overall level of unresolved repurchase demands and

mortgage insurance rescissions outstanding at

December 31, 2013, was down from a year ago both in number of

outstanding loans and in total dollar balances as we continued to

work through the new demands and mortgage insurance

rescissions and as we announced settlements with both FHLMC

and FNMA in 2013, that resolved substantially all repurchase

liabilities associated with loans sold to FHLMC prior to

January 1, 2009, and loans sold to FNMA that were originated

prior to January 1, 2009. Table 39 provides the number of

unresolved repurchase demands and mortgage insurance

rescissions.

Customary with industry practice, we have the right of

recourse against correspondent lenders from whom we have

purchased loans with respect to representations and warranties.

Of total repurchase demands and mortgage insurance

rescissions outstanding as of December 31, 2013, presented in

Table 39, approximately 10% relate to loans purchased from

correspondent lenders. Due primarily to the financial difficulties

of some correspondent lenders, we have been recovering on

average approximately 45% of losses from these lenders.

Historical recovery rates as well as projected lender performance

are incorporated in the establishment of our mortgage

repurchase liability.

We do not typically receive repurchase requests from GNMA,

FHA and the Department of Housing and Urban Development

(HUD) or VA. As an originator of an FHA-insured or VA-

guaranteed loan, we are responsible for obtaining the insurance

with FHA or the guarantee with the VA. To the extent we are not

able to obtain the insurance or the guarantee we must request

permission to repurchase the loan from the GNMA pool. Such

repurchases from GNMA pools typically represent a self-

78