Wells Fargo 2013 Annual Report Download - page 267

Download and view the complete annual report

Please find page 267 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

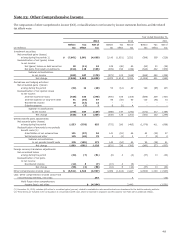

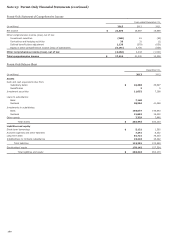

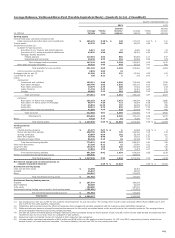

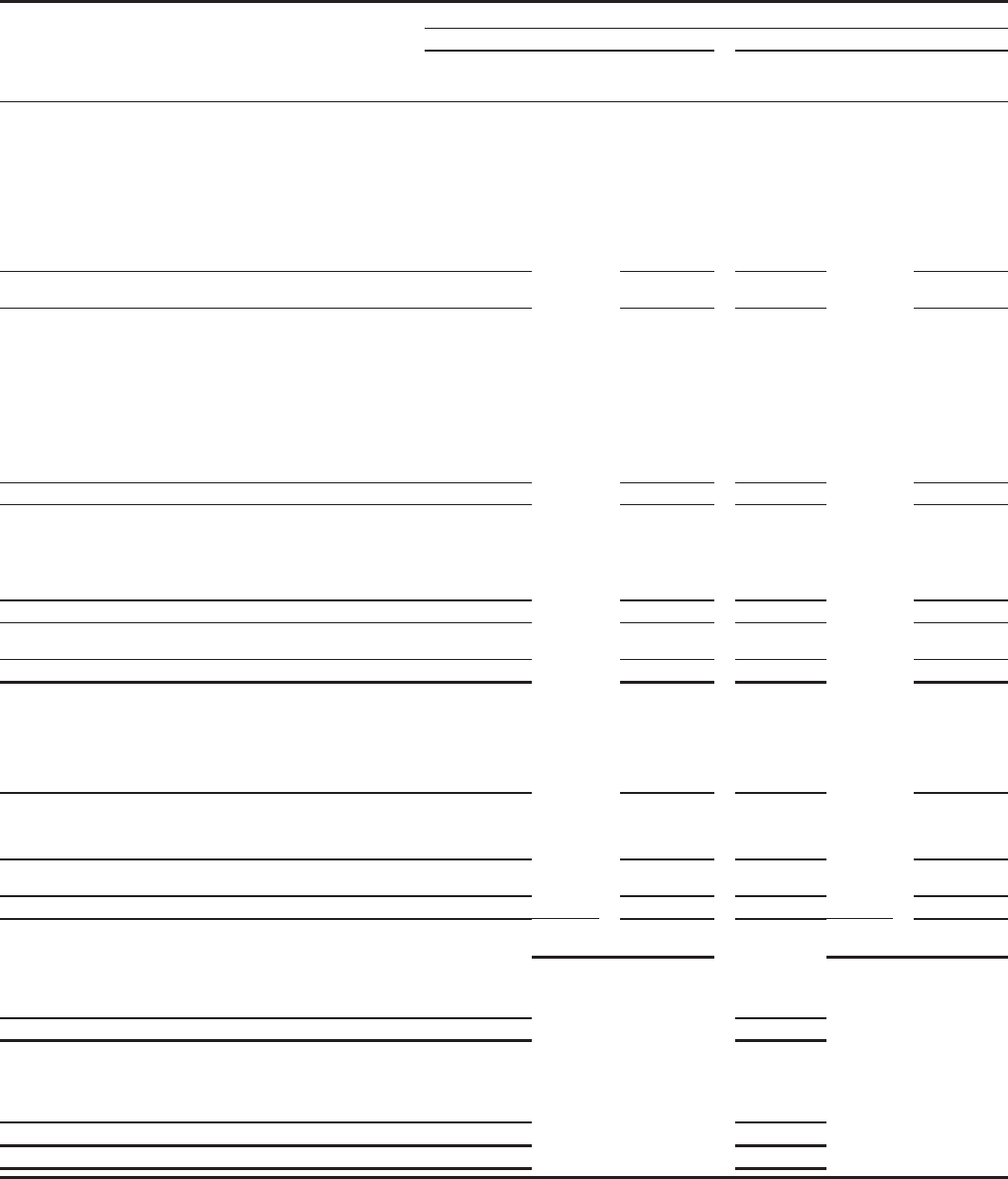

Average Balances, Yields and Rates Paid (Taxable-Equivalent Basis) - Quarterly (1) (2) - (Unaudited)

Quarter ended December 31,

2013 2012

(in millions)

Average

balance

Yields/

rates

Interest

income/

expense

Average

balance

Yields/

rates

Interest

income/

expense

Earning assets

Federal funds sold, securities purchased under

resale agreements and other short-term investments $ 205,276 0.28 % $ 148 117,047 0.41 % $ 121

Trading assets 45,379 3.40 386 42,005 3.28 345

Investment securities (3):

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies 6,611 1.67 27 5,281 1.64 22

Securities of U.S. states and political subdivisions 42,025 4.38 460 36,391 4.64 422

Mortgage-backed securities:

Federal agencies 117,910 2.94 866 90,898 2.71 617

Residential and commercial 29,233 6.35 464 32,669 6.53 533

Total mortgage-backed securities 147,143 3.62 1,330 123,567 3.72 1,150

Other debt and equity securities 55,325 3.43 478 50,025 3.91 490

Total available-for-sale securities 251,104 3.65 2,295 215,264 3.87 2,084

Held-to-maturity securities (4) 2,845 3.09 22 - - -

Mortgages held for sale (5) 21,396 4.13 221 47,241 3.50 413

Loans held for sale (5) 138 8.21 3 135 9.03 3

Loans:

Commercial:

Commercial and industrial 193,211 3.48 1,696 179,493 3.85 1,736

Real estate mortgage 105,795 3.85 1,026 105,107 4.02 1,061

Real estate construction 16,579 4.79 200 17,502 4.97 218

Lease financing 11,744 5.70 167 12,461 6.43 201

Foreign 46,682 2.23 262 39,665 2.32 231

Total commercial 374,011 3.56 3,351 354,228 3.87 3,447

Consumer:

Real estate 1-4 family first mortgage 257,253 4.15 2,673 244,634 4.39 2,686

Real estate 1-4 family junior lien mortgage 66,774 4.29 721 76,908 4.28 826

Credit card 25,854 12.23 797 23,839 12.43 745

Automobile 50,213 6.70 849 45,957 7.34 848

Other revolving credit and installment 42,564 4.94 529 41,644 4.63 485

Total consumer 442,658 5.01 5,569 432,982 5.15 5,590

Total loans (5) 816,669 4.35 8,920 787,210 9,037

Other 4,728 5.22 61 4,280

4.58

5.21 56

Total earning assets $ 1,347,535 3.56 % $ 12,056 1,213,182 3.96 % $ 12,059

Funding sources

Deposits:

Interest-bearing checking $ 35,171 0.07 % $ 6 30,858 0.06 % $ 5

Market rate and other savings 568,750 0.08 110 518,593 0.10 135

Savings certificates 43,067 0.94 102 56,743 1.27 181

Other time deposits 39,700 0.48 47 13,612 1.51 51

Deposits in foreign offices 86,333 0.15 32 69,398 0.15 27

Total interest-bearing deposits 773,021 0.15 297 689,204 0.23 399

Short-term borrowings 52,286 0.12 15 52,820 0.21 28

Long-term debt 153,470 1.65 635 127,505 2.30 735

Other liabilities 12,822 2.70 87 9,975 2.27 56

Total interest-bearing liabilities 991,599 0.42 1,034 879,504 0.55 1,218

Portion of noninterest-bearing funding sources 355,936 - - 333,678 - -

Total funding sources $ 1,347,535 0.30 1,034 1,213,182 0.40 1,218

Net interest margin and net interest income on

a taxable-equivalent basis (6) 3.26 % $ 11,022 3.56 % $ 10,841

Noninterest-earning assets

Cash and due from banks $ 15,998 16,361

Goodwill 25,637 25,637

Other 119,947 131,876

Total noninterest-earning assets $ 161,582 173,874

Noninterest-bearing funding sources

Deposits $ 287,379 286,924

Other liabilities 60,489 63,025

Total equity 169,650 157,603

Noninterest-bearing funding sources used to fund earning assets (355,936) (333,678)

Net noninterest-bearing funding sources $ 161,582 173,874

Total assets $ 1,509,117 1,387,056

(1) Our average prime rate was 3.25% for the quarters ended December 31, 2013 and 2012. The average three-month London Interbank Offered Rate (LIBOR) was 0.24%

and 0.32% for the same quarters, respectively.

(2) Yields/rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

(3) Yields and rates are based on interest income/expense amounts for the period, annualized based on the accrual basis for the respective accounts. The average balance

amounts represent amortized cost for the periods presented.

(4) Includes $6.3 billion of federal agency mortgage-backed securities purchased during the fourth quarter of 2013 and $6.0 billion of auto asset-backed securities that were

transferred near the end of 2013 from the available-for-sale portfolio.

(5) Nonaccrual loans and related income are included in their respective loan categories.

(6) Includes taxable-equivalent adjustments of $219 million and $198 million for the quarters ended December 31, 2013 and 2012, respectively primarily related to tax-

exempt income on certain loans and securities. The federal statutory tax rate was 35% for the periods presented.

265