Wells Fargo 2013 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

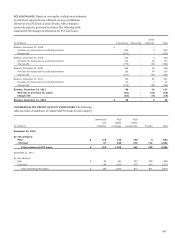

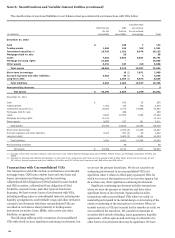

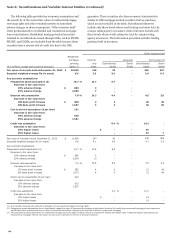

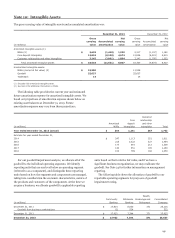

Year ended December 31,

2013 2012 2011

(in millions)

Mortgage

loans

Other

financial

assets

Mortgage

loans

Other

financial

assets

Mortgage

loans

Other

financial

assets

Sales proceeds from securitizations (1) $ 357,807 -535,372 - 337,357 -

Fees from servicing rights retained 4,240 10 4,433 10 4,401 11

Other interests held 2,284 93 1,767 135 1,779 263

Purchases of delinquent assets 18 -62 - 9 -

Servicing advances, net of repayments (34) - 226 - 29 -

(1) Represents cash flow data for all loans securitized in the period presented.

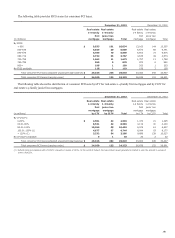

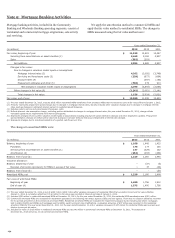

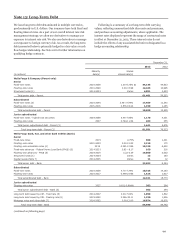

In 2013, 2012, and 2011, we recognized net gains of

$149 million, $518 million and $112 million, respectively, from

transfers accounted for as sales of financial assets in

securitizations. These net gains primarily relate to commercial

mortgage securitizations and residential mortgage

securitizations where the loans were not already carried at fair

value.

Sales with continuing involvement during 2013, 2012 and

2011 predominantly related to securitizations of residential

mortgages that are sold to the GSEs, including FNMA, FHLMC

and GNMA (conforming residential mortgage securitizations).

During 2013, 2012 and 2011 we transferred $343.9 billion,

$517.3 billion and $329.1 billion respectively, in fair value of

conforming residential mortgages to unconsolidated VIEs and

recorded the transfers as sales. Substantially all of these

transfers did not result in a gain or loss because the loans were

already carried at fair value. In connection with all of these

transfers, in 2013 we recorded a $3.5 billion servicing asset,

measured at fair value using a Level 3 measurement technique,

and a $143 million liability for repurchase losses which reflects

management’s estimate of probable losses related to various

representations and warranties for the loans transferred, initially

measured at fair value. In 2012, we recorded a $4.9 billion

servicing asset and a $274 million liability. In 2011, we recorded

a $4.0 billion servicing asset and a $101 million liability.

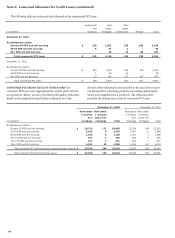

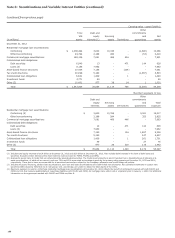

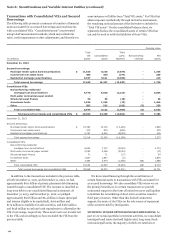

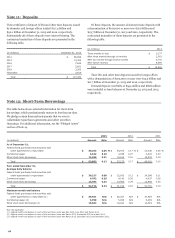

We used the following key weighted-average assumptions to

measure mortgage servicing assets at the date of securitization:

Residential mortgage

servicing rights

Year ended December 31,

2013 2012 2011

Prepayment speed (1) 11.2 % 13.4 12.8

Discount rate 7.3 7.3 7.7

Cost to service ($ per loan) (2) $ 184 151 146

(1) The prepayment speed assumption for residential mortgage servicing rights

includes a blend of prepayment speeds and default rates. Prepayment speed

assumptions are influenced by mortgage interest rate inputs as well as our

estimation of drivers of borrower behavior.

(2) Includes costs to service and unreimbursed foreclosure costs.

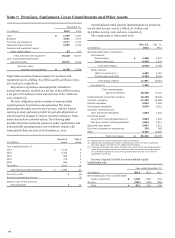

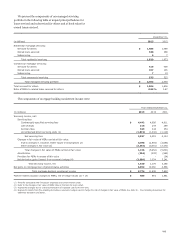

During 2013, 2012 and 2011, we transferred $5.6 billion,

$3.4 billion and $3.0 billion, respectively, in fair value of

commercial mortgages to unconsolidated VIEs and recorded the

transfers as sales. These transfers resulted in a gain of

$152 million in 2013, $178 million in 2012 and $48 million in

2011, respectively, because the loans were carried at LOCOM. In

connection with these transfers, in 2013 we recorded a servicing

asset of $20 million, initially measured at fair value using a Level

3 measurement technique, and available-for-sale securities of

$54 million, classified as Level 2. In 2012, we recorded a

servicing asset of $13 million and available-for-sale securities of

$116 million. In 2011, we recorded a servicing asset of

$20 million and available-for-sale securities of $532 million.

189