Wells Fargo 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272

|

|

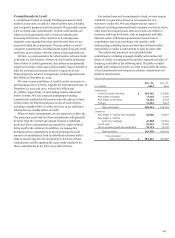

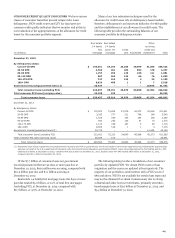

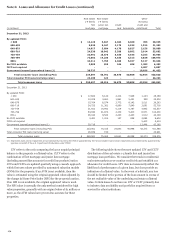

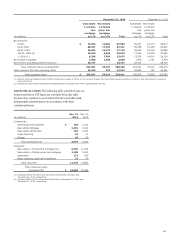

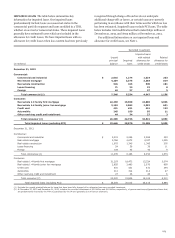

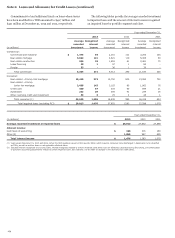

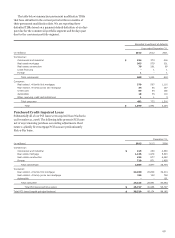

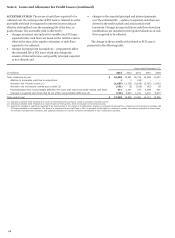

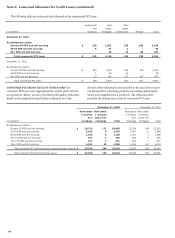

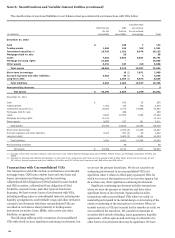

TROUBLED DEBT RESTRUCTURINGS (TDRs) When, for

economic or legal reasons related to a borrower’s financial

difficulties, we grant a concession for other than an insignificant

period of time to a borrower that we would not otherwise

consider, the related loan is classified as a TDR. We do not

consider any loans modified through a loan resolution such as

foreclosure or short sale to be a TDR.

We may require some borrowers experiencing financial

difficulty to make trial payments generally for a period of three

to four months, according to the terms of a planned permanent

modification, to determine if they can perform according to

those terms. These arrangements represent trial modifications,

which we classify and account for as TDRs. While loans are in

trial payment programs, their original terms are not considered

modified and they continue to advance through delinquency

status and accrue interest according to their original terms. The

planned modifications for these arrangements predominantly

involve interest rate reductions or other interest rate

concessions; however, the exact concession type and resulting

financial effect are usually not finalized and do not take effect

until the loan is permanently modified. The trial period terms

are developed in accordance with our proprietary programs or

the U.S. Treasury’s Making Homes Affordable programs for real

estate 1-4 family first lien (i.e. Home Affordable Modification

Program – HAMP) and junior lien (i.e. Second Lien Modification

Program – 2MP) mortgage loans.

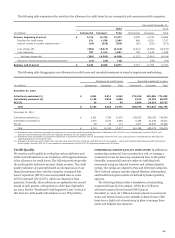

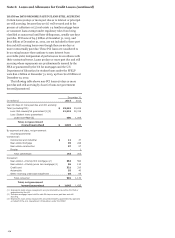

At December 31, 2013, the loans in trial modification period

were $253 million under HAMP, $45 million under 2MP and

$352 million under proprietary programs, compared with

$402 million, $45 million and $258 million at

December 31, 2012, respectively. Trial modifications with a

recorded investment of $286 million at December 31, 2013, and

$276 million at December 31, 2012, were accruing loans and

$364 million and $429 million, respectively, were nonaccruing

loans. Our experience is that most of the mortgages that enter a

trial payment period program are successful in completing the

program requirements and are then permanently modified at the

end of the trial period. Our allowance process considers the

impact of those modifications that are probable to occur.

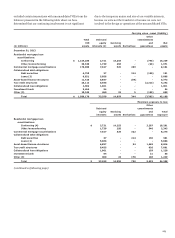

The following table summarizes our TDR modifications for

the periods presented by primary modification type and includes

the financial effects of these modifications. For those loans that

modify more than once, the table reflects each modification that

occurred during the period.

175