Wells Fargo 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272

|

|

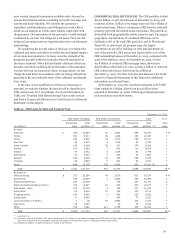

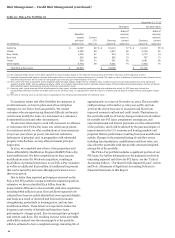

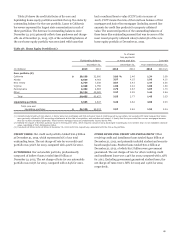

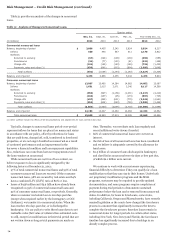

Risk Management – Credit Risk Management (continued)

FOREIGN LOANS AND COUNTRY RISK EXPOSURE We

classify loans for financial statement and certain regulatory

purposes as foreign primarily based on whether the borrower’s

primary address is outside of the United States. At

December 31, 2013, foreign loans totaled $47.7 billion,

representing approximately 6% of our total consolidated loans

outstanding, compared with $37.8 billion, or approximately 5%

of total consolidated loans outstanding, at December 31, 2012.

A significant portion of the growth in foreign loans was due to

the acquisition of CRE loans in the U.K. in third quarter 2013.

Foreign loans were approximately 3% of our consolidated total

assets at December 31, 2013 and at December 31, 2012.

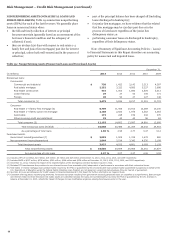

Our foreign country risk monitoring process incorporates

frequent dialogue with our financial institution customers,

counterparties and regulatory agencies, enhanced by

centralized monitoring of macroeconomic and capital markets

conditions in the respective countries. We establish exposure

limits for each country through a centralized oversight process

based on customer needs, and in consideration of relevant

economic, political, social, legal, and transfer risks. We monitor

exposures closely and adjust our country limits in response to

changing conditions.

We evaluate our individual country risk exposure on an

ultimate country of risk basis, which is normally based on the

country of residence of the guarantor or collateral location, and

is different from the reporting based on the borrower’s primary

address. Our largest single foreign country exposure on an

ultimate risk basis at December 31, 2013, was the United

Kingdom, which totaled $21.1 billion, or approximately 1% of

our total assets, and included $3.0 billion of sovereign claims.

Our United Kingdom sovereign claims arise primarily from

deposits we have placed with the Bank of England pursuant to

regulatory requirements in support of our London branch.

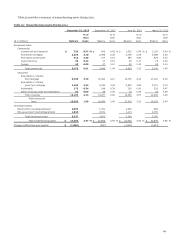

We conduct periodic stress tests of our significant country

risk exposures, analyzing the direct and indirect impacts on the

risk of loss from various macroeconomic and capital markets

scenarios. We do not have significant exposure to foreign

country risks because our foreign portfolio is relatively small.

However, we have identified exposure to increased loss from

U.S. borrowers associated with the potential impact of a

regional or worldwide economic downturn on the U.S.

economy. We mitigate these potential impacts on the risk of

loss through our normal risk management processes which

include active monitoring and, if necessary, the application of

aggressive loss mitigation strategies.

Table 22 provides information regarding our top 20

exposures by country (excluding the U.S.) and our Eurozone

exposure, on an ultimate risk basis.

60