Wells Fargo 2013 Annual Report Download - page 44

Download and view the complete annual report

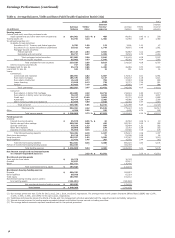

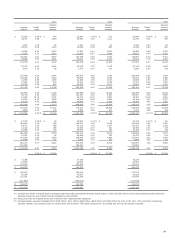

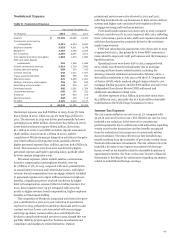

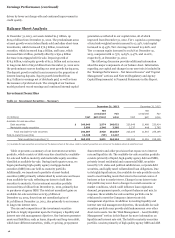

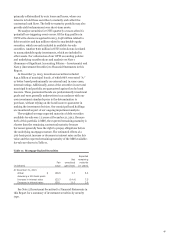

Please find page 44 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Earnings Performance (continued)

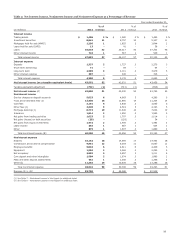

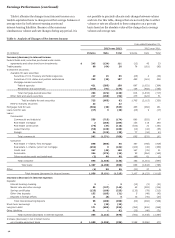

$3.6 billion hedge gain), and net servicing income of $3.3 billion

for 2011 included a $1.6 billion net MSR valuation gain

($3.7 billion decrease in the fair value of MSRs offset by a

$5.3 billion hedge gain). The decrease in the 2012 net MSR

valuation gain from that for 2011 reflected a $677 million

reduction in valuation due to additional costs associated with

implementation of the servicing standards developed in

connection with our settlement with the Department of Justice

(DOJ) and other state and federal agencies relating to our

mortgage servicing and foreclosure practices as well as higher

foreclosure costs. Our portfolio of loans serviced for others was

$1.90 trillion at December 31, 2013, $1.91 trillion at

December 31, 2012, and $1.85 trillion at December 31, 2011. At

December 31, 2013, the ratio of MSRs to related loans serviced

for others was 0.88%, compared with 0.67% at

December 31, 2012 and 0.76% at December 31, 2011. See the

“Risk Management – Mortgage Banking Interest Rate and

Market Risk” section in this Report for additional information

regarding our MSRs risks and hedging approach.

Net gains on mortgage loan origination/sale activities were

$6.9 billion in 2013, compared with $10.3 billion in 2012 and

$4.6 billion in 2011. The decrease from 2012 was primarily

driven by lower margins and origination volumes, and the

increase in 2012 from 2011 was driven by higher loan origination

volume and margins. Mortgage loan originations were

$351 billion in 2013, of which 47% were for home purchases,

compared with $524 billion and 35%, respectively, for 2012 and

$357 billion and 40%, respectively, for 2011. During 2013, we

retained for investment $3.6 billion ($19.4 billion for 2012) of

1-4 family conforming first mortgage loans, forgoing

approximately $120 million ($575 million for 2012) of revenue

that could have been generated had the loans been originated for

sale along with other agency conforming loan production. While

retaining these mortgage loans on our balance sheet reduced

mortgage revenue, we expect to generate spread income in

future quarters from mortgage loans with higher yields than

mortgage-backed securities we could have purchased in the

market. While we do not currently plan to hold additional

conforming mortgages on balance sheet, we have a large

mortgage business and strong capital that provides us with the

flexibility to make such choices in the future to benefit our long-

term results. Mortgage applications were $438 billion in 2013,

compared with $736 billion in 2012 and $537 billion in 2011.

The 1-4 family first mortgage unclosed pipeline was $25 billion

at December 31, 2013, compared with $81 billion at

December 31, 2012 and $72 billion at December 31, 2011. For

additional information about our mortgage banking activities

and results, see the “Risk Management – Mortgage Banking

Interest Rate and Market Risk” section and Note 9 (Mortgage

Banking Activities) and Note 17 (Fair Values of Assets and

Liabilities) to Financial Statements in this Report.

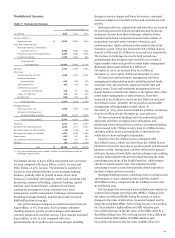

Net gains on mortgage loan origination/sales activities

include the cost of additions to the mortgage repurchase liability.

Mortgage loans are repurchased from third parties based on

standard representations and warranties, and early payment

default clauses in mortgage sale contracts. Additions to the

mortgage repurchase liability that were charged against net

gains on mortgage loan origination/sales activities during 2013

totaled $428 million (compared with $1.9 billion for 2012 and

$1.3 billion for 2011), of which $285 million ($1.7 billion for

2012 and $1.2 billion for 2011) was for subsequent increases in

estimated losses on prior period loan sales. In September and

December 2013, we announced agreements with Federal Home

Loan Mortgage Corporation (FHLMC) and Federal National

Mortgage Association (FNMA), respectively, which resolved

substantially all agency repurchase liabilities for mortgage loans

sold or originated prior to 2009. As a result, outstanding

repurchase demands were down $1.2 billion from a year ago and

our repurchase liability declined to $899 million, the lowest level

since second quarter 2009. For additional information about

mortgage loan repurchases, see the “Risk Management – Credit

Risk Management – Liability for Mortgage Loan Repurchase

Losses” section and Note 9 (Mortgage Banking Activities) to

Financial Statements in this Report.

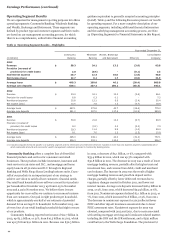

We engage in trading activities primarily to accommodate the

investment activities of our customers, execute economic

hedging to manage certain of our balance sheet risks and for a

very limited amount of proprietary trading for our own account.

Net gains (losses) from trading activities, which reflect

unrealized changes in fair value of our trading positions and

realized gains and losses, were $1.6 billion in 2013, $1.7 billion

in 2012 and $1.0 billion in 2011. The year-over-year decrease in

2013 was largely driven by lower results in customer

accommodation, and the increase in 2012 from 2011 was driven

by gains on customer accommodation trading activities and

economic hedging gains, which included higher gains on

deferred compensation plan investments based on participant

elections (offset entirely in employee benefit expense). Net gains

from trading activities do not include interest and dividend

income and expense on trading securities. Those amounts are

reported within interest income from trading assets and other

interest expense from trading liabilities. Proprietary trading

generated $13 million and $15 million of net gains in 2013 and

2012, respectively, and $14 million of net losses in 2011. Interest

and fees related to proprietary trading are reported in their

corresponding income statement line items. Proprietary trading

activities are not significant to our client-focused business

model. For additional information about proprietary and other

trading, see the “Risk Management – Asset and Liability

Management – Market Risk – Trading Activities” section in this

Report.

Net gains on debt and equity securities totaled $1.4 billion for

both 2013 and 2012 and $1.5 billion for 2011, after other-than-

temporary impairment (OTTI) write-downs of $344 million,

$416 million and $711 million, respectively, for the same periods.

All other income was $113 million for 2013 compared with

$1.1 billion in 2012 and $1.2 billion in 2011. All other income

includes ineffectiveness recognized on derivatives that qualify

for hedge accounting and pre-tax losses on tax credits and

foreign currency adjustments, any of which can cause other

income losses. Lower other income for 2013 compared with a

year ago reflected larger ineffectiveness losses on derivatives that

qualify for hedge accounting and interest-related valuation

changes on certain mortgage-related assets carried at fair value.

42