Wells Fargo 2013 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 16: Derivatives (continued)

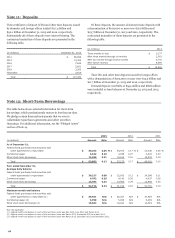

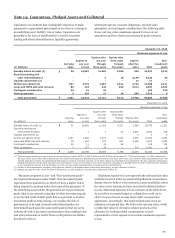

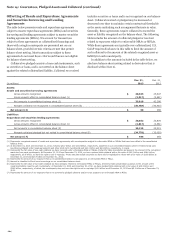

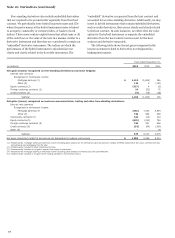

The following table provides information on the gross fair

values of derivative assets and liabilities, the balance sheet

netting adjustments and the resulting net fair value amount

recorded on our balance sheet, as well as the non-cash collateral

associated with such arrangements. We execute substantially all

of our derivative transactions under master netting

arrangements. We reflect all derivative balances and related cash

collateral subject to enforceable master netting arrangements on

a net basis within the balance sheet. The “Gross amounts

recognized” column in the following table include $59.8 billion

and $66.1 billion of gross derivative assets and liabilities,

respectively, at December 31, 2013, and $68.9 billion and

$75.8 billion, respectively, at December 31, 2012, with

counterparties subject to enforceable master netting

arrangements that are carried on the balance sheet net of

offsetting amounts. The remaining gross derivative assets and

liabilities of $12.9 billion and $7.3 billion, respectively, at

December 31, 2013 and $17.0 billion and $7.3 billion,

respectively, at December 31, 2012, include those with

counterparties subject to master netting arrangements for which

we have not assessed the enforceability because they are with

counterparties where we do not currently have positions to

offset, those subject to master netting arrangements where we

have not been able to confirm the enforceability and those not

subject to master netting arrangements. As such,we do not net

derivative balances or collateral within the balance sheet for

these counterparties.

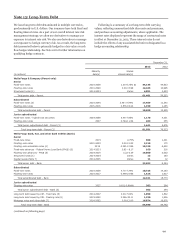

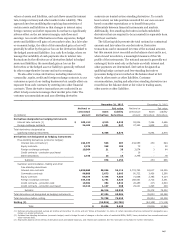

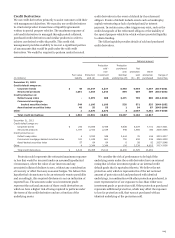

We determine the balance sheet netting adjustments based

on the terms specified within each master netting arrangement.

We disclose the balance sheet netting amounts within the

column titled “Gross amounts offset in consolidated balance

sheet.” Balance sheet netting adjustments are determined at the

counterparty level for which there may be multiple contract

types. For disclosure purposes, we allocate these adjustments to

the contract type for each counterparty proportionally based

upon the “Gross amounts recognized” by counterparty. As a

result, the net amounts disclosed by contract type may not

represent the actual exposure upon settlement of the contracts.

Balance sheet netting does not include non-cash collateral

that we pledge. For disclosure purposes, we present these

amounts in the column titled “Gross amounts not offset in

consolidated balance sheet (Disclosure-only netting)” within the

table. We determine and allocate the Disclosure-only netting

amounts in the same manner as balance sheet netting amounts.

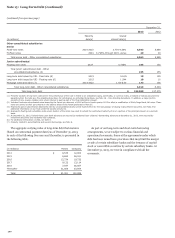

The “Net amounts” column within the following table

represents the aggregate of our net exposure to each

counterparty after considering the balance sheet and Disclosure-

only netting adjustments. We manage derivative exposure by

monitoring the credit risk associated with each counterparty

using counterparty specific credit risk limits, using master

netting arrangements and obtaining collateral. Derivative

contracts executed in over-the-counter markets include bilateral

contractual arrangements that are not cleared through a central

clearing organization but are typically subject to master netting

arrangements. The percentage of our bilateral derivative

transactions outstanding at period end in such markets, based

on gross fair value, is provided within the following table. Other

derivative contracts executed in over-the-counter or exchange-

traded markets are settled through a central clearing

organization and are excluded from this percentage. In addition

to the netting amounts included in the table, we also have

balance sheet netting related to resale and repurchase

agreements that are disclosed within Note 14.

208