Wells Fargo 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

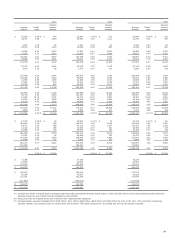

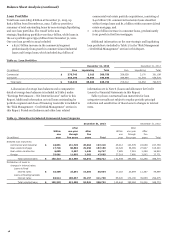

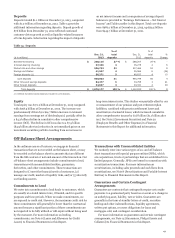

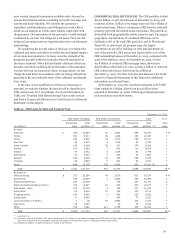

Deposits

Deposits totaled $1.1 trillion at December 31, 2013, compared

with $1.0 trillion at December 31, 2012. Table 14 provides

additional information regarding deposits. Deposit growth of

$76 billion from December 31, 2012 reflected continued

customer-driven growth as well as liquidity-related issuances

of term deposits. Information regarding the impact of deposits

on net interest income and a comparison of average deposit

balances is provided in “Earnings Performance – Net Interest

Income” and Table 5 earlier in this Report. Total core deposits

were $980.1 billion at December 31, 2013, up $34.4 billion

from $945.7 billion at December 31, 2012.

Table 14: Deposits

($ in millions)

Dec. 31,

2013

% of

total

deposits

Dec. 31,

2012

% of

total

deposits

%

Change

Noninterest-bearing $ 288,116 27 % $ 288,207 29 % -

Interest-bearing checking 37,346 3 35,275 4 6

Market rate and other savings 556,763 52 517,464 52 8

Savings certificates 41,567 4 55,966 6 (26)

Foreign deposits (1) 56,271 5 48,837 4 15

Core deposits 980,063 91 945,749 95 4

Other time and savings deposits 64,477 6 33,755 3 91

Other foreign deposits 34,637 3 23,331 2 48

Total deposits $ 1,079,177 100 % $ 1,002,835 100 % 8

(1) Reflects Eurodollar sweep balances included in core deposits.

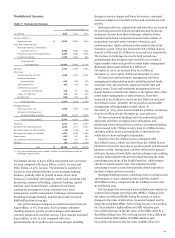

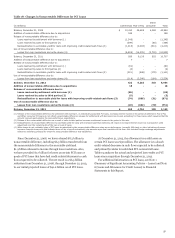

Equity

Total equity was $171.0 billion at December 31, 2013 compared

with $158.9 billion at December 31, 2012. The increase was

predominantly driven by a $14.7 billion increase in retained

earnings from earnings net of dividends paid, partially offset by

a $4.3 billion decline in cumulative other comprehensive

income (OCI). The decline in OCI was due to a $7.9 billion

($4.9 billion after tax) reduction in net unrealized gains on our

investment securities portfolio resulting from an increase in

long-term interest rates. This decline was partially offset by our

re-measurement of our pension and post-retirement plan

liabilities, combined with pension settlement losses and

amortization of actuarial losses, which increased cumulative

other comprehensive income by $1.8 billion ($1.1 billion after

tax). See Note 5 (Investment Securities) and Note 20

(Employee Benefits and Other Expenses) to Financial

Statements in this Report for additional information.

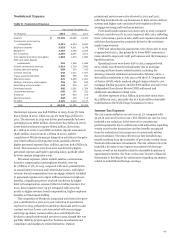

Off-Balance Sheet Arrangements

In the ordinary course of business, we engage in financial

transactions that are not recorded on the balance sheet, or may

be recorded on the balance sheet in amounts that are different

from the full contract or notional amount of the transaction. Our

off-balance sheet arrangements include commitments to lend,

transactions with unconsolidated entities, guarantees,

derivatives, and other commitments. These transactions are

designed to (1) meet the financial needs of customers, (2)

manage our credit, market or liquidity risks, and/or (3) diversify

our funding sources.

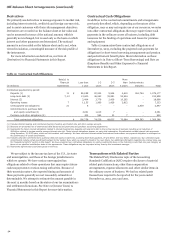

Commitments to Lend

We enter into commitments to lend funds to customers, which

are usually at a stated interest rate, if funded, and for specific

purposes and time periods. When we make commitments, we

are exposed to credit risk. However, the maximum credit risk for

these commitments will generally be lower than the contractual

amount because a significant portion of these commitments are

not expected to be fully utilized or will expire without being used

by the customer. For more information on lending

commitments, see Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements in this Report.

Transactions with Unconsolidated Entities

We routinely enter into various types of on- and off-balance

sheet transactions with special purpose entities (SPEs), which

are corporations, trusts or partnerships that are established for a

limited purpose. Generally, SPEs are formed in connection with

securitization transactions. For more information on

securitizations, including sales proceeds and cash flows from

securitizations, see Note 8 (Securitizations and Variable Interest

Entities) to Financial Statements in this Report.

Guarantees and Certain Contingent

Arrangements

Guarantees are contracts that contingently require us to make

payments to a guaranteed party based on an event or a change in

an underlying asset, liability, rate or index. Guarantees are

generally in the form of standby letters of credit, securities

lending and other indemnifications, liquidity agreements,

written put options, recourse obligations for loans and

mortgages sold, and contingent consideration.

For more information on guarantees and certain contingent

arrangements, see Note 14 (Guarantees, Pledged Assets and

Collateral) to Financial Statements in this Report.

49