Wells Fargo 2013 Annual Report Download - page 244

Download and view the complete annual report

Please find page 244 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

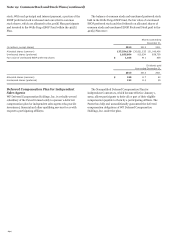

Note 19: Common Stock and Stock Plans (continued)

For various acquisitions and mergers, we converted employee

and director stock options of acquired or merged companies into

stock options to purchase our common stock based on the terms

of the original stock option plan and the agreed-upon exchange

ratio. In addition, we converted restricted stock awards into

awards that entitle holders to our stock after the vesting

conditions are met. Holders receive cash dividends on

outstanding awards if provided in the original award.

The total number of shares of common stock available for

grant under the plans at December 31, 2013, was 282 million.

Director Awards

Beginning in 2011, we granted only common stock awards under

the LTICP to non-employee directors elected or re-elected at the

annual meeting of stockholders and prorated awards to directors

who join the Board at any other time. Stock awards vest

immediately. Options also were granted to directors prior to

2011, and can be exercised after twelve months through the tenth

anniversary of the grant date. Options granted prior to 2005 may

include the right to acquire a “reload” stock option.

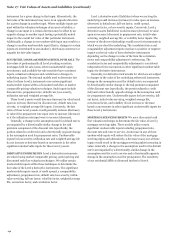

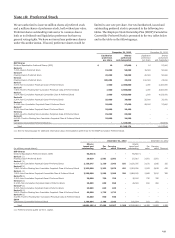

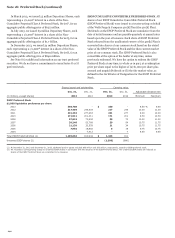

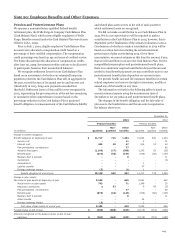

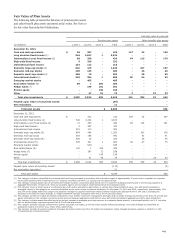

Restricted Share Rights

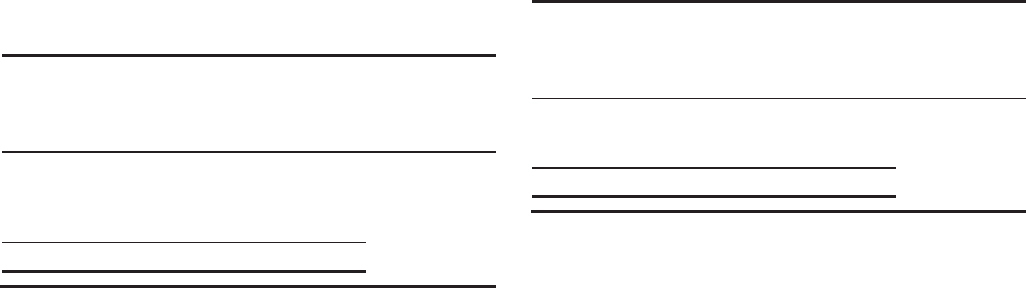

A summary of the status of our RSRs and restricted share awards

at December 31, 2013, and changes during 2013 is in the

following table:

Number

Weighted-

average

grant-date

fair value

Nonvested at January 1, 2013 55,287,337 $ 29.78

Granted 18,476,399 35.52

Vested (12,233,361) 29.32

Canceled or forfeited (886,381) 30.70

Nonvested at December 31, 2013 60,643,994 31.61

The weighted-average grant date fair value of RSRs granted

during 2012 and 2011 was $31.49 and $31.02, respectively.

At December 31, 2013, there was $702 million of total

unrecognized compensation cost related to nonvested RSRs. The

cost is expected to be recognized over a weighted-average period

of 2.5 years. The total fair value of RSRs that vested during 2013,

2012 and 2011 was $472 million, $89 million and $41 million,

respectively.

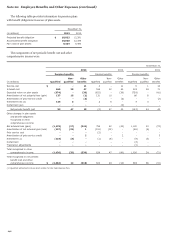

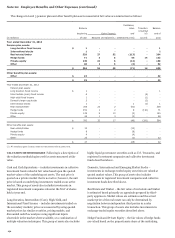

Performance Share Awards

Holders of PSAs are entitled to the related shares of common

stock at no cost subject to the Company's achievement of

specified performance criteria over a three-year period. PSAs are

granted at a target number; based on the Company's

performance, the number of awards that vest can be adjusted

downward to zero and upward to a maximum of either 125% or

150% of target. The awards vest in the quarter after the end of

the performance period. For PSAs whose performance period

ended December 31, 2013, the determination of the number of

performance shares that will vest will occur in the first quarter of

2014, after review of the Company’s performance by the Human

Resources Committee of the Board of Directors. In 2013, PSAs

granted include discretionary performance based vesting

conditions and are subject to variable accounting. For these

awards, the associated compensation expense fluctuates with

changes in our stock price and the estimated outcome of meeting

the performance conditions. The total expense that will be

recognized on these awards cannot be finalized until the

determination of the awards that will vest.

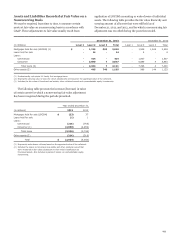

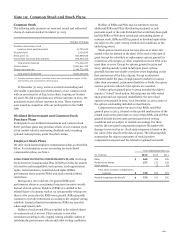

A summary of the status of our PSAs at December 31, 2013

and changes during 2013 is in the following table, based on the

target amount of awards:

Number

Weighted-

average

grant date

fair value

Nonvested at January 1, 2013 10,294,881 $ 30.35

Granted 4,614,295 33.56

Vested (4,070,028) 27.67

Nonvested at December 31, 2013 10,839,148 32.72

The weighted-average grant date fair value of performance

awards granted during 2012 and 2011 was $31.44 and $31.26,

respectively.

At December 31, 2013, there was $56 million of total

unrecognized compensation cost related to nonvested

performance awards. The cost is expected to be recognized over

a weighted-average period of 1.7 years.

242