Wells Fargo 2013 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272

|

|

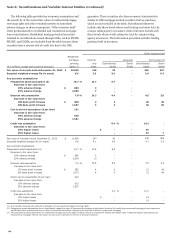

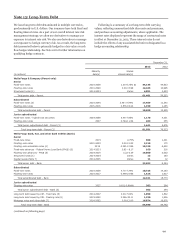

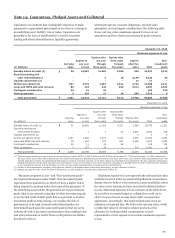

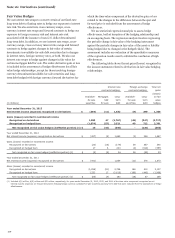

Note 13: Long-Term Debt (continued)

(continued from previous page)

December 31,

2013 2012

(in millions)

Maturity

date(s)

Stated

interest rate(s)

Other consolidated subsidiaries

Senior

Fixed-rate notes 2014-2023 2.774-4.38% 6,543 5,968

FixFloat notes 2020 6.795% through 2015, varies 20 20

Total senior debt - Other consolidated subsidiaries 6,563 5,988

Junior subordinated

Floating-rate notes 2027 0.736% 155 155

Total junior subordinated debt - Other

consolidated subsidiaries (3) 155 155

Long-term debt issued by VIE - Fixed rate (6) 2015 5.16% 18 105

Long-term debt issued by VIE - Floating rate (6) 2015 1.544 10 10

Mortgage notes and other (7) 2014-2022 1.54-6.00 173 136

Total long-term debt - Other consolidated subsidiaries 6,919 6,394

Total long-term debt $ 152,998 127,379

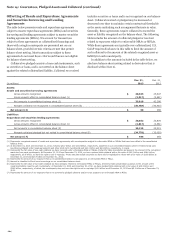

(1) Primarily consists of long-term notes where the performance of the note is linked to an embedded equity, commodity, or currency index, or basket of indices accounted for

separately from the note as a free-standing derivative. For information on embedded derivatives, see Note 16 – Free-standing derivatives. In addition, a major portion

consists of zero coupon callable notes where interest is paid as part of the final redemption amount.

(2) Includes fixed-rate subordinated notes issued by the Parent at a discount of $140 million in fourth quarter 2013 to effect a modification of Wells Fargo Bank, NA notes. These

notes are carried at their par amount on the balance sheet of the Parent presented in Note 25.

(3) Represents junior subordinated debentures held by unconsolidated wholly-owned trusts formed for the sole purpose of issuing trust preferred securities. See Note 8 for

additional information on our trust preferred security structures.

(4) Represents floating-rate extendible notes where holders of the notes may elect to extend the contractual maturity of all or a portion of the principal amount on a periodic

basis.

(5) At December 31, 2013, Federal Home Loan Bank advances are secured by residential loan collateral. Outstanding advances at December 31, 2012, were secured by

investment securities and residential loan collateral.

(6) For additional information on VIEs, see Note 8.

(7) Primarily related to securitizations and secured borrowings, see Note 8.

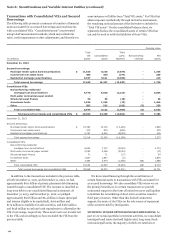

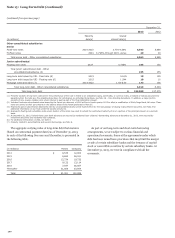

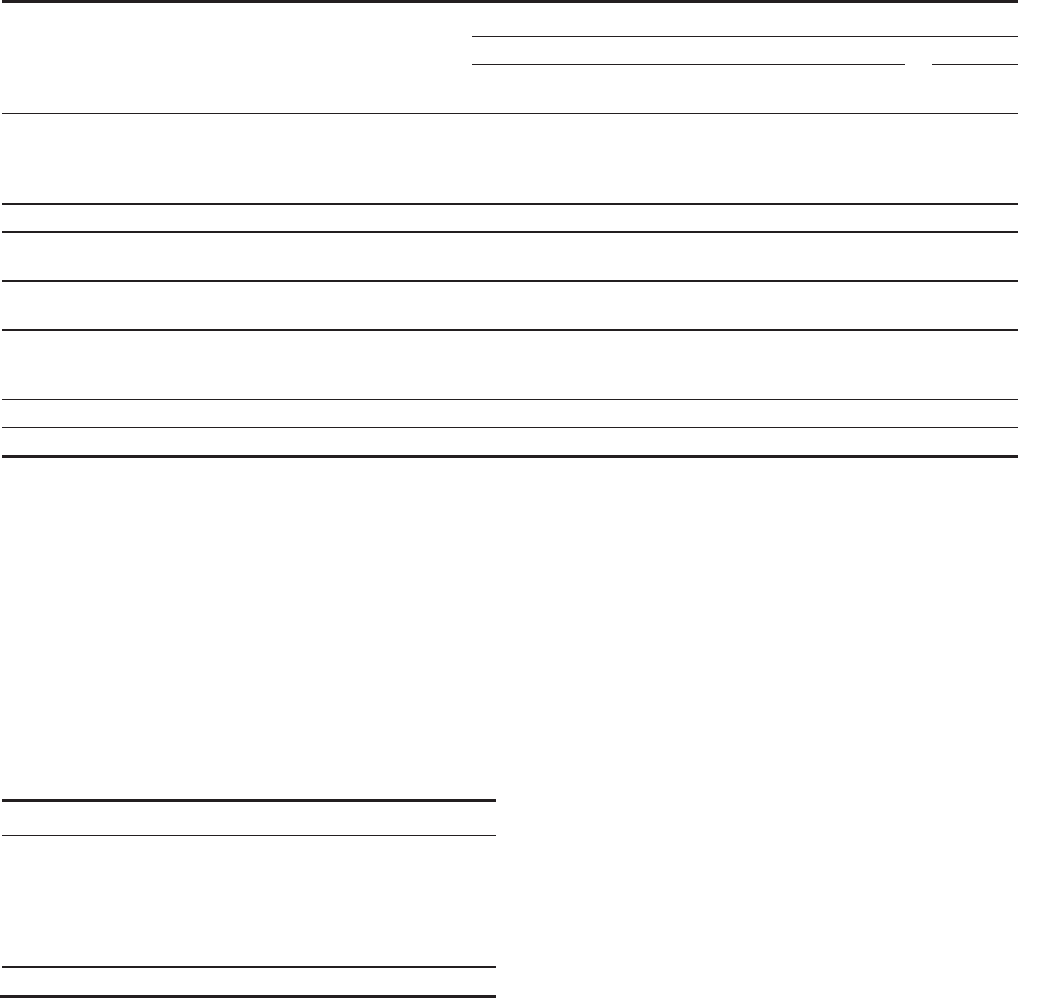

The aggregate carrying value of long-term debt that matures

(based on contractual payment dates) as of December 31, 2013,

in each of the following five years and thereafter, is presented in

the following table.

(in millions) Parent Company

2014 $ 8,535 12,800

2015 8,684 26,531

2016 15,734 19,732

2017 9,122 13,114

2018 7,937 26,867

Thereafter 31,569 53,954

Total $ 81,581 152,998

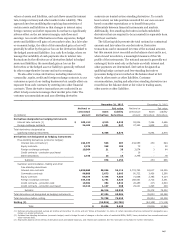

As part of our long-term and short-term borrowing

arrangements, we are subject to various financial and

operational covenants. Some of the agreements under which

debt has been issued have provisions that may limit the merger

or sale of certain subsidiary banks and the issuance of capital

stock or convertible securities by certain subsidiary banks. At

December 31, 2013, we were in compliance with all the

covenants.

200